Avon 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART II

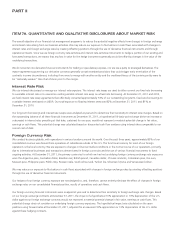

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The overall objective of our financial risk management program is to reduce the potential negative effects from changes in foreign exchange

and interest rates arising from our business activities. We may reduce our exposure to fluctuations in cash flows associated with changes in

interest rates and foreign exchange rates by creating offsetting positions through the use of derivative financial instruments and through

operational means. Since we use foreign currency rate-sensitive and interest rate-sensitive instruments to hedge a portion of our existing and

forecasted transactions, we expect that any loss in value for the hedge instruments generally would be offset by changes in the value of the

underlying transactions.

We do not enter into derivative financial instruments for trading or speculative purposes, nor are we a party to leveraged derivatives. The

master agreements governing our derivative contracts generally contain standard provisions that could trigger early termination of the

contracts in some circumstances, including if we were to merge with another entity and the creditworthiness of the surviving entity were to

be “materially weaker” than that of Avon prior to the merger.

Interest Rate Risk

We use interest rate swaps to manage our interest rate exposure. The interest rate swaps are used to either convert our fixed rate borrowing

to a variable interest rate or to unwind an existing variable interest rate swap on a fixed rate borrowing. At December 31, 2011 and 2010,

we held interest rate swap agreements that effectively converted approximately 74% of our outstanding long-term, fixed-rate borrowings to

a variable interest rate based on LIBOR. Our total exposure to floating interest rates was 82% at December 31, 2011, and 81% at

December 31, 2010.

Our long-term borrowings and interest rate swaps were analyzed at year-end to determine their sensitivity to interest rate changes. Based on

the outstanding balance of all these financial instruments at December 31, 2011, a hypothetical 50-basis-point change (either an increase or

a decrease) in interest rates prevailing at that date, sustained for one year, would not represent a material potential change in fair value,

earnings or cash flows. This potential change was calculated based on discounted cash flow analyses using interest rates comparable to our

current cost of debt.

Foreign Currency Risk

We conduct business globally, with operations in various locations around the world. Over the past three years, approximately 83% of our

consolidated revenue was derived from operations of subsidiaries outside of the U.S. The functional currency for most of our foreign

operations is the local currency. We are exposed to changes in financial market conditions in the normal course of our operations, primarily

due to international businesses and transactions denominated in foreign currencies and the use of various financial instruments to fund

ongoing activities. At December 31, 2011, the primary currencies for which we had net underlying foreign currency exchange rate exposures

were the Argentine peso, Australian dollar, Brazilian real, British pound, Canadian dollar, Chinese renminbi, Colombian peso, the euro,

Mexican peso, Philippine peso, Polish zloty, Russian ruble, South Africa rand, Turkish lira, Ukrainian hryvnia and Venezuelan bolívar.

We may reduce our exposure to fluctuations in cash flows associated with changes in foreign exchange rates by creating offsetting positions

through the use of derivative financial instruments.

Our hedges of our foreign currency exposure are not designed to, and, therefore, cannot entirely eliminate the effect of changes in foreign

exchange rates on our consolidated financial position, results of operations and cash flows.

Our foreign-currency financial instruments were analyzed at year-end to determine their sensitivity to foreign exchange rate changes. Based

on our foreign exchange contracts at December 31, 2011, the impact of a hypothetical 10% appreciation or 10% depreciation of the U.S.

dollar against our foreign exchange contracts would not represent a material potential change in fair value, earnings or cash flows. This

potential change does not consider our underlying foreign currency exposures. The hypothetical impact was calculated on the open

positions using forward rates at December 31, 2011, adjusted for an assumed 10% appreciation or 10% depreciation of the U.S. dollar

against these hedging contracts.