Berkshire Hathaway 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BERKSHIRE HATHAWAY INC.

2001 ANNUAL REPORT

TABLE OF CONTENTS

Business Activities.................................................... Inside Front Cover

Corporate Performance vs. the S&P 500 ................................................ 2

Chairman's Letter*.................................................................................. 3

Selected Financial Data For The

Past Five Years .................................................................................. 20

Acquisition Criteria ................................................................................21

Independent Auditors' Report ................................................................. 21

Consolidated Financial Statements.........................................................22

Management's Discussion....................................................................... 47

Chairman’ s Memo to Managers

Following September 11th Terrorist Attack ........................................ 61

Owner's Manual...................................................................................... 62

Shareholder-Designated Contributions................................................... 69

Common Stock Data............................................................................... 71

Subsidiary Listing...................................................................................72

Directors and Officers of the Company.........................Inside Back Cover

*Copyright © 2002 By Warren E. Buffett

All Rights Reserved

Table of contents

-

Page 1

BERKSHIRE HATHAWAY INC. 2001 ANNUAL REPORT TABLE OF CONTENTS Business Activities... Inside Front Cover Corporate Performance vs. the S&P 500 ...2 Chairman's Letter*...3 Selected Financial Data For The Past Five Years ...20 Acquisition Criteria ...21 Independent Auditors' Report ...21 Consolidated ... -

Page 2

... Jet provides fractional ownership programs for general aviation aircraft. Nebraska Furniture Mart, R.C. Willey Home Furnishings, Star Furniture, and Jordan' s Furniture are retailers of home furnishings. Borsheim' s, Helzberg Diamond Shops and Ben Bridge Jeweler are retailers of fine jewelry... -

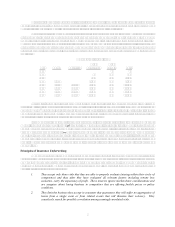

Page 3

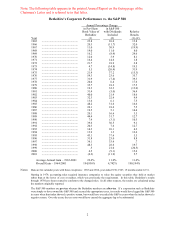

...,194% Average Annual Gain - 1965-2001 Overall Gain - 1964-2001 Notes: Data are for calendar years with these exceptions: 1965 and 1966, year ended 9/30; 1967, 15 months ended 12/31. Starting in 1979, accounting rules required insurance companies to value the equity securities they hold at market... -

Page 4

... To the Shareholders of Berkshire Hathaway Inc.: BerkshireÂ's loss in net worth during 2001 was $3.77 billion, which decreased the per-share book value of both our Class A and Class B stock by 6.2%. Over the last 37 years (that is, since present management took over) per-share book value has grown... -

Page 5

... our investment in Washington Post in 1973 or GEICO in 1976). Today, the combination of ten such ideas and a triple in the value of each would increase the net worth of Berkshire by only ¼ of 1%. We need Â"elephantsÂ" to make significant gains now Â- and they are hard to find. On the positive side... -

Page 6

... we should earn decent returns over time. Lew brings a new talent to Berkshire, and we hope to expand in leasing On December 3rd, I received a call from Craig Ponzio, owner of Larson-Juhl, the U.S. leader in custommade picture frames. Craig had bought the company in 1981 (after first working at its... -

Page 7

.... As I told you in the 1999 annual report, the store immediately became a huge success ― and it has since grown. Shortly after the Boise opening, Bill suggested we try Las Vegas, and this time I was even more skeptical. How could we do business in a metropolis of that size and be closed on Sundays... -

Page 8

... operation (a business we explained in last yearÂ's annual report), which has desirable economics even though it currently hits us with an annual underwriting loss of about $425 million. Principles of Insurance Underwriting When property/casualty companies are judged by their cost of float, very few... -

Page 9

..., chain-letter-like stock promotions and a potpourri of other unsavory activities. When stocks fall, these sins surface, hammering investors with losses that can run into the hundreds of billions. Juries deciding whether those losses should be borne by small investors or big insurance companies can... -

Page 10

... to add enormous value to Berkshire. Working with only 18 associates, Ajit manages one of the worldÂ's largest reinsurance operations measured by assets, and the largest, based upon the size of individual risks assumed. I have known the details of almost every policy that Ajit has written since he... -

