Berkshire Hathaway 2001 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

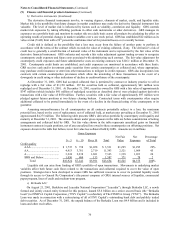

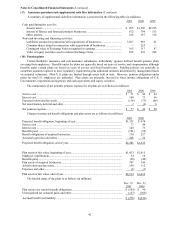

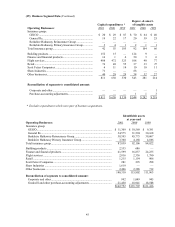

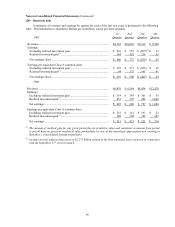

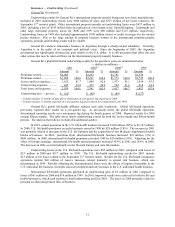

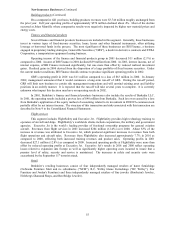

(19) Business Segment Data (Continued)

Deprec. & amort.

Capital expenditures * of tangible assets

Operating Businesses: 2001 2000 1999 2001 2000 1999

Insurance group:

GEICO ........................................................................... $ 20 $ 29 $ 87 $ 70 $ 64 $ 40

General Re...................................................................... 19 22 17 20 39 25

Berkshire Hathaway Reinsurance Group ....................... — —————

Berkshire Hathaway Primary Insurance Group.............. 3 4 1 2 1 1

Total insurance group........................................................ 42 55 105 92 104 66

Building products.............................................................. 152 15 — 124 9 —

Finance and financial products.......................................... 16 1 4 50 3 6

Flight services ................................................................... 408 472 323 108 90 77

Retail................................................................................. 76 48 55 37 33 27

Scott Fetzer Companies .................................................... 6 11 14 10 10 11

Shaw Industries................................................................. 71 — — 88 — —

Other businesses................................................................ 40 28 29 34 32 27

811 630 530 543 281 214

Reconciliation of segments to consolidated amount:

Corporate and other........................................................ — ———— 1

Purchase-accounting adjustments................................... — — — 1 1 3

$ 811 $ 630 $ 530 $ 544 $ 282 $ 218

* Excludes expenditures which were part of business acquisitions.

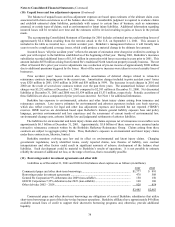

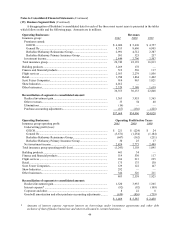

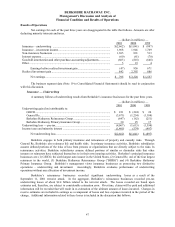

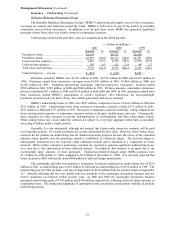

Identifiable assets

at year-end

Operating Businesses: 2001 2000 1999

Insurance group:

GEICO........................................................................................................ $ 11,309 $ 10,569 $ 9,381

General Re.................................................................................................. 34,575 31,594 30,168

Berkshire Hathaway Reinsurance Group.................................................... 38,595 45,775 39,607

Berkshire Hathaway Primary Insurance Group.......................................... 3,360 4,168 4,866

Total insurance group.................................................................................... 87,839 92,106 84,022

Building products .......................................................................................... 2,535 686 —

Finance and financial products...................................................................... 41,599 16,837 24,235

Flight services ............................................................................................... 2,816 2,336 1,790

Retail ............................................................................................................. 1,215 1,154 906

Scott Fetzer Companies................................................................................. 281 295 298

Shaw Industries ............................................................................................. 1,619 — —

Other businesses............................................................................................ 2,406 2,388 712

140,310 115,802 111,963

Reconciliation of segments to consolidated amount:

Corporate and other .................................................................................... 992 1,049 945

Goodwill and other purchase-accounting adjustments ............................... 21,450 18,941 18,508

$162,752 $135,792 $131,416