Berkshire Hathaway 2001 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

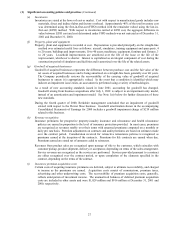

(9) Finance and financial products businesses (Continued)

c) Berkadia LLC (Continued)

Berkadia financed the entire Berkadia Loan through a third party lending facility led by Fleet Bank (“Fleet Loan”).

Both the Berkadia Loan and the Fleet Loan are due on August 20, 2006. Under the terms of the Fleet Loan, Berkadia is

obligated to use the proceeds received from principal prepayments on the Berkadia Loan to prepay the Fleet Loan. Since

the end of 2001, FNV Capital has prepaid $1.0 billion aggregate principal amount of the Berkadia Loan and Berkadia

has repaid a like amount to its lenders. The Fleet Loan is collateralized by the Berkadia Loan. Among other things, the

Fleet Loan requires that FNV maintain a minimum ratio of its consolidated assets to the outstanding Fleet Loan balance.

Berkadia is required to pay down the loan to the extent such ratio is under the minimum. Berkshire provided Berkadia’ s

lenders with a 90% primary guaranty of the Berkadia Loan and also provided a secondary guaranty to the 10% primary

guaranty provided by Leucadia. Berkshire has a 90% economic interest in Berkadia’ s loan to FNV Capital and

Berkadia’ s borrowings from the lending facility.

In connection with the restructuring and concurrent with the loan to FNV Capital, Berkadia received 61,020,581

shares of FNV common stock representing 50% of the total FNV outstanding shares. Berkadia initially recorded the

FNV common stock at fair value and subsequently accounted for the stock pursuant to the equity method. The value

assigned to the stock increased the discount on the Berkadia Loan, which will subsequently be accreted into interest

income over the life of the Berkadia Loan. Berkshire and Leucadia each have a 50% economic interest in Berkadia’ s

ownership of the FNV common stock. Due to post-August 21 operating losses of FNV, the investment in FNV common

stock was completely written off. Consequently, the equity method was suspended as of September 30, 2001.

d) Other investment

On July 1, 1998, Value Capital L.P., a limited partnership commenced operations. A wholly owned subsidiary of

Berkshire is a limited partner in Value Capital. The partnership’ s investment objective is to achieve income and capital

growth from investments and arbitrage in fixed income investments. Berkshire accounts for this investment pursuant to

the equity method. Since inception Berkshire has contributed $430 million to the partnership. At December 31, 2001,

the carrying value of $542 million (including Berkshire’ s share of accumulated earnings of $112 million) is included as

a component of other assets on the preceding summary of assets and liabilities. Neither Berkshire nor any of its

subsidiaries provides or will provide any financial support of the obligations of this partnership or of the other partners.

As a limited partner, Berkshire’ s exposure to loss is limited to the carrying value of its investment.

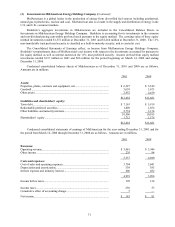

(10) Unpaid losses and loss adjustment expenses

Supplemental data with respect to unpaid losses and loss adjustment expenses of property/casualty insurance

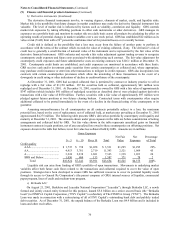

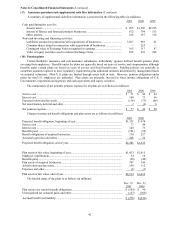

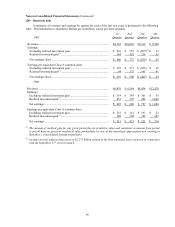

subsidiaries (in millions) is as follows. 2001 2000 1999

Unpaid losses and loss adjustment expenses:

Gross liabilities at beginning of year ................................................................ $33,022 $26,802 $23,012

Ceded losses and deferred charges.................................................................... (5,590) (3,848) (2,727)

Net balance........................................................................................................ 27,432 22,954 20,285

Incurred losses recorded:

Current accident year ........................................................................................ 15,608 15,252 11,275

All prior accident years ..................................................................................... 1,165 211 (192)

Total incurred losses ......................................................................................... 16,773 15,463 11,083

Payments with respect to:

Current accident year ........................................................................................ 4,435 4,589 3,648

All prior accident years ..................................................................................... 5,366 5,890 4,532

Total payments .................................................................................................. 9,801 10,479 8,180

Unpaid losses and loss adjustment expenses:

Net balance at end of year................................................................................. 34,404 27,938 23,188

Ceded losses and deferred charges.................................................................... 6,189 5,590 3,848

Foreign currency translation adjustment........................................................... 30 (722) (234)

Net liabilities assumed in connection with business acquisitions..................... 93 216 —

Gross liabilities at end of year.............................................................................. $40,716 $33,022 $26,802