Page 11

...and depend on no one. And whatever the worldÂ's problems, our checks will clear. AjitÂ's business will ebb and flow Â- but his underwriting principles wonÂ't waver. ItÂ's impossible to overstate his value to Berkshire GEICO, by far our largest primary insurer, made major progress in 2001, thanks to... -

Page 12

... its product (insurance protection) was costing considerably less than was truly the case. Consequently, the company sailed blissfully along, underpricing its product and selling more and more policies at ever-larger losses. When it becomes evident that reserves at past reporting dates understated... -

Page 13

...) Pre-Tax Earnings 2001 2000 2001 2000 Operating Earnings: Insurance Group: Underwriting Â- Reinsurance...Underwriting Â- GEICO ...Underwriting Â- Other Primary ...Net Investment Income ...Building Products(1) ...Finance and Financial Products Business ...Flight Services...MidAmerican Energy (76... -

Page 14

... high. Same-store sales at our home-furnishings retailers were unchanged and so was the margin Â- 9.1% pre-tax Â- these operations earned. Here, too, return on invested capital is excellent. We continue to expand in both jewelry and home-furnishings. Of particular note, Nebraska Furniture Mart... -

Page 15

...,000,000 1,727,765 53,265,080 Company American Express Company...The Coca-Cola Company ...The Gillette Company ...H&R Block, Inc...MoodyÂ's Corporation ...The Washington Post Company...Wells Fargo & Company ...Others ...Total Common Stocks...12/31/01 Cost Market (dollars in millions) $ 1,470 $ 5,410... -

Page 16

...731) hit its all-time high of 5,132. That same day, Berkshire shares traded at $40,800, their lowest price since mid-1997 During 2001, we were somewhat more active than usual in Â"junkÂ" bonds. These are not, we should emphasize, suitable investments for the general public, because too often these... -

Page 17

... key executives ItÂ's déjà vu time again: In early 1965, when the investment partnership I ran took control of Berkshire, that company had its main banking relationships with First National Bank of Boston and a large New York City bank. Previously, I had done no business with either. Fast forward... -

Page 18

... Revenue Code can be designated by shareholders. Last year Berkshire made contributions of $16.7 million at the direction of 5,700 shareholders, who named 3,550 charities as recipients. Since we started this program, our shareholdersÂ' gifts have totaled $181 million. Most public corporations... -

Page 19

... buy a fraction of a plane, we might even throw in a three-pack of briefs or boxers. At Nebraska Furniture Mart, located on a 75-acre site on 72nd Street between Dodge and Pacific, we will again be having "Berkshire Weekend" pricing, which means we will be offering our shareholders a discount that... -

Page 20

... smooth handling of the array of duties that come with our current size and scope - as well as some additional activities almost unique to Berkshire, such as our shareholder gala and designated-gifts program - takes a very special group of people. And that we most definitely have. February 28, 2002... -

Page 21

..., except per share data) 2001 Revenues: Insurance premiums earned ...Sales and service revenues...Interest, dividend and other investment income ...Income from finance and financial products businesses ...Realized investment gain (1) ...Total revenues...Earnings: Before realized investment gain... -

Page 22

...'t come close to meeting our tests: We've found that if you advertise an interest in buying collies, a lot of people will call hoping to sell you their cocker spaniels. A line from a country song expresses our feeling about new ventures, turnarounds, or auction-like sales: "When the phone don't ring... -

Page 23

...Investments in MidAmerican Energy Holdings Company...Assets of finance and financial products businesses ...Property, plant and equipment...Goodwill of acquired businesses...Other assets ...$ 5,313 36,509 28,675 1,974 11,926 2,213 1,826 41,591 4,776 21,407 6,542 $162,752 LIABILITIES AND SHAREHOLDERS... -

Page 24

... 2000 1999 Revenues: Insurance premiums earned...Sales and service revenues ...Interest, dividend and other investment income ...Income from MidAmerican Energy Holdings Company ...Income from finance and financial products businesses ...Realized investment gain...Cost and expenses: Insurance losses... -

Page 25

...accruals and other liabilities ...Finance businesses trading activities ...Income taxes ...Other...Net cash flows from operating activities ...Cash flows from investing activities: Purchases of securities with fixed maturities...Purchases of equity securities...Proceeds from sales of securities with... -

Page 26

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY (dollars in millions) Accumulated Class A & B Capital in Other Common Excess of Retained Comprehensive Comprehensive Stock Income Income Par Value Earnings Balance December 31, 1998...Net earnings...... -

