Berkshire Hathaway 2001 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10

Since September 11th, Ajit has been particularly busy. Among the policies we have written and retained

entirely for our own account are (1) $578 million of property coverage for a South American refinery once a loss

there exceeds $1 billion; (2) $1 billion of non-cancelable third-party liability coverage for losses arising from acts of

terrorism at several large international airlines; (3) £500 million of property coverage on a large North Sea oil

platform, covering losses from terrorism and sabotage, above £600 million that the insured retained or reinsured

elsewhere; and (4) significant coverage on the Sears Tower, including losses caused by terrorism, above a $500

million threshold. We have written many other jumbo risks as well, such as protection for the World Cup Soccer

Tournament and the 2002 Winter Olympics. In all cases, however, we have attempted to avoid writing groups of

policies from which losses might seriously aggregate. We will not, for example, write coverages on a large number

of office and apartment towers in a single metropolis without excluding losses from both a nuclear explosion and

the fires that would follow it.

No one can match the speed with which Ajit can offer huge policies. After September 11th, his quickness

to respond, always important, has become a major competitive advantage. So, too, has our unsurpassed financial

strength. Some reinsurers particularly those who, in turn, are accustomed to laying off much of their business on a

second layer of reinsurers known as retrocessionaires are in a weakened condition and would have difficulty

surviving a second mega-cat. When a daisy chain of retrocessionaires exists, a single weak link can pose trouble for

all. In assessing the soundness of their reinsurance protection, insurers must therefore apply a stress test to all

participants in the chain, and must contemplate a catastrophe loss occurring during a very unfavorable economic

environment. After all, you only find out who is swimming naked when the tide goes out. At Berkshire, we retain

our risks and depend on no one. And whatever the worlds problems, our checks will clear.

Ajits business will ebb and flow but his underwriting principles wont waver. Its impossible to

overstate his value to Berkshire.

* * * * * * * * * * * *

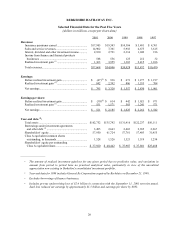

GEICO, by far our largest primary insurer, made major progress in 2001, thanks to Tony Nicely, its CEO,

and his associates. Quite simply, Tony is an owners dream.

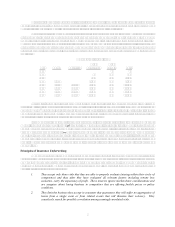

GEICOs premium volume grew 6.6% last year, its float grew $308 million, and it achieved an

underwriting profit of $221 million. This means we were actually paid that amount last year to hold the $4.25

billion in float, which of course doesnt belong to Berkshire but can be used by us for investment.

The only disappointment at GEICO in 2001 and its an important one was our inability to add

policyholders. Our preferred customers (81% of our total) grew by 1.6% but our standard and non-standard policies

fell by 10.1%. Overall, policies in force fell .8%.

New business has improved in recent months. Our closure rate from telephone inquiries has climbed, and

our Internet business continues its steady growth. We, therefore, expect at least a modest gain in policy count

during 2002. Tony and I are eager to commit much more to marketing than the $219 million we spent last year, but

at the moment we cannot see how to do so effectively. In the meantime, our operating costs are low and far below

those of our major competitors; our prices are attractive; and our float is cost-free and growing.

* * * * * * * * * * * *

Our other primary insurers delivered their usual fine results last year. These operations, run by Rod

Eldred, John Kizer, Tom Nerney, Michael Stearns, Don Towle and Don Wurster had combined premium volume of

$579 million, up 40% over 2000. Their float increased 14.5% to $685 million, and they recorded an underwriting

profit of $30 million. In aggregate, these companies are one of the finest insurance operations in the country, and

their 2002 prospects look excellent.

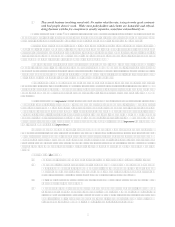

“Loss Development” and Insurance Accounting

Bad terminology is the enemy of good thinking. When companies or investment professionals use terms

such as EBITDA and pro forma, they want you to unthinkingly accept concepts that are dangerously flawed.

(In golf, my score is frequently below par on a pro forma basis: I have firm plans to restructure my putting stroke

and therefore only count the swings I take before reaching the green.)