Berkshire Hathaway 2001 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

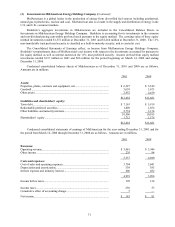

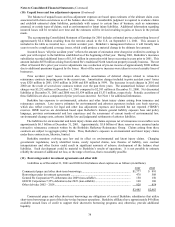

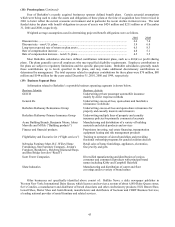

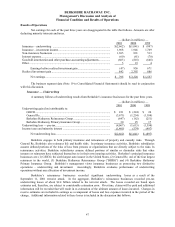

(11) Borrowings under investment agreements and other debt (Continued)

Borrowings under investment agreements are made pursuant to contracts calling for interest payable, normally

semiannually, at fixed rates ranging from 2.5% to 8.6% per annum. Contractual maturities of borrowings under

investment agreements generally range from 3 months to 30 years. Under certain conditions, these borrowings may be

redeemable prior to the contractual maturity dates.

Other debt includes variable and fixed rate term bonds and notes issued by various of Berkshire subsidiaries.

These obligations generally, are redeemable prior to maturity at the option of the issuing company.

No materially restrictive covenants are included in any of the various debt agreements. Payments of principal

amounts expected during the next five years are as follows (in millions).

2002 2003 2004 2005 2006

$1,835 $53 $40 $415 $98

During the second quarter of 2001, Berkshire filed a shelf registration to issue up to $700 million in new debt

securities at a future date. The intended purpose of the future issuance of debt is to fund the repayment of borrowings of

certain Berkshire subsidiaries. The timing and amount of the debt to be issued under the shelf registration has not yet

been determined.

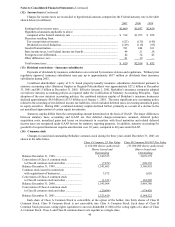

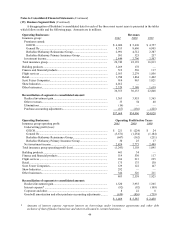

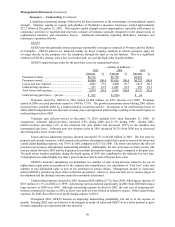

(12) Income taxes

The liability for income taxes as of December 31, 2001 and 2000 as reflected in the accompanying Consolidated

Balance Sheets is as follows (in millions). 2001 2000

Payable currently ................................................................................. $ (272) $ 522

Deferred ............................................................................................... 7,293 9,603

$7,021 $10,125

The Consolidated Statements of Earnings reflect charges for income taxes as shown below (in millions).

2001 2000 1999

Federal......................................................................................................................... $ 629 $2,136 $ 748

State............................................................................................................................. 68 32 43

Foreign ........................................................................................................................ (77) (150) 61

$ 620 $2,018 $ 852

Current ........................................................................................................................ $ 109 $2,012 $1,189

Deferred ...................................................................................................................... 511 6 (337)

$ 620 $2,018 $ 852

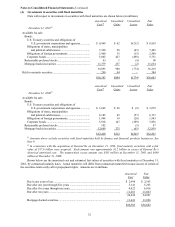

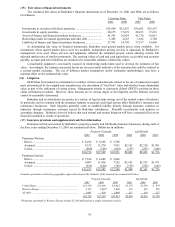

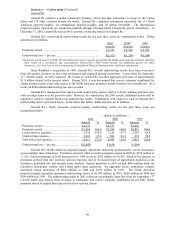

The tax effects of temporary differences that give rise to significant portions of deferred tax assets and deferred

tax liabilities at December 31, 2001 and 2000 are shown below (in millions).

2001 2000

Deferred tax liabilities:

Relating to unrealized appreciation of investments........................... $7,078 $9,571

Deferred charges reinsurance assumed ............................................. 1,131 916

Investments ....................................................................................... 382 441

Other ................................................................................................. 1,552 717

10,143 11,645

Deferred tax assets:

Unpaid losses and loss adjustment expenses..................................... (752) (1,061)

Unearned premiums .......................................................................... (294) (227)

Other ................................................................................................. (1,804) (754)

(2,850) (2,042)

Net deferred tax liability ...................................................................... $7,293 $9,603