Berkshire Hathaway 2001 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Business Activities

Berkshire Hathaway Inc. is a holding company owning subsidiaries engaged in a

number of diverse business activities. The most important of these is the property and

casualty insurance business conducted on both a direct and reinsurance basis through a

number of subsidiaries. Included in this group of subsidiaries is GEICO Corporation, the

sixth largest auto insurer in the United States and General Re Corporation, one of the four

largest reinsurers in the world.

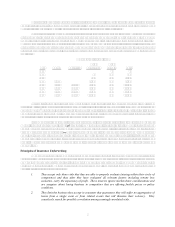

Investment portfolios of insurance subsidiaries include meaningful equity ownership

percentages of other publicly traded companies. Investments with a market value in

excess of $500 million at the end of 2001 include approximately 11% of the capital stock

of American Express Company, approximately 8% of the capital stock of The Coca-Cola

Company, approximately 9% of the capital stock of The Gillette Company,

approximately 9% of the capital stock of H&R Block, Inc., approximately 15% of the

capital stock of Moody’ s Corporation, approximately 18% of the capital stock of The

Washington Post Company and approximately 3% of the capital stock of Wells Fargo

and Company. Much information about these publicly-owned companies is available,

including information released from time to time by the companies themselves.

Numerous business activities are conducted through non-insurance subsidiaries.

FlightSafety International provides training of aircraft and ship operators. Executive Jet

provides fractional ownership programs for general aviation aircraft. Nebraska Furniture

Mart, R.C. Willey Home Furnishings, Star Furniture, and Jordan’s Furniture are retailers

of home furnishings. Borsheim’s, Helzberg Diamond Shops and Ben Bridge Jeweler are

retailers of fine jewelry. Scott Fetzer is a diversified manufacturer and distributor of

commercial and industrial products, the principal products are sold under the Kirby and

Campbell Hausfeld brand names.

Also included in the non-insurance subsidiaries are several large manufacturing

businesses acquired during 2000 and 2001. Shaw Industries is the world’ s largest

manufacturer of tufted broadloom carpet. Benjamin Moore is a formulator, manufacturer

and retailer of architectural and industrial coatings. Johns Manville is a leading

manufacturer of insulation and building products. Acme Building Brands is a

manufacturer of face brick and concrete masonry products. MiTek Inc. produces steel

connector products and engineering software for the building components market.

In addition, Berkshire’ s other non-insurance business activities include: Buffalo News,

a publisher of a daily and Sunday newspaper; See’s Candies, a manufacturer and seller of

boxed chocolates and other confectionery products; H.H. Brown, Lowell, Dexter and

Justin Brands, manufacturers and distributors of footwear under a variety of brand

names; International Dairy Queen, which licenses and services a system of about 6,000

stores that offer prepared dairy treats and food; CORT, a provider of rental furniture,

accessories and related services and XTRA Corporation, a leading operating lessor of

transportation equipment.

Operating decisions for the various Berkshire businesses are made by managers of the

business units. Investment decisions and all other capital allocation decisions are made

for Berkshire and its subsidiaries by Warren E. Buffett, in consultation with Charles T.

Munger. Mr. Buffett is Chairman and Mr. Munger is Vice Chairman of Berkshire's Board

of Directors.

************