Page 27

... and basis of consolidation Berkshire Hathaway Inc. ("Berkshire" or "Company") is a holding company owning subsidiaries engaged in a number of diverse business activities. The most important of these are property and casualty insurance businesses conducted on both a direct and reinsurance basis... -

Page 28

... related to this business. (h) Revenue recognition Insurance premiums for prospective property/casualty insurance and reinsurance and health reinsurance policies are earned in proportion to the level of insurance protection provided. In most cases, premiums are recognized as revenues ratably over... -

Page 29

... structured settlement reinsurance contracts by Berkshire Hathaway Reinsurance Group are carried in the Consolidated Balance Sheets at discounted amounts. Discounted amounts pertaining to General Re' s workers' compensation risks are based upon an annual discount rate of 4.5%. The discounted amounts... -

Page 30

... Note 3 (Investments in MidAmerican Energy Holdings Company). CORT Business Services Corporation ("CORT") Effective February 18, 2000, Wesco Financial Corporation, an indirect 80.1% owned subsidiary of Berkshire, acquired CORT. CORT is a leading national provider of rental furniture, accessories and... -

Page 31

...footwear under a number of brand names. U.S. Investment Corporation ("USIC") Effective August 8, 2000, Berkshire acquired USIC. USIC is the parent of the United States Liability Insurance Group, one of the premier U.S. writers of specialty insurance. Benjamin Moore & Co. ("Benjamin Moore") Effective... -

Page 32

...and is carried at cost. The Consolidated Statements of Earnings reflect, as Income from MidAmerican Energy Holdings Company, Berkshire' s proportionate share of MidAmerican' s net income with respect to the investments accounted for pursuant to the equity method, as well as interest earned on the 11... -

Page 33

... with fixed maturities Data with respect to investments in securities with fixed maturities are shown below (in millions). Amortized Cost(2) December 31, 2001(1) Available for sale: Bonds: U.S. Treasury securities and obligations of U.S. government corporations and agencies...Obligations of states... -

Page 34

... Company ("AXP") owned by Berkshire and its subsidiaries possessed approximately 11% of the voting rights of all AXP shares outstanding at December 31, 2001. The shares are held subject to various agreements with certain insurance and banking regulators which, among other things, prohibit Berkshire... -

Page 35

... investing (BH Finance), real estate financing (Berkshire Hathaway Credit Corporation), transportation equipment leasing (XTRA Corporation, acquired in September 2001), risk management products (General Re Securities or "GRS"), annuities (Berkshire Hathaway Life Insurance Company of Nebraska... -

Page 36

... 996 Earnings before income taxes ... $ 568 Additional information regarding Berkshire' s finance and financial products business follows: a) Significant accounting policies Investment securities (principally fixed maturity and equity investments) that are acquired with the expectation of selling... -

Page 37

... the value of open positions. Strategies have been developed to ensure GRS has sufficient resources to cover its potential liquidity needs through its access to General Re Corporation' s (the parent company of GRS) internal sources of liquidity, commercial paper program, lines of credit and medium... -

Page 38

... partnership or of the other partners. As a limited partner, Berkshire' s exposure to loss is limited to the carrying value of its investment. (10) Unpaid losses and loss adjustment expenses Supplemental data with respect to unpaid losses and loss adjustment expenses of property/casualty insurance... -

Page 39

... were assumed under retroactive reinsurance contracts written by the Berkshire Hathaway Reinsurance Group. Claims arising from these contracts are subject to aggregate policy limits. Thus, Berkshire' s exposure to environmental and latent injury claims under these contracts are, likewise, limited... -

Page 40

... borrowings under investment agreements generally range from 3 months to 30 years. Under certain conditions, these borrowings may be redeemable prior to the contractual maturity dates. Other debt includes variable and fixed rate term bonds and notes issued by various of Berkshire subsidiaries. These... -

Page 41

... 1, 2001, Berkshire' s insurance companies adopted several new statutory accounting policies as required under the Codification of Statutory Accounting Principles. Upon adoption of the new statutory accounting policies, the combined statutory surplus of Berkshire' s insurance businesses declined... -

Page 42

... GEICO has been named as a defendant in a number of class action lawsuits related to the use of replacement repair parts not produced by the original auto manufacturer, the calculation of "total loss" value and whether to pay diminished value as part of the settlement of certain claims. Management... -

