Berkshire Hathaway 2001 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

After September 11th, training for commercial airlines fell, and today it remains depressed. However, training

for business and general aviation, our main activity, is at near-normal levels and should continue to grow. In

2002, we expect to spend $162 million for 27 simulators, a sum far in excess of our annual depreciation charge

of $95 million. Those who believe that EBITDA is in any way equivalent to true earnings are welcome to pick

up the tab.

Our NetJets® fractional ownership program sold a record number of planes last year and also showed a gain of

21.9% in service income from management fees and hourly charges. Nevertheless, it operated at a small loss,

versus a small profit in 2000. We made a little money in the U.S., but these earnings were more than offset by

European losses. Measured by the value of our customers planes, NetJets accounts for about half of the

industry. We believe the other participants, in aggregate, lost significant money.

Maintaining a premier level of safety, security and service was always expensive, and the cost of sticking to

those standards was exacerbated by September 11th. No matter how much the cost, we will continue to be the

industry leader in all three respects. An uncompromising insistence on delivering only the best to his

customers is embedded in the DNA of Rich Santulli, CEO of the company and the inventor of fractional

ownership. Im delighted with his fanaticism on these matters for both the companys sake and my familys: I

believe the Buffetts fly more fractional-ownership hours we log in excess of 800 annually than does any

other family. In case youre wondering, we use exactly the same planes and crews that serve NetJets other

customers.

NetJets experienced a spurt in new orders shortly after September 11th, but its sales pace has since returned to

normal. Per-customer usage declined somewhat during the year, probably because of the recession.

Both we and our customers derive significant operational benefits from our being the runaway leader in the

fractional ownership business. We have more than 300 planes constantly on the go in the U.S. and can

therefore be wherever a customer needs us on very short notice. The ubiquity of our fleet also reduces our

positioning costs below those incurred by operators with smaller fleets.

These advantages of scale, and others we have, give NetJets a significant economic edge over competition.

Under the competitive conditions likely to prevail for a few years, however, our advantage will at best produce

modest profits.

• Our finance and financial products line of business now includes XTRA, General Re Securities (which is in a

run-off mode that will continue for an extended period) and a few other relatively small operations. The bulk

of the assets and liabilities in this segment, however, arise from a few fixed-income strategies, involving

highly-liquid AAA securities, that I manage. This activity, which only makes sense when certain market

relationships exist, has produced good returns in the past and has reasonable prospects for continuing to do so

over the next year or two.

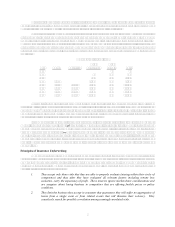

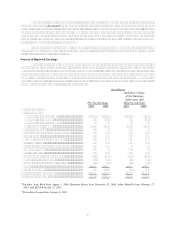

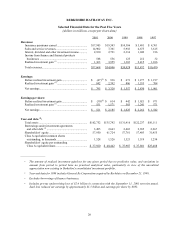

Investments

Below we present our common stock investments. Those that had a market value of more than $500

million at the end of 2001 are itemized.

12/31/01

Shares Company Cost Market

(dollars in millions)

151,610,700 American Express Company..................................................................... $ 1,470 $ 5,410

200,000,000 The Coca-Cola Company.......................................................................... 1,299 9,430

96,000,000 The Gillette Company ............................................................................... 600 3,206

15,999,200 H&R Block, Inc. ....................................................................................... 255 715

24,000,000 Moodys Corporation................................................................................ 499 957

1,727,765 The Washington Post Company................................................................ 11 916

53,265,080 Wells Fargo & Company .......................................................................... 306 2,315

Others ........................................................................................................ 4,103 5,726

Total Common Stocks............................................................................... $8,543 $28,675