Berkshire Hathaway 2001 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

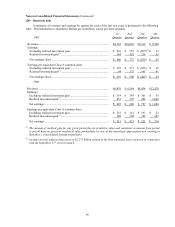

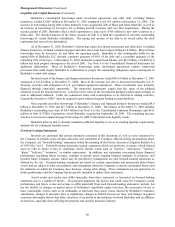

Insurance — Underwriting (Continued)

General Re (Continued)

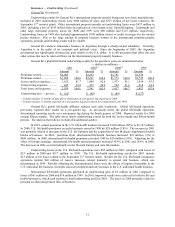

Underwriting results for General Re’ s international property/casualty businesses have been unsatisfactory.

Included in 2001 underwriting results were $500 million of gross and $313 million of net losses related to the

September 11th terrorist attack. Other international property/casualty net underwriting losses were $433 million in

2001, including a loss of $143 million from an explosion at a steel plant in the United Kingdom. Catastrophe and

other large individual property losses for 2000 and 1999 were $80 million and $112 million, respectively.

Underwriting losses in 1999 also included approximately $100 million related to credit coverages for the motion

picture business. Due to the large amount of property business written in the international property/casualty

operations, periodic underwriting results will be volatile.

General Re conducts reinsurance business in Argentina through a wholly-owned subsidiary. Currently,

Argentina is in the midst of an economic and political crisis. Since the beginning of 2002, the Argentine

government has significantly devalued the peso relative to the U.S. dollar. It is still uncertain what effect this and

other actions that may be taken will have on the international property/casualty business.

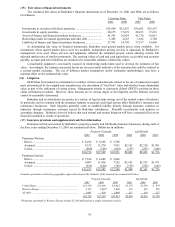

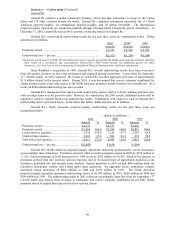

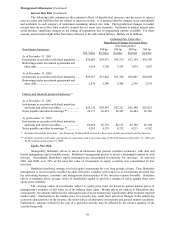

General Re’ s global life/health underwriting results for the past three years are summarized below.

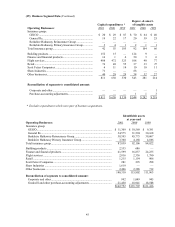

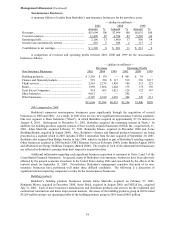

— (dollars in millions) —

2001 2000(1) 2000(2) 1999

Amount %Amount %Amount %Amount %

Premiums written ..................... $2,005 $2,263 $1,781 $1,736

Premiums earned...................... $1,988 100.0 $2,261 100.0 $1,773 100.0 $1,725 100.0

Losses and loss expenses ......... 1,625 81.7 1,869 82.6 1,473 83.1 1,434 83.2

Underwriting expenses............. 445 22.4 472 20.9 384 21.6 418 24.2

Total losses and expenses......... 2,070 104.1 2,341 103.5 1,857 104.7 1,852 107.4

Underwriting loss — pre-tax.... $ (82) $ (80) $ (84) $ (127)

(1) Column includes 15 months of data due to elimination of one-quarter lag reporting in 2000.

(2) Column includes 12 months reported on a one-quarter lag and is shown for comparability with 1999.

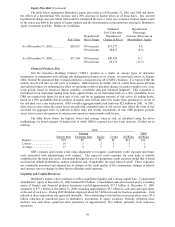

General Re’ s global life/health affiliates reinsure such risks worldwide. Global life/health operations

previously reported their results on a one-quarter lag. As previously noted, the global life/health operations

discontinued reporting results on a one-quarter lag during the fourth quarter of 2000. Reported results for 2000

contain fifteen months. The table above shows underwriting results for both the twelve-month and fifteen-month

periods. The analysis that follows excludes this additional quarter.

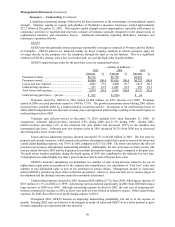

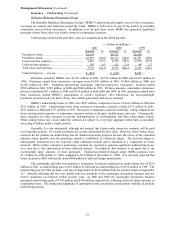

In 2001, earned premiums in the U.S. life/health business increased $194 million (20%) to $1,147 million.

In 2000, U.S. life/health premiums exceeded amounts earned in 1999 by $28 million (3.0%). The increase in 2001

was primarily related to increases in the U.S. life business and the acquisition of two Medicare supplement (health)

blocks of business. In 2001, premiums from international life/health business increased $21 million (3%) to

$841 million. In 2000, international life/health premiums exceeded 1999 by $20 million (3.0%). Adjusting for the

effect of foreign exchange, international life/health earned premiums increased 10.4% in 2001 and 14.8% in 2000.

The increases in 2001 occurred primarily in the Western Europe and Asia life markets.

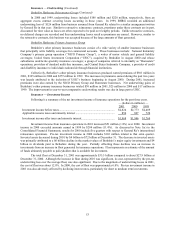

Underwriting losses in the U.S. life/health operations were $87 million in 2001, compared with losses of

$23 million in 2000 and $117 million in 1999. The U.S. life/health underwriting results for 2001 include

$15 million of net losses related to the September 11th terrorist attack. Results for the U.S. life/health reinsurance

operations include $46 million of reserve increases related primarily to special risk business, which was

discontinued in 1999. Partially offsetting the aforementioned losses were the effects of improved mortality in the

U.S. individual life business, favorable claim development and rate increases in the U.S. individual health business.

International life/health operations generated an underwriting gain of $5 million in 2001 compared to

losses of $61 million in 2000 and $10 million in 1999. In 2001, improved results were achieved in both the life and

health businesses, which each reported a small underwriting profit in 2001. The losses in 2000 primarily related to

personal accident and pension lines of business.