Berkshire Hathaway 2001 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

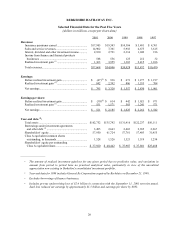

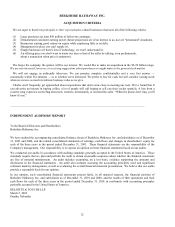

BERKSHIRE HATHAWAY INC.

and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2001

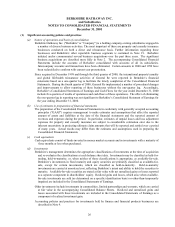

(1) Significant accounting policies and practices

(a) Nature of operations and basis of consolidation

Berkshire Hathaway Inc. ("Berkshire" or "Company") is a holding company owning subsidiaries engaged in

a number of diverse business activities. The most important of these are property and casualty insurance

businesses conducted on both a direct and reinsurance basis. Further information regarding these

businesses and Berkshire's other reportable business segments is contained in Note 19. Berkshire

initiated and/or consummated several business acquisitions over the past three years. The significant

business acquisitions are described more fully in Note 2. The accompanying Consolidated Financial

Statements include the accounts of Berkshire consolidated with accounts of all its subsidiaries.

Intercompany accounts and transactions have been eliminated. Certain amounts in 2000 and 1999 have

been reclassified to conform with current year presentation.

Since acquired in December 1998 and through the third quarter of 2000, the international property/casualty

and global life/health reinsurance activities of General Re were reported in Berkshire’ s financial

statements based on a one-quarter lag to facilitate the timely completion of the Consolidated Financial

Statements. During the fourth quarter of 2000, General Re implemented a number of procedural changes

and improvements to allow reporting of these businesses without the one-quarter lag. Accordingly,

Berkshire’ s Consolidated Statements of Earnings and Cash Flows for the year ended December 31, 2000

include five quarters of results of operations and cash flows of these operations. The effect of eliminating

the one-quarter lag in reporting was not significant to Berkshire’ s Consolidated Statement of Earnings for

the year ending December 31, 2000.

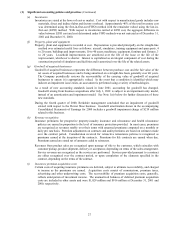

(b) Use of estimates in preparation of financial statements

The preparation of the Consolidated Financial Statements in conformity with generally accepted accounting

principles ("GAAP") requires management to make estimates and assumptions that affect the reported

amount of assets and liabilities at the date of the financial statements and the reported amount of

revenues and expenses during the period. In particular, estimates of unpaid losses and loss adjustment

expenses for property and casualty insurance are subject to considerable estimation error due to the

inherent uncertainty in projecting ultimate claim amounts that will be reported and settled over a period

of many years. Actual results may differ from the estimates and assumptions used in preparing the

Consolidated Financial Statements.

(c) Cash equivalents

Cash equivalents consist of funds invested in money market accounts and in investments with a maturity of

three months or less when purchased.

(d) Investments

Berkshire’ s management determines the appropriate classifications of investments at the time of acquisition

and re-evaluates the classifications at each balance sheet date. Investments may be classified as held-for-

trading, held-to-maturity, or, when neither of those classifications is appropriate, as available-for-sale.

Berkshire’ s investments in fixed maturity and equity securities are primarily classified as available-for-

sale, except for certain investments, which are classified as held-to-maturity. Held-to-maturity

investments are carried at amortized cost, reflecting Berkshire’ s intent and ability to hold the securities to

maturity. Available-for-sale securities are stated at fair value with net unrealized gains or losses reported

as a separate component in shareholders’ equity. Realized gains and losses, which arise when available-

for-sale investments are sold (as determined on a specific identification basis) or other-than-temporarily

impaired are included in the Consolidated Statements of Earnings.

Other investments include investments in commodities, limited partnerships and warrants, which are carried

at fair value in the accompanying Consolidated Balance Sheets. Realized and unrealized gains and

losses associated with these investments are included in the Consolidated Statements of Earnings as a

component of realized investment gain.

Accounting policies and practices for investments held by finance and financial products businesses are

described in Note 9.