Avon 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

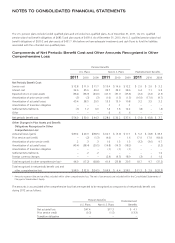

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

We also have used foreign exchange forward contracts and foreign currency-denominated debt to hedge the foreign currency exposure

related to the net assets of foreign subsidiaries. A gain of $2.8 for 2011, and losses of $3.7 for 2010 and $23.8 for 2009, related to the

effective portions of these hedges were included in foreign currency translation adjustments within AOCI on the Consolidated Balance

Sheets. During 2010 a loss of $20.1 was reclassified from AOCI to discontinued operations due to the sale of Avon Japan. During 2011, we

identified an out-of-period adjustment relating to balances included in AOCI relating to Avon Japan. See Note 1, Description of the Business

and Summary of Significant Accounting Policies, for further information.

Credit Risk of Financial Instruments

We attempt to minimize our credit exposure to counterparties by entering into derivative transactions and similar agreements with major

international financial institutions with “A” or higher credit ratings as issued by Standard & Poor’s Corporation. Our foreign currency and

interest rate derivatives are comprised of over-the-counter forward contracts, swaps or options with major international financial institutions.

Although our theoretical credit risk is the replacement cost at the then estimated fair value of these instruments, we believe that the risk of

incurring credit risk losses is remote and that such losses, if any, would not be material.

Non-performance of the counterparties on the balance of all the foreign exchange and interest rate agreements would result in a write-off

of $159.2 at December 31, 2011. In addition, in the event of non-performance by such counterparties, we would be exposed to market risk

on the underlying items being hedged as a result of changes in foreign exchange and interest rates.

NOTE 9. Fair Value

Assets and Liabilities Measured at Fair Value

We adopted the fair value measurement provisions required by the Fair Value Measurements and Disclosures Topic of the Codification as of

January 1, 2008, with the exception of the application to nonfinancial assets and liabilities measured at fair value on a non-recurring basis,

which was adopted as of January 1, 2009, with no impact to our Consolidated Financial Statements. The adoption of the fair value

measurement provisions did not have a material impact on our fair value measurements. The fair value measurement provisions define fair

value as the price that would be received to sell an asset or paid to transfer a liability in the principal or most advantageous market for the

asset or liability in an orderly transaction between market participants at the measurement date. In addition, the fair value measurement

provisions establish a fair value hierarchy, which prioritizes the inputs used in measuring fair value into three broad levels as follows:

• Level 1 – Quoted prices in active markets for identical assets or liabilities.

• Level 2 – Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly.

• Level 3 – Unobservable inputs based on our own assumptions.

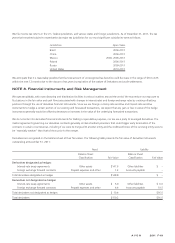

The following table presents the fair value hierarchy for those assets and liabilities measured at fair value on a recurring basis as of

December 31, 2011:

Level 1 Level 2 Total

Assets:

Available-for-sale securities $1.8 $ – $ 1.8

Interest-rate swap agreements – 153.6 153.6

Foreign exchange forward contracts – 5.6 5.6

Total $1.8 $159.2 $161.0

Liabilities:

Interest-rate swap agreements $ – $ 6.0 $ 6.0

Foreign exchange forward contracts – 10.5 10.5

Total $ – $ 16.5 $ 16.5