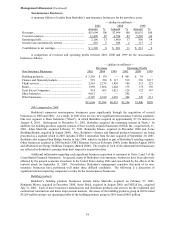

Berkshire Hathaway 2001 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

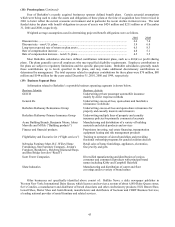

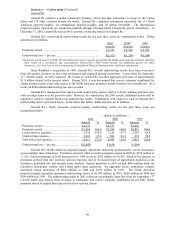

Insurance — Underwriting (Continued)

Berkshire Hathaway Reinsurance Group (Continued)

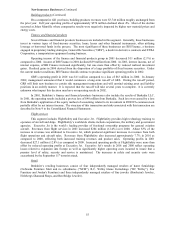

In 2000 and 1999, underwriting losses included $186 million and $220 million, respectively, from an

aggregate excess contract covering losses occurring in those years. In 1999, BHRG recorded an additional

underwriting loss of $126 million from business assumed from General Re related to a similar arrangement written

by General Re in that year. Similar to retroactive reinsurance contracts, premiums under these contracts are in part,

discounted for time value as losses are often expected to be paid over lengthy periods. Unlike retroactive contracts,

no deferred charges are recorded and thus underwriting losses result as premiums are earned. However, similar to

the retroactive contracts, this business was accepted because of the large amounts of float generated.

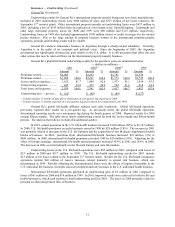

Berkshire Hathaway Primary Insurance Group

Berkshire’ s other primary insurance businesses consist of a wide variety of smaller insurance businesses

that principally write liability coverages for commercial accounts. These businesses include: National Indemnity

Company’ s primary group operation (“NICO Primary Group”), a writer of motor vehicle and general liability

coverages; United States Investment Corporation (“USIC”), acquired by Berkshire in August 2000 and whose

subsidiaries underwrite specialty insurance coverages; a group of companies referred to internally as “Homestate”

operations, providers of standard multi-line insurance, and Central States Indemnity Company, a provider of credit

and disability insurance to individuals nationwide through financial institutions.

Collectively, Berkshire’ s other primary insurance businesses produced earned premiums of $501 million in

2001, $325 million in 2000 and $257 million in 1999. The increases in premiums earned during the past two years

was largely attributed to the inclusion of USIC’ s business beginning in August 2000. During 2001, increased

premiums were also earned by the NICO Primary Group and Homestate businesses. Net underwriting gains of

Berkshire’ s other primary insurance businesses totaled $30 million in 2001, $25 million in 2000 and $17 million in

1999. The improvement in year-to-year comparative underwriting results was due in large part to USIC.

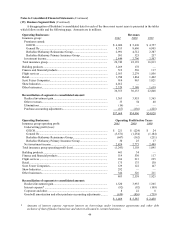

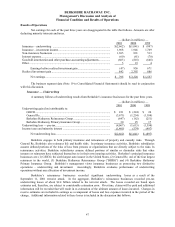

Insurance — Investment Income

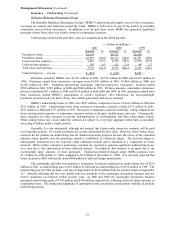

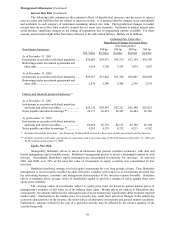

Following is a summary of the net investment income of insurance operations for the past three years.

— (dollars in millions) —

2001 2000 1999

Investment income before taxes............................................................................. $2,824 $2,773 $2,489

Applicable income taxes and minority interest ...................................................... 856 827 720

Investment income after taxes and minority interest.............................................. $1,968 $1,946 $1,769

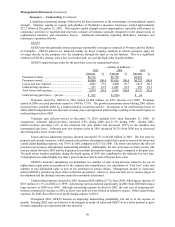

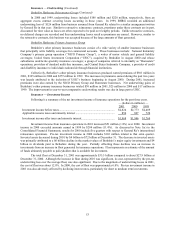

Investment income from insurance operations in 2001 increased $51 million (1.8%) over 2000. Investment

income in 2000 exceeded amounts earned in 1999 by $284 million (11.4%). As discussed in Note 1(a) to the

Consolidated Financial Statements, results for 2000 include five quarters with respect to General Re’ s international

reinsurance operations. Pre-tax investment income in 2000 includes $103 million related to that extra quarter.

Invested assets decreased during 2001 by $4 billion to $72 billion at December 31. The decrease in invested assets

was primarily attributed to a $6 billion decline in the market values of Berkshire’ s major equity investments and $4

billion in dividends paid to Berkshire during the year. Partially offsetting these declines was an increase in

investments from an increase in float generated by insurance operations. Float represents an estimate of the amount

of funds ultimately payable to policyholders that is available for investment.

The total float at December 31, 2001 was approximately $35.5 billion compared to about $27.9 billion at

December 31, 2000. Although the increase in float during 2001 was significant, its cost, represented by the pre-tax

underwriting loss over the average float, was also significant. Due to the magnitude of underwriting losses in 2001,

the cost of float was about 12.8%. In 2000, the cost of float was approximately 6.0%. Pre-tax investment income in

2001 was also adversely affected by declining interest rates, particularly for short to medium term investments.