Berkshire Hathaway 2001 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

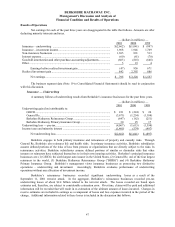

Insurance — Underwriting (Continued)

General Re

General Re conducts a global reinsurance business, which provides reinsurance coverage in the United

States and 135 other countries around the world. General Re’ s principal reinsurance operations are: (1) North

American property/casualty, (2) international property/casualty, and (3) global life/health. The international

property/casualty operations are conducted primarily through Germany-based Cologne Re and its subsidiaries. At

December 31, 2001, General Re had an 88% economic ownership interest in Cologne Re.

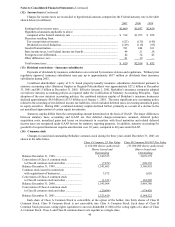

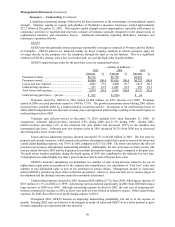

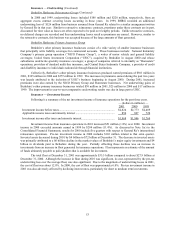

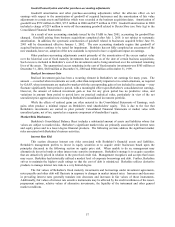

General Re’ s consolidated underwriting results for the past three years are summarized below. Dollar

amounts are in millions.

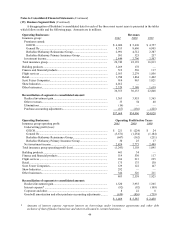

2001 2000(1) 1999

Amount Amount Amount

Premiums earned .............................................................................. $ 8,353 $ 8,696 $ 6,905

Underwriting loss — pre-tax............................................................ $(3,671) $(1,254) $(1,184)

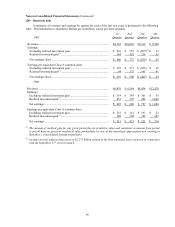

(1) During the fourth quarter of 2000, the international property/casualty and global life/health operations discontinued reporting

their results on a one-quarter lag. Consequently, General Re’s 2000 results include one additional quarter for these

businesses. See Note 1(a) to the accompanying Consolidated Financial Statements for additional information.

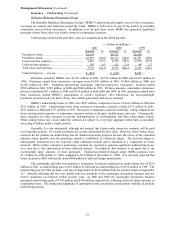

Since Berkshire’ s acquisition in 1998, General Re’ s overall underwriting results have been very poor.

Over this period, increases in loss costs accelerated and outpaced pricing corrections. Losses from the September

11th terrorist attack severely impacted the results as General Re recorded aggregate net losses of approximately

$1.9 billion related to the terrorist attack. During 2001, it was determined that reserve estimates established for

claims arising in prior years with respect to the North American property/casualty business were insufficient. As a

result, an $800 million underwriting loss was recorded.

General Re’ s management has taken several underwriting actions relative to better aligning premium rates

with coverage terms over the past two years. However, as evidenced by the 2001 results, additional actions will be

required to achieve targeted break-even underwriting results. Information with respect to each of General Re’ s

underwriting units is presented below. In the tables that follow, dollar amounts are in millions.

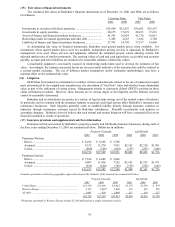

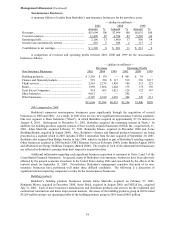

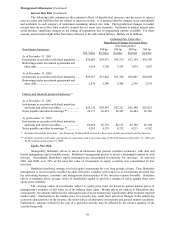

General Re’ s North American property/casualty underwriting results for the past three years are

summarized below.

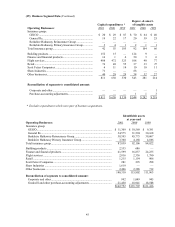

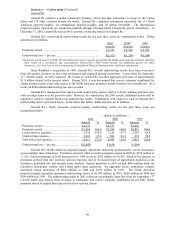

— (dollars in millions) —

2001 2000 1999

Amount %Amount %Amount %

Premiums written ................................................. $ 4,172 $3,517 $2,801

Premiums earned .................................................. $ 3,968 100.0 $3,389 100.0 $2,837 100.0

Losses and loss expenses...................................... 5,795 146.0 3,161 93.3 2,547 89.8

Underwriting expenses......................................... 1,016 25.6 884 26.1 874 30.8

Total losses and expenses..................................... 6,811 171.6 4,045 119.4 3,421 120.6

Underwriting loss — pre-tax................................ $(2,843) $ (656) $ (584)

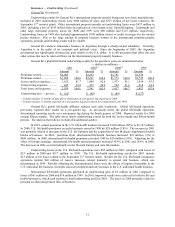

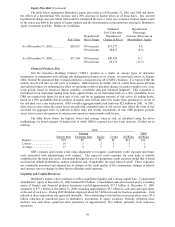

General Re’ s North American property/casualty operations underwrite predominantly excess reinsurance

across multiple lines of business. Premiums earned in 2001 exceeded premiums earned in 2000 by $579 million or

17.1%. Earned premiums in 2000 increased over 1999 levels by $552 million or 19.5%. Much of the increase in

premiums derived from rate increases and new business (net of the non-renewal of unprofitable business) in the

facultative individual risk and casualty treaty markets. Earned premiums in 2001 include $400 million from one

retroactive reinsurance contract and a large quota share agreement. An aggregate excess reinsurance contract

generated earned premiums of $404 million in 2000 and $154 million in 1999. The North American

property/casualty operations generated underwriting losses of $2,843 million in 2001, $656 million in 2000 and

$584 million in 1999. The underwriting results in 2001 reflect an exceptionally large loss from the September 11th

terrorist attack and charges from revisions to inadequate loss reserve estimates established for pre-2001 claims

primarily driven by higher than expected levels of reported claims.