Berkshire Hathaway 2001 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.13

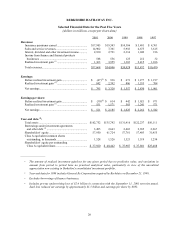

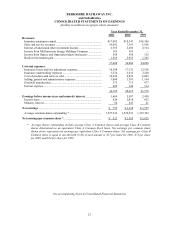

Here are some highlights (and lowlights) from 2001 relating to our non-insurance activities:

• Our shoe operations (included in other businesses) lost $46.2 million pre-tax, with profits at H.H. Brown

and Justin swamped by losses at Dexter.

Ive made three decisions relating to Dexter that have hurt you in a major way: (1) buying it in the first place;

(2) paying for it with stock and (3) procrastinating when the need for changes in its operations was obvious. I

would like to lay these mistakes on Charlie (or anyone else, for that matter) but they were mine. Dexter, prior

to our purchase and indeed for a few years after prospered despite low-cost foreign competition that was

brutal. I concluded that Dexter could continue to cope with that problem, and I was wrong.

We have now placed the Dexter operation which is still substantial in size under the management of Frank

Rooney and Jim Issler at H.H. Brown. These men have performed outstandingly for Berkshire, skillfully

contending with the extraordinary changes that have bedeviled the footwear industry. During part of 2002,

Dexter will be hurt by unprofitable sales commitments it made last year. After that, we believe our shoe

business will be reasonably profitable.

• MidAmerican Energy, of which we own 76% on a fully-diluted basis, had a good year in 2001. Its reported

earnings should also increase considerably in 2002 given that the company has been shouldering a large

charge for the amortization of goodwill and that this cost will disappear under the new GAAP rules.

Last year MidAmerican swapped some properties in England, adding Yorkshire Electric, with its 2.1 million

customers. We are now serving 3.6 million customers in the U.K. and are its 2nd largest electric utility. We

have an equally important operation in Iowa as well as major generating facilities in California and the

Philippines.

At MidAmerican this may surprise you we also own the second-largest residential real estate brokerage

business in the country. We are market-share leaders in a number of large cities, primarily in the Midwest, and

have recently acquired important firms in Atlanta and Southern California. Last year, operating under various

names that are locally familiar, we handled about 106,000 transactions involving properties worth nearly $20

billion. Ron Peltier has built this business for us, and its likely he will make more acquisitions in 2002 and

the years to come.

• Considering the recessionary environment plaguing them, our retailing operations did well in 2001. In

jewelry, same-store sales fell 7.6% and pre-tax margins were 8.9% versus 10.7% in 2000. Return on invested

capital remains high.

Same-store sales at our home-furnishings retailers were unchanged and so was the margin 9.1% pre-tax

these operations earned. Here, too, return on invested capital is excellent.

We continue to expand in both jewelry and home-furnishings. Of particular note, Nebraska Furniture Mart is

constructing a mammoth 450,000 square foot store that will serve the greater Kansas City area beginning in

the fall of 2003. Despite Bill Childs counter-successes, we will keep this store open on Sundays.

• The large acquisitions we initiated in late 2000 Shaw, Johns Manville and Benjamin Moore all came

through their first year with us in great fashion. Charlie and I knew at the time of our purchases that we were

in good hands with Bob Shaw, Jerry Henry and Yvan Dupuy, respectively and we admire their work even

more now. Together these businesses earned about $659 million pre-tax.

Shortly after yearend we exchanged 4,740 Berkshire A shares (or their equivalent in B shares) for the 12.7%

minority interest in Shaw, which means we now own 100% of the company. Shaw is our largest non-

insurance operation and will play a big part in Berkshires future.

• All of the income shown for Flight Services in 2001 and a bit more came from FlightSafety, our pilot-

training subsidiary. Its earnings increased 2.5%, though return on invested capital fell slightly because of the

$258 million investment we made last year in simulators and other fixed assets. My 84-year-old friend, Al

Ueltschi, continues to run FlightSafety with the same enthusiasm and competitive spirit that he has exhibited

since 1951, when he invested $10,000 to start the company. If I line Al up with a bunch of 60-year-olds at the

annual meeting, you will not be able to pick him out.