Avon 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

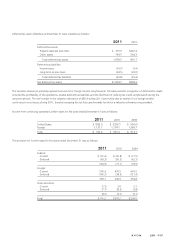

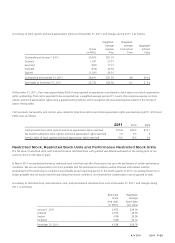

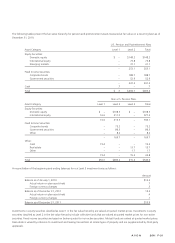

A summary of stock options and stock appreciation rights as of December 31, 2011, and changes during 2011, is as follows:

Shares

(in 000’s)

Weighted-

Average

Exercise

Price

Weighted-

Average

Contractual

Term

Aggregate

Intrinsic

Value

Outstanding at January 1, 2011 29,655 $31.07

Granted 1,041 27.31

Exercised (941) 17.71

Forfeited (373) 22.56

Expired (1,021) 36.31

Outstanding at December 31, 2011 28,361 $31.30 4.8 $10.0

Exercisable at December 31, 2011 22,732 $32.60 4.1 $ 6.2

At December 31, 2011, there was approximately $6.8 of unrecognized compensation cost related to stock options and stock appreciation

rights outstanding. That cost is expected to be recognized over a weighted-average period of 1.2 years. We recognize expense on stock

options and stock appreciation rights using a graded vesting method, which recognizes the associated expense based on the timing of

option vesting dates.

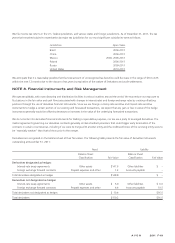

Cash proceeds, tax benefits, and intrinsic value related to total stock options and stock appreciation rights exercised during 2011, 2010 and

2009, were as follows:

2011 2010 2009

Cash proceeds from stock options and stock appreciation rights exercised $16.8 $23.9 $13.1

Tax benefit realized for stock options and stock appreciation rights exercised 1.3 3.3 .9

Intrinsic value of stock options and stock appreciation rights exercised 10.0 14.6 5.0

Restricted Stock, Restricted Stock Units and Performance Restricted Stock Units

The fair value of restricted stock units and performance restricted stock units granted was determined based on the closing price of our

common stock on the date of grant.

In March 2011 we granted performance restricted stock units that vest after three years only upon the satisfaction of certain performance

conditions. We accrue compensation cost if it is probable that the performance conditions will be achieved and reassess whether

achievement of the performance conditions are probable at each reporting period. In the fourth quarter of 2011, we assessed that it is no

longer probable that we would meet the specified performance conditions, and reversed the compensation cost recognized to-date.

A summary of restricted stock, restricted stock units, and performance restricted stock units at December 31, 2011, and changes during

2011, is as follows:

Restricted

Stock

And Units

(in 000’s)

Weighted-

Average

Grant-Date

Fair Value

January 1, 2011 2,952 $26.36

Granted 2,335 26.36

Vested (769) 35.56

Forfeited (180) 25.16

December 31, 2011 4,338 $24.78

A V O N 2011 F-25