Berkshire Hathaway 2001 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

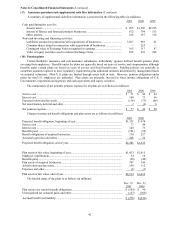

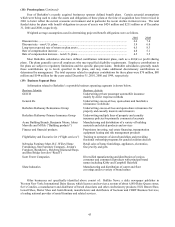

Notes to Consolidated Financial Statements (Continued)

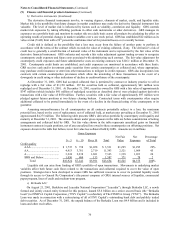

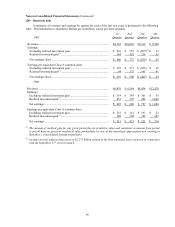

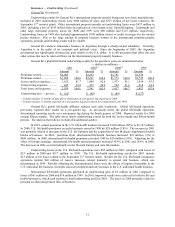

(19) Business Segment Data (Continued)

A disaggregation of Berkshire’ s consolidated data for each of the three most recent years is presented in the tables

which follow on this and the following page. Amounts are in millions.

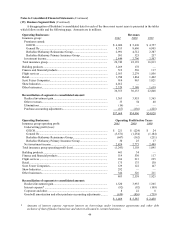

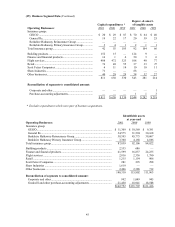

Operating Businesses: Revenues

Insurance group: 2001 2000 1999

Premiums earned:

GEICO.................................................................................................... $ 6,060 $ 5,610 $ 4,757

General Re.............................................................................................. 8,353 8,696 6,905

Berkshire Hathaway Reinsurance Group................................................ 2,991 4,712 2,387

Berkshire Hathaway Primary Insurance Group ...................................... 501 325 257

Investment income..................................................................................... 2,844 2,796 2,507

Total insurance group................................................................................... 20,749 22,139 16,813

Building products ......................................................................................... 3,269 178 —

Finance and financial products..................................................................... 519 530 117

Flight services .............................................................................................. 2,563 2,279 1,856

Retail ............................................................................................................ 1,998 1,864 1,402

Scott Fetzer Companies................................................................................ 914 963 1,021

Shaw Industries ............................................................................................ 4,012 — —

Other businesses........................................................................................... 2,329 2,180 1,639

36,353 30,133 22,848

Reconciliation of segments to consolidated amount:

Realized investment gain........................................................................... 1,363 3,955 1,365

Other revenues........................................................................................... 35 54 40

Eliminations............................................................................................... (16) — —

Purchase-accounting adjustments.............................................................. (67) (136) (225)

$37,668 $34,006 $24,028

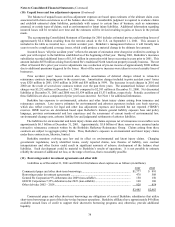

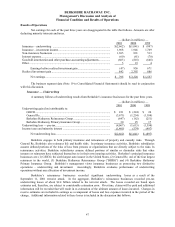

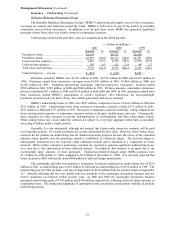

Operating Businesses: Operating Profit before Taxes

Insurance group operating profit: 2001 2000 1999

Underwriting profit (loss):

GEICO.................................................................................................... $ 221 $ (224) $ 24

General Re.............................................................................................. (3,671) (1,254) (1,184)

Berkshire Hathaway Reinsurance Group................................................ (647) (162) (251)

Berkshire Hathaway Primary Insurance Group ...................................... 30 25 17

Net investment income.............................................................................. 2,824 2,773 2,489

Total insurance group operating profit (loss) ............................................... (1,243) 1,158 1,095

Building products ......................................................................................... 461 34 —

Finance and financial products..................................................................... 519 530 117

Flight services .............................................................................................. 186 213 225

Retail ............................................................................................................ 175 175 130

Scott Fetzer Companies................................................................................ 129 122 147

Shaw Industries ............................................................................................ 292 — —

Other businesses........................................................................................... 344 326 211

863 2,558 1,925

Reconciliation of segments to consolidated amount:

Realized investment gain........................................................................... 1,320 3,955 1,365

Interest expense* ....................................................................................... (92) (92) (109)

Corporate and other................................................................................... 8 22 8

Goodwill amortization and other purchase-accounting adjustments ......... (630) (856) (739)

$ 1,469 $ 5,587 $ 2,450

* Amounts of interest expense represent interest on borrowings under investment agreements and other debt

exclusive of that of finance businesses and interest allocated to certain businesses.