Berkshire Hathaway 2001 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.60

Management's Discussion (Continued)

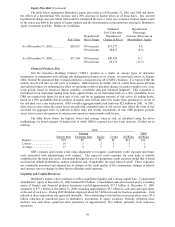

Liquidity and Capital Resources (Continued)

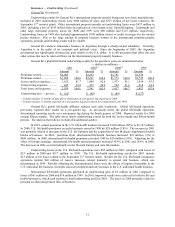

Berkshire’ s consolidated borrowings under investment agreements and other debt, excluding finance

businesses, totaled $3,485 million at December 31, 2001 compared to $2,663 million at December 31, 2000. The

increase in borrowings during 2001 relates primarily to pre-acquisition debt of Shaw and Johns Manville, as well as

an increase in borrowings by Executive Jet to finance aircraft inventory and core fleet acquisitions. During the

second quarter of 2001, Berkshire filed a shelf registration to issue up to $700 million in new debt securities at a

future date. The intended purpose of the future issuance of debt is to fund the repayment of currently outstanding

borrowings of certain Berkshire subsidiaries. The timing and amount of the debt to be issued under the shelf

registration has not yet been determined.

As of December 31, 2001, Berkshire’ s borrowings under investment agreements and other debt, excluding

finance businesses, included commercial paper and other short-term borrowings totaling $1.8 billion. Most of these

borrowings were by Executive Jet and Shaw for operating needs. Berkshire is also contingently liable for the

unpaid debt of Berkadia LLC through a primary guaranty of 90% of the debt and a secondary guaranty of the

remaining 10% of the loan. At December 31, 2001, Berkadia’ s unpaid loan balance was $4.9 billion, of which $1.0

billion has been prepaid subsequent to the end of 2001. See Note 9 to the Consolidated Financial Statements for

additional information. Most of Berkshire’ s borrowings under investment agreements contain contractual

provisions that could require Berkshire to collateralize or prepay the outstanding obligations upon a downgrade in

Berkshire’ s senior debt ratings.

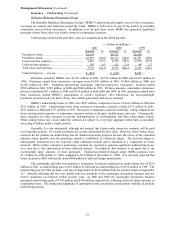

Invested assets of the finance and financial products businesses totaled $41.6 billion at December 31, 2001

compared to $16.8 billion at December 31, 2000. Most of the increase was due to increased investments in U.S.

Treasury securities and obligations of U.S. government-sponsored enterprises. These investments were primarily

financed through repurchase agreements. The repurchase agreements require that fair value of the pledged

collateral exceed the amount borrowed. A decline in the value of the investments pledged would require pledges of

cash or additional collateral. Under the contractual terms with counterparties to its derivatives trading activities,

General Re Securities (“GRS”) may be required to post collateral against trading account liabilities.

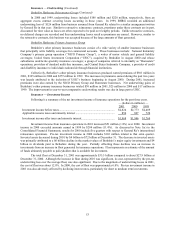

Notes payable and other borrowings of Berkshire’ s finance and financial products businesses totaled $9.0

billion at December 31, 2001 and $2.1 billion at December 31, 2000. The balance at December 31, 2001 includes

Berkadia’ s outstanding term loan of $4.9 billion (see Note 9 to the Consolidated Financial Statements) and $613

million of debt of XTRA Corporation, which Berkshire acquired on September 20, 2001. The remaining increase

was due to increased commercial paper borrowings by GRS to fund short-term liquidity needs.

Berkshire believes that it currently maintains sufficient liquidity to cover its existing liquidity requirements

and provide for contingent liquidity needs.

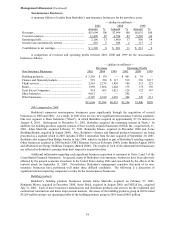

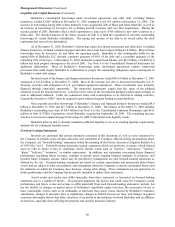

Forward-Looking Statements

Investors are cautioned that certain statements contained in this document, as well as some statements by

the Company in periodic press releases and some oral statements of Company officials during presentations about

the Company, are "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act

of 1995 (the "Act"). Forward-looking statements include statements which are predictive in nature, which depend

upon or refer to future events or conditions, which include words such as "expects," "anticipates," "intends,"

"plans," "believes," "estimates," or similar expressions. In addition, any statements concerning future financial

performance (including future revenues, earnings or growth rates), ongoing business strategies or prospects, and

possible future Company actions, which may be provided by management are also forward-looking statements as

defined by the Act. Forward-looking statements are based on current expectations and projections about future

events and are subject to risks, uncertainties, and assumptions about the Company, economic and market factors and

the industries in which the Company does business, among other things. These statements are not guaranties of

future performance and the Company has no specific intention to update these statements.

Actual events and results may differ materially from those expressed or forecasted in forward-looking

statements due to a number of factors. The principal important risk factors that could cause the Company's actual

performance and future events and actions to differ materially from such forward-looking statements, include, but

are not limited to, changes in market prices of Berkshire's significant equity investees, the occurrence of one or

more catastrophic events, such as an earthquake or hurricane that causes losses insured by Berkshire's insurance

subsidiaries, changes in insurance laws or regulations, changes in Federal income tax laws, and changes in general

economic and market factors that affect the prices of securities or the industries in which Berkshire and its affiliates

do business, especially those affecting the property and casualty insurance industry.