Berkshire Hathaway 2001 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

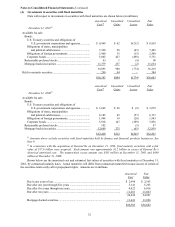

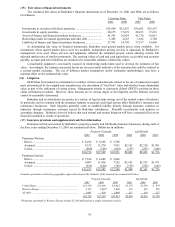

Notes to Consolidated Financial Statements (Continued)

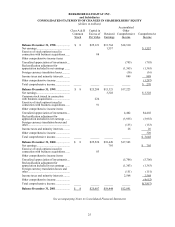

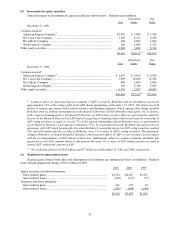

(4) Investments in securities with fixed maturities

Data with respect to investments in securities with fixed maturities are shown below (in millions).

Amortized Unrealized Unrealized Fair

Cost(2) Gains Losses Value

December 31, 2001(1)

Available for sale:

Bonds:

U.S. Treasury securities and obligations of

U.S. government corporations and agencies.............. $ 8,969 $ 62 $(212) $ 8,819

Obligations of states, municipalities

and political subdivisions........................................... 7,390 98 (43) 7,445

Obligations of foreign governments................................ 2,460 55 (15) 2,500

Corporate bonds .............................................................. 5,802 427 (498) 5,731

Redeemable preferred stocks .............................................. 93 1 (4) 90

Mortgage-backed securities ................................................ 11,379 257 (2) 11,634

36,093 900 (774) 36,219

Held to maturity securities ..................................................... 290 94 – 384

$36,383 $994 $(774) $36,603

Amortized Unrealized Unrealized Fair

Cost(2) Gains Losses Value

December 31, 2000(1)

Available for sale:

Bonds:

U.S. Treasury securities and obligations of

U.S. government corporations and agencies.............. $ 3,662 $ 26 $ (9) $ 3,679

Obligations of states, municipalities

and political subdivisions........................................... 8,185 45 (57) 8,173

Obligations of foreign governments................................ 1,944 19 (20) 1,943

Corporate bonds .............................................................. 5,918 147 (209) 5,856

Redeemable preferred stocks .............................................. 102 – (5) 97

Mortgage-backed securities ................................................ 12,609 275 (65) 12,819

$32,420 $512 $(365) $32,567

(1) Amounts above exclude securities with fixed maturities held by finance and financial products businesses. See

Note 9.

(2) In connection with the acquisition of General Re on December 21, 1998, fixed maturity securities with a fair

value of $17.6 billion were acquired. Such amount was approximately $1.2 billion in excess of General Re’s

historical amortized cost. The unamortized excess amount was $565 million at December 31, 2001 and $680

million at December 31, 2000.

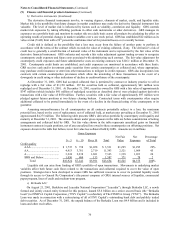

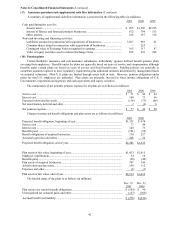

Shown below are the amortized cost and estimated fair values of securities with fixed maturities at December 31,

2001, by contractual maturity dates. Actual maturities will differ from contractual maturities because issuers of certain of

the securities retain early call or prepayment rights. Amounts are in millions.

Amortized Fair

Cost Value

Due in one year or less ............................................................................................... $ 2,498 $ 2,563

Due after one year through five years ........................................................................ 5,141 5,265

Due after five years through ten years........................................................................ 6,022 6,016

Due after ten years...................................................................................................... 11,281 11,063

24,942 24,907

Mortgage-backed securities........................................................................................ 11,441 11,696

$36,383 $36,603