Berkshire Hathaway 2001 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

Management's Discussion (Continued)

Insurance — Underwriting (Continued)

Berkshire Hathaway Reinsurance Group

The Berkshire Hathaway Reinsurance Group (“BHRG”) underwrites principally excess-of-loss reinsurance

coverages for insurers and reinsurers around the world. BHRG is believed to be one of the leaders in providing

catastrophe excess-of-loss reinsurance. In addition, over the past three years, BHRG has generated significant

premium volume from a few very sizable retroactive reinsurance contracts.

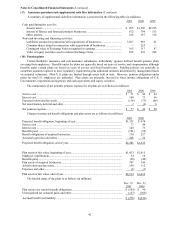

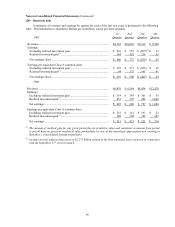

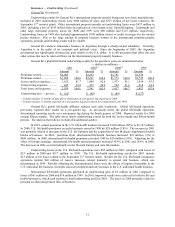

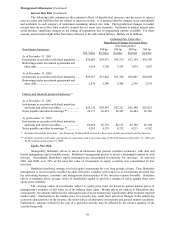

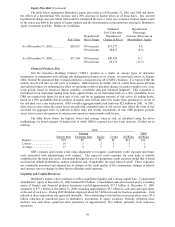

Underwriting results for the past three years are summarized in the following table.

— (dollars in millions) —

2001 2000 1999

Amount %Amount %Amount %

Premiums written ....................................................... $3,254 $4,732 $2,418

Premiums earned........................................................ $2,991 100.0 $4,712 100.0 $2,387 100.0

Losses and loss expenses ........................................... 3,443 115.1 4,759 101.0 2,572 107.8

Underwriting expenses............................................... 195 6.5 115 2.4 66 2.7

Total losses and expenses........................................... 3,638 121.6 4,874 103.4 2,638 110.5

Underwriting loss — pre-tax...................................... $ (647) $ (162) $(251)

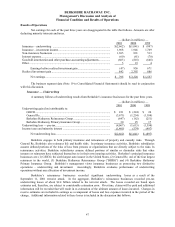

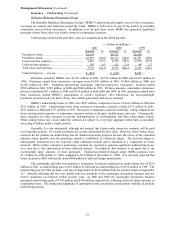

Premiums earned by BHRG were $2,991 million in 2001, $4,712 million in 2000 and $2,387 million in

1999. Premiums earned from retroactive coverages were $1,993 million in 2001, $3,944 million in 2000 and

$1,507 million in 1999. Premiums earned from catastrophe and non-retroactive reinsurance business totaled

$998 million in 2001, $768 million in 2000 and $880 million in 1999. Of these amounts, catastrophe reinsurance

policies contributed $511 million in 2001 and $314 million in both 2000 and 1999. In 2001, premiums earned from

these businesses include BHRG’ s participation in Lloyd’ s Syndicate 1861. Otherwise, the non-catastrophe

premiums earned in each year derive from a few sizable quota-share and excess contracts.

BHRG’ s underwriting losses in 2001 were $647 million, compared to losses of $162 million in 2000 and

$251 million in 1999. Underwriting losses from retroactive reinsurance contracts totaled $371 million in 2001,

$191 million in 2000 and $ 97 million in 1999. Retroactive reinsurance contracts indemnify ceding companies for

losses arising under insurance or reinsurance contracts written in the past, usually many years ago. Consequently,

these contracts are often expected to provide indemnification of environmental and other latent injury claims.

While contract terms vary, losses under the contracts are subject to a very large aggregate dollar limit, occasionally

exceeding $1 billion under a single contract.

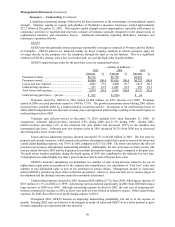

Generally, it is also anticipated, although not assured, that claims under retroactive contracts will be paid

over long time periods. As a result, premiums are, in part, discounted for time value. However, when written, these

contracts do not produce an underwriting loss for financial reporting purposes because the excess of the estimated

ultimate claims payable over the premiums earned is established as a deferred charge. The deferred charge is

subsequently amortized over the expected claim settlement periods and is included as a component of losses

incurred. When written, retroactive reinsurance contracts are expected to generate significant underwriting losses

over time due to the amortization of these deferred charges. Nevertheless, this business is accepted due to the

exceptionally large amounts of float generated. Unamortized deferred charges under BHRG contracts were

$3.1 billion as of December 31, 2001 compared to $2.6 billion at December 31, 2000. It is currently expected that

losses incurred in 2002 will include about $400 million of deferred charge amortization.

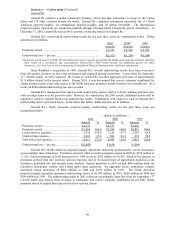

The catastrophe and other non-retroactive reinsurance businesses generated an underwriting loss of $276

million in 2001, an underwriting gain of $29 million in 2000 and an underwriting loss of $154 million in 1999. The

underwriting loss for 2001 includes a net loss of approximately $530 million from the terrorist attack on September

11th. Partially offsetting this loss were profits from the remainder of the catastrophe reinsurance business and loss

reserve reductions on contracts written in prior years. In 2000 and 1999, the catastrophe reinsurance business

generated underwriting gains of $183 million and $196 million, respectively, reflecting relatively minor amounts of

catastrophe losses. The timing and magnitude of catastrophe losses can produce considerable volatility in periodic

underwriting results.