Berkshire Hathaway 2001 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

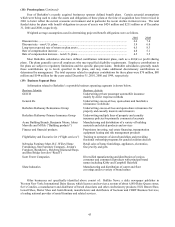

Notes to Consolidated Financial Statements (Continued)

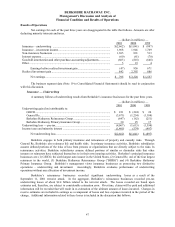

(12) Income taxes (Continued)

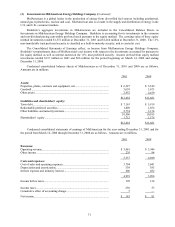

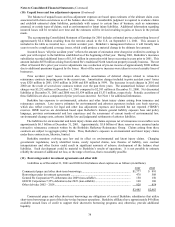

Charges for income taxes are reconciled to hypothetical amounts computed at the Federal statutory rate in the table

shown below (in millions). 2001 2000 1999

Earnings before income taxes ................................................................................. $1,469 $5,587 $2,450

Hypothetical amounts applicable to above

computed at the Federal statutory rate ................................................................. $ 514 $1,955 $ 858

Decreases resulting from:

Tax-exempt interest income................................................................................. (123) (135) (145)

Dividends received deduction .............................................................................. (129) (116) (95)

Goodwill amortization ............................................................................................ 191 240 161

State income taxes, less Federal income tax benefit ............................................... 44 21 28

Foreign tax rate differential..................................................................................... 82 34 45

Other differences, net.............................................................................................. 41 19 —

Total income taxes .................................................................................................. $ 620 $2,018 $ 852

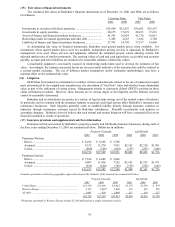

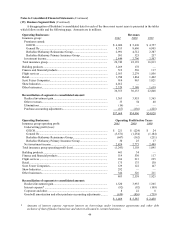

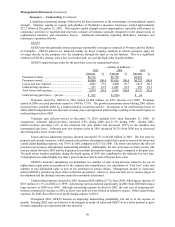

(13) Dividend restrictions – Insurance subsidiaries

Payments of dividends by insurance subsidiaries are restricted by insurance statutes and regulations. Without prior

regulatory approval, insurance subsidiaries may pay up to approximately $637 million as dividends from insurance

subsidiaries during 2002.

Combined shareholders’ equity of U.S. based property/casualty insurance subsidiaries determined pursuant to

statutory accounting rules (Statutory Surplus as Regards Policyholders) was approximately $27.2 billion at December

31, 2001 and $41.5 billion at December 31, 2000. Effective January 1, 2001, Berkshire’ s insurance companies adopted

several new statutory accounting policies as required under the Codification of Statutory Accounting Principles. Upon

adoption of the new statutory accounting policies, the combined statutory surplus of Berkshire’ s insurance businesses

declined approximately $8.0 billion to $33.5 billion as of January 1, 2001. The most significant new accounting policy

related to the recording of net deferred income tax liabilities, which included deferred taxes on existing unrealized gains

in equity securities. During 2001, combined statutory surplus declined further, primarily as a result of a decline in the

net unrealized appreciation of certain equity investments.

Statutory surplus differs from the corresponding amount determined on the basis of GAAP. The major differences

between statutory basis accounting and GAAP are that deferred charges-reinsurance assumed, deferred policy

acquisition costs, unrealized gains and losses on investments in securities with fixed maturities and related deferred

income taxes are recognized under GAAP but not for statutory reporting purposes. In addition, statutory accounting for

goodwill of acquired businesses requires amortization over 10 years, compared to 40 years under GAAP.

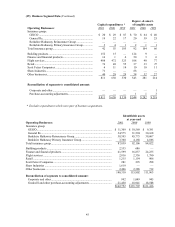

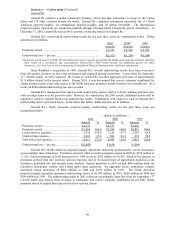

(14) Common stock

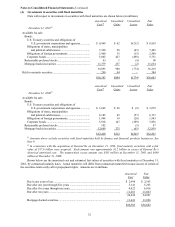

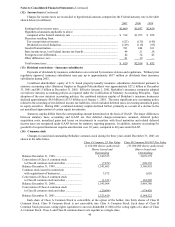

Changes in issued and outstanding Berkshire common stock during the three years ended December 31, 2001 are

shown in the table below. Class A Common, $5 Par Value Class B Common $0.1667 Par Value

(1,650,000 shares authorized) (55,000,000 shares authorized)

Shares Issued and Shares Issued and

Outstanding Outstanding

Balance December 31, 1998..................................... 1,349,535 5,070,379

Conversions of Class A common stock

to Class B common stock and other ...................... (7,872) 296,576

Balance December 31, 1999..................................... 1,341,663 5,366,955

Common stock issued in connection

with acquisitions of businesses.............................. 3,572 1,626

Conversions of Class A common stock

to Class B common stock and other ...................... (1,331) 101,205

Balance December 31, 2000..................................... 1,343,904 5,469,786

Conversions of Class A common stock

to Class B common stock and other ...................... (20,494) 674,436

Balance December 31, 2001..................................... 1,323,410 6,144,222

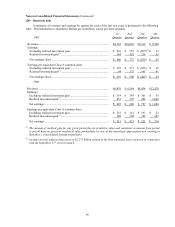

Each share of Class A Common Stock is convertible, at the option of the holder, into thirty shares of Class B

Common Stock. Class B Common Stock is not convertible into Class A Common Stock. Each share of Class B

Common Stock possesses voting rights equivalent to one-two-hundredth (1/200) of the voting rights of a share of Class

A Common Stock. Class A and Class B common shares vote together as a single class.