Berkshire Hathaway 2001 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

Notes to Consolidated Financial Statements (Continued)

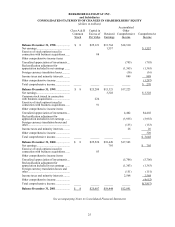

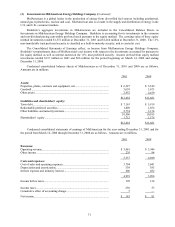

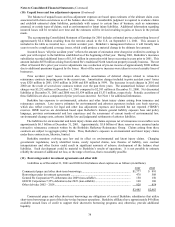

(7) Receivables

Receivable balances as of December 31, 2001 and 2000 are as follows (in millions).

2001 2000

Insurance and reinsurance premiums............................................................................ $ 5,571 $ 5,624

Ceded loss reserves ...................................................................................................... 2,959 2,997

Trade receivables and other.......................................................................................... 3,396 3,143

$11,926 $11,764

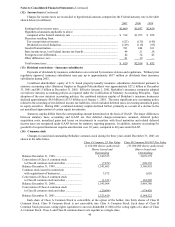

(8) Accounts payable, accruals and other liabilities

Accounts payable, accruals and other liabilities as of December 31, 2001 and 2000 are as follows (in millions).

2001 2000

Life and health insurance benefits................................................................................ $ 2,058 $ 1,959

Other balances due to policyholders............................................................................. 3,319 3,554

Trade payables and other.............................................................................................. 4,249 2,861

$ 9,626 $ 8,374

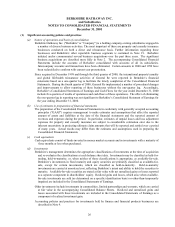

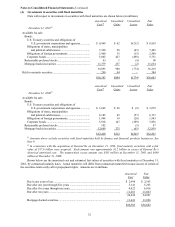

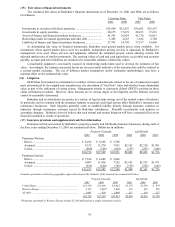

(9) Finance and financial products businesses

Berkshire’ s finance and financial products businesses consist of numerous businesses engaged in a variety of

activities. The principal business activities include proprietary investing (BH Finance), real estate financing (Berkshire

Hathaway Credit Corporation), transportation equipment leasing (XTRA Corporation, acquired in September 2001), risk

management products (General Re Securities or “GRS”), annuities (Berkshire Hathaway Life Insurance Company of

Nebraska) and Berkadia LLC (see Note (c) below).

In January 2002, General Re announced that it would commence a long-term run-off of GRS. The run-off is

expected to occur over a period of years, during which, GRS will limit its new business to certain risk management

transactions and will unwind its existing asset and liability positions in an orderly manner.

Assets and liabilities of Berkshire's finance and financial products businesses as of December 31, 2001 and 2000

are summarized below (in millions).

2001 2000

Assets

Cash and cash equivalents................................................................................................................ $ 1,185 $ 341

Investments in securities with fixed maturities:

Held-to-maturity, at cost (fair value $1,888 in 2001; $1,734 in 2000)......................................... 1,813 1,664

Available-for-sale, at fair value (cost $21,125 in 2001; $880 in 2000)*...................................... 21,061 880

Trading, at fair value (cost $2,297 in 2001; $5,194 in 2000) ....................................................... 2,252 5,244

Trading account assets ..................................................................................................................... 5,561 5,429

Loans and other receivables............................................................................................................. 6,262 1,186

Securities purchased under agreements to resell ............................................................................. 333 680

Other................................................................................................................................................. 3,124 1,405

$41,591 $16,829

Liabilities

Securities sold under agreements to repurchase .............................................................................. $21,465 $ 3,386

Securities sold but not yet purchased............................................................................................... 354 715

Trading account liabilities................................................................................................................ 4,803 4,974

Notes payable and other borrowings**............................................................................................ 9,019 2,116

Annuity reserves and policyholder liabilities...................................................................................894868

Other................................................................................................................................................. 1,256 2,671

$37,791 $14,730

* Consists primarily of U.S. Treasury securities and obligations of U.S. government corporations and agencies.

** Payments of principal amounts of notes payable and other borrowings during the next five years are due as follows (in

millions). 2002 2003 2004 2005 2006

$2,405 $490 $459 $73 $5,022