Berkshire Hathaway 2001 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

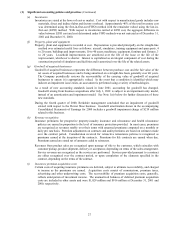

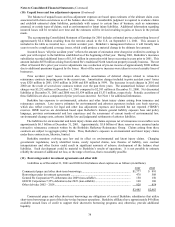

(3) Investments in MidAmerican Energy Holdings Company (Continued)

MidAmerican is a global leader in the production of energy from diversified fuel sources including geothermal,

natural gas, hydroelectric, nuclear and coal. MidAmerican also is a leader in the supply and distribution of energy in the

U.S. and U.K. consumer markets.

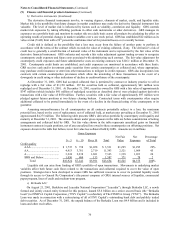

Berkshire’ s aggregate investments in MidAmerican are included in the Consolidated Balance Sheets as

Investments in MidAmerican Energy Holdings Company. Berkshire is accounting for its investments in the common

and non-dividend paying convertible preferred stock pursuant to the equity method. The carrying value of these equity

method investments totaled $1,372 million at December 31, 2001 and $1,264 million at December 31, 2000. The 11%

non-transferable trust preferred security is classified as a held-to-maturity security, and is carried at cost.

The Consolidated Statements of Earnings reflect, as Income from MidAmerican Energy Holdings Company,

Berkshire’ s proportionate share of MidAmerican’ s net income with respect to the investments accounted for pursuant to

the equity method, as well as interest earned on the 11% trust preferred security. Income derived from equity method

investments totaled $115 million in 2001 and $66 million for the period beginning on March 14, 2000 and ending

December 31, 2000.

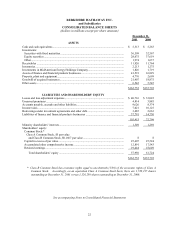

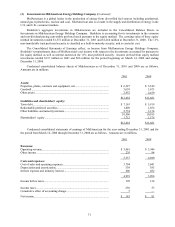

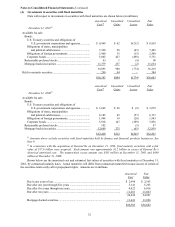

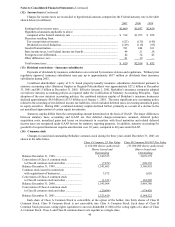

Condensed consolidated balance sheets of MidAmerican as of December 31, 2001 and 2000 are as follows.

Amounts are in millions.

2001 2000

Assets:

Properties, plants, contracts and equipment, net............................................... $ 6,527 $ 5,349

Goodwill........................................................................................................... 3,639 3,673

Other assets....................................................................................................... 2,452 2,659

$12,618 $11,681

Liabilities and shareholders’ equity:

Term debt.......................................................................................................... $ 7,163 $ 5,919

Redeemable preferred securities....................................................................... 1,009 1,032

Other liabilities and minority interests.............................................................. 2,734 3,154

10,906 10,105

Shareholders’ equity ......................................................................................... 1,712 1,576

$12,618 $11,681

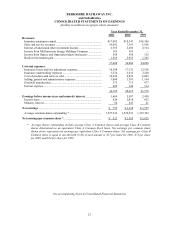

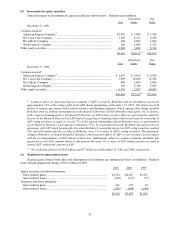

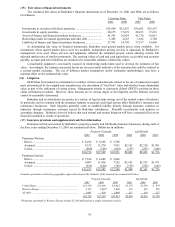

Condensed consolidated statements of earnings of MidAmerican for the year ending December 31, 2001 and for

the period from March 14, 2000 through December 31, 2000 are as follows. Amounts are in millions.

2001 2000

Revenues:

Operating revenue............................................................................................. $ 5,061 $ 3,946

Other income .................................................................................................... 276 94

5,337 4,040

Costs and expenses:

Cost of sales and operating expenses................................................................ 3,794 3,041

Depreciation and amortization.......................................................................... 539 383

Interest expense and minority interest .............................................................. 606 482

4,939 3,906

Income before taxes.......................................................................................... 398 134

Income taxes..................................................................................................... 250 53

Cumulative effect of accounting change .......................................................... 5 —

Net income........................................................................................................ $ 143 $ 81