Berkshire Hathaway 2001 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.29

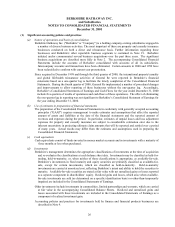

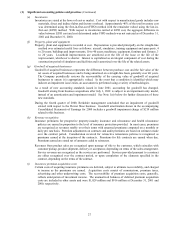

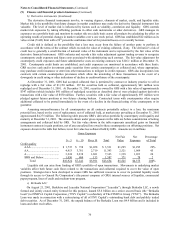

(1) Significant accounting policies and practices (Continued)

(n) Accounting pronouncements to be adopted subsequent to December 31, 2001 (Continued)

SFAS No. 144 “Accounting for the Impairment or Disposal of Long-Lived Assets” generally retains the

basic accounting model for the identification and measurement of impairments to long-lived assets to be

held and such assets to be disposed. SFAS No. 144 also addresses several implementation and financial

statement presentation issues not previously addressed under GAAP. The provisions of SFAS No. 144

will be effective for Berkshire at the beginning of 2002.

Although Berkshire has not completed its assessment of these new accounting standards, it expects that the

provisions of SFAS No. 142 related to accounting for goodwill will have a significant impact on its

consolidated earnings in 2002 when compared to consolidated earnings for years prior to 2002. The

accompanying Consolidated Statement of Earnings for 2001 includes goodwill amortization of $572

million. Additionally Berkshire’ s equity income from its investment in MidAmerican Energy Holdings

Company includes its share of MidAmerican’ s $96 million of goodwill amortization.

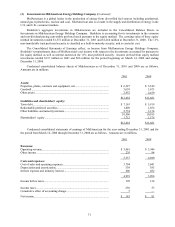

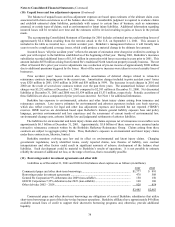

(2) Significant business acquisitions

During 2001, Berkshire completed four significant business acquisitions. Information concerning these

acquisitions follows.

Shaw Industries, Inc. (“Shaw”)

On January 8, 2001, Berkshire acquired approximately 87.3% of the common stock of Shaw for $19 per share or

$2.1 billion in total. An investment group consisting of Robert E. Shaw, Chairman and CEO of Shaw, Julian D. Saul,

President of Shaw, certain family members and related family interests of Messrs. Shaw and Saul, and certain other

directors and members of management acquired the remaining 12.7% of Shaw. In January 2002, Berkshire acquired all

of the shares of Shaw held by the investment group in exchange for 4,505 shares of Berkshire Class A common stock

and 7,063 shares of Class B common stock.

Shaw is the world’ s largest manufacturer of tufted broadloom carpet and rugs for residential and commercial

applications throughout the U.S. and exports to most markets worldwide. Shaw markets its residential and commercial

products under a variety of brand names.

Johns Manville Corporation (“Johns Manville”)

On February 27, 2001, Berkshire acquired Johns Manville. Berkshire purchased all of the outstanding shares of

Johns Manville common stock for $13 per share or $1.8 billion in total. Johns Manville is a leading manufacturer of

insulation and building products. Johns Manville manufactures and markets products for building and equipment

insulation, commercial and industrial roofing systems, high-efficiency filtration media, and fibers and non-woven mats

used as reinforcements in building and industrial applications.

MiTek Inc. (“MiTek”)

On July 31, 2001, Berkshire acquired a 90% equity interest in MiTek from Rexam PLC for approximately $400

million. Existing MiTek management acquired the remaining 10% interest. MiTek, headquartered in Chesterfield,

Missouri, produces steel connector products, design engineering software and ancillary services for the building

components market.

XTRA Corporation (“XTRA”)

On September 20, 2001, Berkshire acquired XTRA through a cash tender offer and subsequent statutory merger

for all of the outstanding shares. Holders of XTRA common stock received aggregate consideration of approximately

$578 million. XTRA, headquartered in Westport, Connecticut, is a leading operating lessor of transportation

equipment, including over-the-road trailers, marine containers and intermodal equipment.

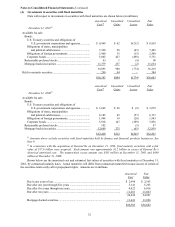

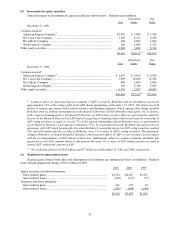

In addition, Berkshire completed six significant acquisitions in 2000. Information concerning five of these

acquisitions follows. Information concerning the other acquisition is contained in Note 3 (Investments in MidAmerican

Energy Holdings Company).

CORT Business Services Corporation (“CORT”)

Effective February 18, 2000, Wesco Financial Corporation, an indirect 80.1% owned subsidiary of Berkshire,

acquired CORT. CORT is a leading national provider of rental furniture, accessories and related services in the “rent-

to-rent” segment of the furniture industry.

Ben Bridge Jeweler (“Ben Bridge”)

Effective July 3, 2000, Berkshire acquired Ben Bridge. Ben Bridge is the leading operator of upscale jewelry

stores based in major shopping malls in the Western U.S.