Page 43

...non-insurance subsidiaries individually sponsor defined benefit pension plans covering their employees. Benefits under the plans are generally based on years of service and compensation, although benefits under certain plans are based on years of service and fixed benefit rates. Funding policies are... -

Page 44

... Hathaway Primary Insurance Group Acme Building Brands, Benjamin Moore, Johns Manville and MiTek ("Building products") Finance and financial products FlightSafety and Executive Jet ("Flight services") Nebraska Furniture Mart, R.C. Willey Home Furnishings, Star Furniture Company, Jordan' s Furniture... -

Page 45

.... Operating Businesses: Insurance group: Premiums earned: GEICO...General Re ...Berkshire Hathaway Reinsurance Group...Berkshire Hathaway Primary Insurance Group ...Investment income...Total insurance group...Building products ...Finance and financial products...Flight services ...Retail ...Scott... -

Page 46

... 214 Operating Businesses: Insurance group: GEICO ...General Re...Berkshire Hathaway Reinsurance Group ...Berkshire Hathaway Primary Insurance Group...Total insurance group...Building products...Finance and financial products...Flight services ...Retail ...Scott Fetzer Companies ...Shaw Industries... -

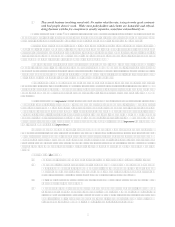

Page 47

... Statements (Continued) (20) Quarterly data A summary of revenues and earnings by quarter for each of the last two years is presented in the following table. This information is unaudited. Dollars are in millions, except per share amounts. 2001 Revenues...Earnings: Excluding realized investment... -

Page 48

... investment gain ...Realized investment gain ...Net earnings... The business segment data (Note 19 to Consolidated Financial Statements) should be read in conjunction with this discussion. Insurance - Underwriting A summary follows of underwriting results from Berkshire' s insurance businesses... -

Page 49

... Columbia. GEICO policies are marketed mainly by direct response methods in which customers apply for coverage directly to the company over the telephone, through the mail or via the Internet. This is a significant element in GEICO' s strategy to be a low cost insurer and, yet, provide high value to... -

Page 50

... in premiums derived from rate increases and new business (net of the non-renewal of unprofitable business) in the facultative individual risk and casualty treaty markets. Earned premiums in 2001 include $400 million from one retroactive reinsurance contract and a large quota share agreement. An... -

Page 51

... all casualty lines of business, including commercial umbrella, professional liability, medical malpractice, general liability, and workers compensation. Long-tail liabilities such as these, particularly reinsurance lines, are inherently difficult to estimate, and while management now believes that... -

Page 52

... quarter of 2000. Reported results for 2000 contain fifteen months. The table above shows underwriting results for both the twelve-month and fifteen-month periods. The analysis that follows excludes this additional quarter. In 2001, earned premiums in the U.S. life/health business increased $194... -

Page 53

... paid over long time periods. As a result, premiums are, in part, discounted for time value. However, when written, these contracts do not produce an underwriting loss for financial reporting purposes because the excess of the estimated ultimate claims payable over the premiums earned is established... -

Page 54

... "Homestate" operations, providers of standard multi-line insurance, and Central States Indemnity Company, a provider of credit and disability insurance to individuals nationwide through financial institutions. Collectively, Berkshire' s other primary insurance businesses produced earned premiums of... -

Page 55

...acquired February 27, 2001, Benjamin Moore, acquired in December 2000 and Acme Building Brands, acquired in August 2000). Also, Berkshire' s finance and financial products businesses are being presented as a segment which in 2001 includes XTRA Corporation from the date acquired of September 20, 2001... -

Page 56

... four independently managed retailers of home furnishings (Nebraska Furniture Mart and its subsidiaries ("NFM"), R.C. Willey Home Furnishings ("RC Willey"), Star Furniture and Jordan's Furniture) and three independently managed retailers of fine jewelry (Borsheim's Jewelry, Helzberg's Diamond Shops... -

Page 57

... under common management. Principal businesses in this group of companies sell products under the Kirby (home cleaning systems), Campbell Hausfeld (air compressors, paint sprayers, generators and pressure washers) and World Book (encyclopedias and other educational products) names. Revenues in 2001... -

