Berkshire Hathaway 2001 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

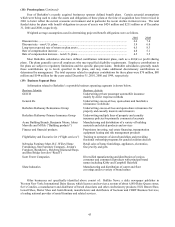

Notes to Consolidated Financial Statements (Continued)

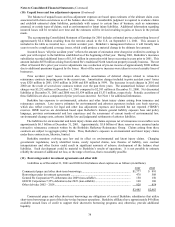

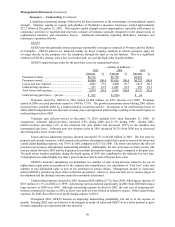

(10) Unpaid losses and loss adjustment expenses (Continued)

The balances of unpaid losses and loss adjustment expenses are based upon estimates of the ultimate claim costs

associated with claim occurrences as of the balance sheet dates. Considerable judgment is required to evaluate claims

and establish estimated claim liabilities, particularly with respect to certain lines of business, such as reinsurance

assumed, or certain types of claims, such as environmental or latent injury liabilities. Additional information regarding

incurred losses will be revealed over time and the estimates will be revised resulting in gains or losses in the periods

made.

The accompanying Consolidated Statement of Earnings for 2001 includes estimated pre-tax underwriting losses of

approximately $2.4 billion resulting from the terrorist attack in the U.S. on September 11, 2001. This amount is

included in the table as incurred loss – current accident year. Berkshire’ s management believes it will literally take

years to resolve complicated coverage issues, which could produce a material change in the ultimate loss amount.

Incurred losses “all prior accident years” reflects the amount of estimation error charged or credited to earnings in

each year with respect to the liabilities established as of the beginning of that year. During 2001, Berkshire’ s insurance

subsidiaries recorded additional losses of $1,165 million in connection with losses occurring in years prior to 2001. This

amount includes $878 million arising from General Re’ s traditional North American property/casualty business. The net

effect of General Re’ s prior year reserve adjustments was a reduction of pre-tax income of approximately $800 million

due to additional premiums triggered by the losses. Most of the reserve increases were taken in several casualty lines of

businesses.

Prior accident years’ losses incurred also include amortization of deferred charges related to retroactive

reinsurance contracts incepting prior to the current year. Amortization charges included in prior accident years’ losses

were $328 million in 2001, $145 million in 2000 and $59 million in 1999. The increases in such charges in 2001 and

2000 are the result of several new contracts written over the past three years. The unamortized balance of deferred

charges was $3,232 million at December 31, 2001 compared to $2,593 million at December 31, 2000. Net discounted

liabilities at December 31, 2001 and 2000 were $1,834 million and $1,531 million, respectively. Periodic accretions of

these liabilities are also a component of prior year losses incurred. See Note 1 for additional information.

Berkshire has exposure to environmental, asbestos and other latent injury claims arising from insurance and

reinsurance contracts. Loss reserve estimates for environmental and asbestos exposures include case basis reserves,

which also reflect reserves for legal and other loss adjustment expenses and incurred but not reported (“IBNR”)

reserves. IBNR reserves are determined based upon Berkshire’ s historic general liability exposure base and policy

language, previous environmental and loss experience and the assessment of current trends of environmental law,

environmental cleanup costs, asbestos liability law and judgmental settlements of asbestos liabilities.

The liabilities for environmental and latent injury claims and claims expenses net of reinsurance recoverables were

approximately $6.3 billion at December 31, 2001. Approximately, $5.0 billion of these reserves were assumed under

retroactive reinsurance contracts written by the Berkshire Hathaway Reinsurance Group. Claims arising from these

contracts are subject to aggregate policy limits. Thus, Berkshire’ s exposure to environmental and latent injury claims

under these contracts are, likewise, limited.

Berkshire monitors evolving case law and its effect on environmental and latent injury claims. Changing

government regulations, newly identified toxins, newly reported claims, new theories of liability, new contract

interpretations and other factors could result in significant amounts of adverse development of the balance sheet

liabilities. Such development could be material to Berkshire’ s results of operations. It is not possible to estimate

reliably the amount of additional net loss, or the range of net loss, that is reasonably possible.

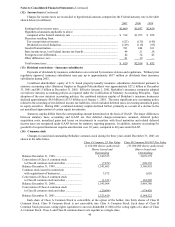

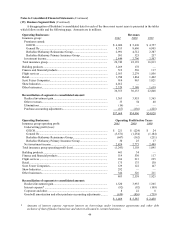

(11) Borrowings under investment agreements and other debt

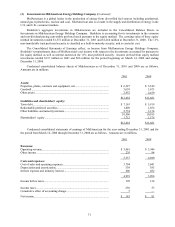

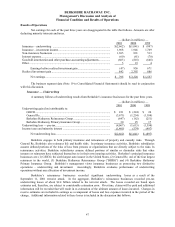

Liabilities as of December 31, 2001 and 2000 for this balance sheet caption are as follows (in millions).

2001 2000

Commercial paper and other short-term borrowings.................................................................... $1,777 $ 991

Borrowings under investment agreements ................................................................................... 478 508

General Re Corporation 9% debentures due 2009 (non-callable) ................................................ 150 150

GEICO Corporation 7.35% debentures due 2023 (non-callable) ................................................. 160 160

Other debt due 2002 – 2028 ......................................................................................................... 920 854

$3,485 $2,663

Commercial paper and other short-term borrowings are obligations of several Berkshire subsidiaries that utilize

short-term borrowings as part of their day-to-day business operations. Berkshire affiliates have approximately $4 billion

available unused lines of credit to support their short-term borrowing programs and, otherwise, provide additional

liquidity.