Berkshire Hathaway 2001 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

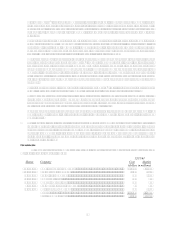

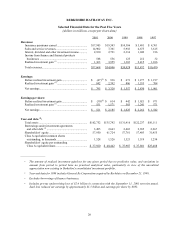

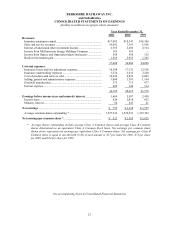

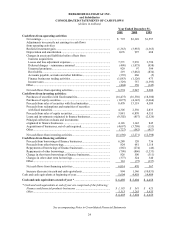

BERKSHIRE HATHAWAY INC.

and Subsidiaries

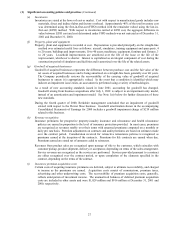

CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollars in millions)

Year Ended December 31,

2001 2000 1999

Cash flows from operating activities:

Net earnings................................................................................................ $ 795 $3,328 $1,557

Adjustments to reconcile net earnings to cash flows

from operating activities:

Realized investment gain............................................................................ (1,363) (3,955) (1,365)

Depreciation and amortization.................................................................... 1,076 997 688

Changes in assets and liabilities before effects from

business acquisitions:

Losses and loss adjustment expenses....................................................... 7,571 5,976 3,790

Deferred charges – reinsurance assumed ................................................. (498) (1,075) (958)

Unearned premiums................................................................................. 929 97 394

Receivables .............................................................................................. 219 (3,062) (834)

Accounts payable, accruals and other liabilities ...................................... (339) 660 (5)

Finance businesses trading activities ....................................................... (1,083) (1,126) 473

Income taxes ............................................................................................ (329) 757 (1,395)

Other........................................................................................................... (404) 350 (145)

Net cash flows from operating activities .................................................... 6,574 2,947 2,200

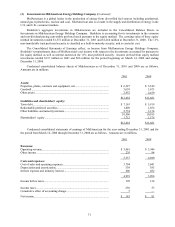

Cash flows from investing activities:

Purchases of securities with fixed maturities.............................................. (16,475) (16,550) (18,380)

Purchases of equity securities..................................................................... (1,075) (4,145) (3,664)

Proceeds from sales of securities with fixed maturities.............................. 8,470 13,119 4,509

Proceeds from redemptions and maturities of securities

with fixed maturities ................................................................................ 4,305 2,530 2,833

Proceeds from sales of equity securities..................................................... 3,881 6,870 4,355

Loans and investments originated in finance businesses............................ (9,502) (857) (2,526)

Principal collection on loans and investments

originated in finance businesses ................................................................. 4,126 1,142 845

Acquisitions of businesses, net of cash acquired........................................ (4,697) (3,798) (153)

Other........................................................................................................... (727) (582) (417)

Net cash flows from investing activities..................................................... (11,694) (2,271) (12,598)

Cash flows from financing activities:

Proceeds from borrowings of finance businesses....................................... 6,288 120 736

Proceeds from other borrowings................................................................. 824 681 1,118

Repayments of borrowings of finance businesses ...................................... (865) (274) (46)

Repayments of other borrowings................................................................ (798) (806) (1,333)

Change in short term borrowings of finance businesses............................. 826 500 (311)

Changes in other short term borrowings..................................................... (377) 324 340

Other........................................................................................................... 116 (75) (137)

Net cash flows from financing activities .................................................... 6,014 470 367

Increase (decrease) in cash and cash equivalents ....................................... 894 1,146 (10,031)

Cash and cash equivalents at beginning of year............................................... 5,604 4,458 14,489

Cash and cash equivalents at end of year *.................................................. $ 6,498 $ 5,604 $ 4,458

* Cash and cash equivalents at end of year are comprised of the following:

Finance and financial products businesses................................................ $ 1,185 $ 341 $ 623

Other........................................................................................................... 5,313 5,263 3,835

$ 6,498 $ 5,604 $ 4,458

See accompanying Notes to Consolidated Financial Statements