Page 58

... Consolidated Statements of Earnings, such gains often produce a minimal impact on Berkshire's total shareholders' equity. This is due to the fact that Berkshire's investments are carried in prior periods' Consolidated Financial Statements at market value with unrealized gains, net of tax, reported... -

Page 59

... investees. Berkshire's preferred strategy is to hold equity investments for very long periods of time. Thus, Berkshire management is not necessarily troubled by short term price volatility with respect to its investments provided that the underlying business, economic and management characteristics... -

Page 60

... Interest Rate $18 10 13 Credit $3 1 1 All Risks $14 3 7 GRS evaluates and records a fair-value adjustment to recognize counterparty credit exposure and future costs associated with administering each contract. The expected credit exposure for each trade is initially established on the trade date... -

Page 61

... financial performance (including future revenues, earnings or growth rates), ongoing business strategies or prospects, and possible future Company actions, which may be provided by management are also forward-looking statements as defined by the Act. Forward-looking statements are based on current... -

Page 62

... MEMO TO: Berkshire Hathaway Managers ("The All-Stars") FROM: Warren E. Buffett DATE: September 26, 2001 The last few weeks have been tough times for all of us in our personal lives and for many of us in our business activities. At Berkshire we have estimated our September 11 insurance loss was... -

Page 63

... has an investment. As owners of, say, Coca-Cola or Gillette shares, we think of Berkshire as being a non-managing partner in two extraordinary businesses, in which we measure our success by the long-term progress of the companies rather than by the month-to-month movements of their stocks. In fact... -

Page 64

... goal by directly owning a diversified group of businesses that generate cash and consistently earn above-average returns on capital. Our second choice is to own parts of similar businesses, attained primarily through purchases of marketable common stocks by our insurance subsidiaries. The price and... -

Page 65

..., Berkshire has access to two low-cost, non-perilous sources of leverage that allow us to safely own far more assets than our equity capital alone would permit: deferred taxes and "float," the funds of others that our insurance business holds because it receives premiums before needing to pay out... -

Page 66

... securities as well. We will not sell small portions of your company - and that is what the issuance of shares amounts to - on a basis inconsistent with the value of the entire enterprise. When we sold the Class B shares in 1996, we stated that Berkshire stock was not undervalued - and some... -

Page 67

...That isn't feasible given Berkshire's many thousands of owners. In all of our communications, we try to make sure that no single shareholder gets an edge: We do not follow the usual practice of giving earnings "guidance" or other information of value to analysts or large shareholders. Our goal is to... -

Page 68

...of investment, a college education. Think of the education's cost as its "book value." If this cost is to be accurate, it should include the earnings that were foregone by the student because he chose college rather than a job. For this exercise, we will ignore the important non-economic benefits of... -

Page 69

... period after my death, you can be sure that I have thought through the succession question carefully. You can be equally sure that the principles we have employed to date in running Berkshire will continue to guide the managers who succeed me. Lest we end on a morbid note, I also want to assure... -

Page 70

... exercised by the managers in more widely-held businesses. "In a widely-held corporation the executives ordinarily arrange all charitable donations, with no input at all from shareholders, in two main categories: (1) (2) Donations considered to benefit the corporation directly in an amount... -

Page 71

... in this area ..."I am pleased that Berkshire donations can become owner-directed. It is ironic, but understandable, that a large and growing number of major corporations have charitable policies pursuant to which they will match gifts made by their employees (and - brace yourself for this one... -

Page 72

... owners. Price Range of Common Stock Berkshire' s Class A and Class B Common Stock are listed for trading on the New York Stock Exchange, trading symbol: BRK.A and BRK.B. The following table sets forth the high and low sales prices per share, as reported on the New York Stock Exchange Composite List... -

Page 73

... www.starfurniture.com United States Liability Insurance Group 190 South Warner Road Wayne, PA 19087 (610) 688-2535 www.usli.com Wesco Financial Corp. 301 East Colorado Blvd. Pasadena, CA 91101-1901 (626) 585-6700 Berkshire Hathaway Homestate Companies 9290 West Dodge Road Omaha, NE 68114 (402) 393... -

Page 74

... 9. Berkshire' s 2002 Annual Report is scheduled to be posted on the Internet on Saturday March 8, 2003. A three volume set of compilations of letters (1977 through 2000) is available upon written request accompanied by a payment of $35.00 to cover production, postage and handling costs. Requests...