Berkshire Hathaway 2001 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

Notes to Consolidated Financial Statements (Continued)

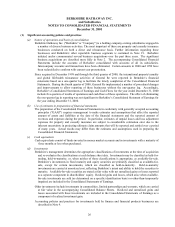

(2) Significant business acquisitions (Continued)

Justin Industries, Inc. (“Justin”)

Effective August 1, 2000, Berkshire acquired Justin. Principal businesses of Justin include: Acme Building

Brands, a leading manufacturer and producer of face brick, concrete masonry products and ceramic and marble floor

and wall tile and Justin Brands, a leading manufacturer of Western footwear under a number of brand names.

U.S. Investment Corporation (“USIC”)

Effective August 8, 2000, Berkshire acquired USIC. USIC is the parent of the United States Liability Insurance

Group, one of the premier U.S. writers of specialty insurance.

Benjamin Moore & Co. (“Benjamin Moore”)

Effective December 18, 2000, Berkshire acquired Benjamin Moore. Benjamin Moore is a formulator,

manufacturer and retailer of a broad range of architectural and industrial coatings, available principally in the U.S. and

Canada.

Aggregate consideration paid for the five business acquisitions consummated in 2000 totaled $2,370 million,

consisting of $2,146 million in cash and the remainder in Berkshire Class A and Class B common stock.

Each of the business acquisitions described above was accounted for under the purchase method. The excess of the

purchase cost of the business over the fair value of net assets acquired was recorded as goodwill of acquired businesses.

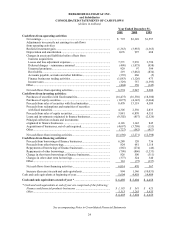

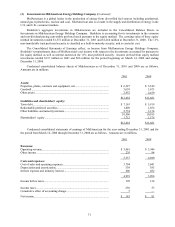

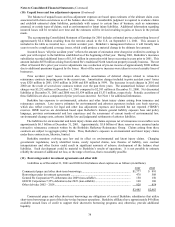

The results of operations for each of the nine entities acquired in 2001 and 2000 are included in Berkshire’ s

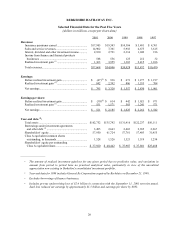

consolidated results of operations from the effective date of each merger. The following table sets forth certain

unaudited consolidated earnings data for 2001 and 2000, as if each of the acquisitions discussed above were

consummated on the same terms at the beginning of each year. Dollars are in millions except per share amounts.

2001 2000

Total revenues ............................................................................................................................ $38,137 $41,724

Net earnings ............................................................................................................................... 803 3,420

Earnings per equivalent Class A Common Share...................................................................... 526 2,243

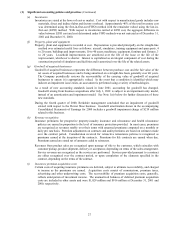

During the second half of 2001 Berkshire initiated two additional business acquisitions which had not closed as of

December 31, 2001. Information concerning these transactions follows.

Albecca Inc. (“Albecca”)

Effective February 8, 2002, Berkshire acquired for cash all of the outstanding shares of Albecca. Albecca designs,

manufactures and distributes a complete line of high-quality custom picture framing products primarily under the

Larson-Juhl name.

Fruit of the Loom (“FOL”)

On November 1, 2001, Berkshire announced that it had entered into an agreement with Fruit of the Loom, LTD.

and Fruit of the Loom, Inc. (together the “FOL entities”) to acquire the FOL entities’ basic apparel business. Under

terms of the agreement, the purchase price of $835 million in cash is subject to significant reduction for certain

liabilities, as well as adjustment upward or downward depending on working capital levels.

The FOL entities are currently operating as debtors-in-possession pursuant to its Chapter 11 bankruptcy filing

currently pending before the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). On

January 2, 2002, the Bankruptcy Court issued an order determining Berkshire as the successful bidder for the FOL

entities’ basic apparel business. A hearing to determine whether the FOL reorganization plan is confirmed (such plan

contemplates the aforementioned sale of the basic apparel business to Berkshire) has been scheduled for April 4, 2002.

If the FOL reorganization plan is confirmed at that time, the closing will occur in the second quarter of 2002.

The FOL apparel business is a leading vertically integrated basic apparel company manufacturing and marketing

underwear, activewear, casualwear and childrenswear. The FOL apparel business operates on a worldwide basis and

sells its products principally in North America under the Fruit of the Loom and BVD brand names.

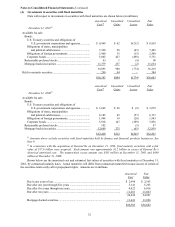

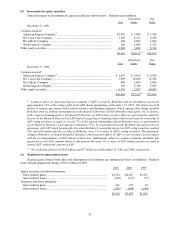

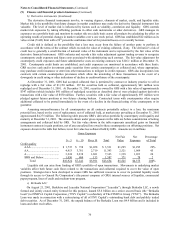

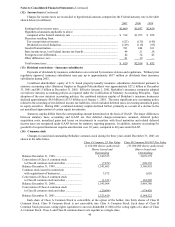

(3) Investments in MidAmerican Energy Holdings Company

On March 14, 2000, Berkshire invested approximately $1.24 billion in common stock and a non-dividend paying

convertible preferred stock of MidAmerican Energy Holdings Company (“MidAmerican”). Such investment gave

Berkshire about a 9.7% voting interest and a 76% economic interest in MidAmerican on a fully-diluted basis. Berkshire

subsidiaries also acquired approximately $455 million of an 11% non-transferable trust preferred security. Mr. Walter

Scott, Jr., a member of Berkshire’ s Board of Directors, controls approximately 86% of the voting interest in

MidAmerican.