Avon 2011 Annual Report Download - page 49

Download and view the complete annual report

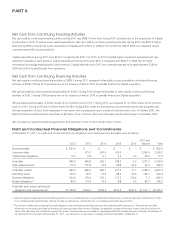

Please find page 49 of the 2011 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.See Note 5, Debt and Other Financing, and Note 14, Leases and Commitments, to our 2011 Annual Report for further information on our

debt and contractual financial obligations and commitments. Additionally, as disclosed in Note 15, Restructuring Initiatives, we have a

remaining liability of $73.9 at December 31, 2011, associated with the restructuring charges recorded to date under the 2005 and 2009

Restructuring Programs, and we also expect to record additional restructuring charges of $7.5 in future periods to implement the actions

approved to date. The significant majority of these liabilities will require cash payments during 2012.

Off Balance Sheet Arrangements

At December 31, 2011, we had no material off-balance-sheet arrangements.

Capital Resources

We maintain a three-year, $1 billion revolving credit and competitive advance facility, which expires in November 2013. Borrowings under

the credit facility bear interest at a rate per annum, which are either based on LIBOR or a floating base rate plus an applicable margin. The

credit facility contains various covenants, including a financial covenant that requires our interest coverage ratio (determined in relation to

our consolidated pretax income and interest expense) to equal or exceed 4:1. The credit facility may be used for general corporate purposes.

At December 31, 2011, there were no amounts outstanding under the credit facility.

We also maintain a $1 billion commercial paper program. Under this program, we may issue from time to time unsecured promissory notes

in the commercial paper market in private placements exempt from registration under federal and state securities laws, for a cumulative face

amount not to exceed $1 billion outstanding at any one time and with maturities not exceeding 270 days from the date of issue. The

commercial paper short-term notes issued under the program are not redeemable prior to maturity and are not subject to voluntary

prepayment. The commercial paper program is supported by our three-year credit facility. Outstanding commercial paper effectively reduces

the amount available for borrowing under the three-year credit facility. At December 31, 2011, there was $709.0 outstanding under this

program. For more information regarding risks associated with our ability to access certain debt markets, including the commercial paper

market, see “Risk Factors – A general economic downturn, a recession globally or in one or more of our geographic regions or sudden

disruption in business conditions or other challenges may adversely affect our business and our access to liquidity and capital” included in

Item 1A herein.

In November 2010, we issued, in a private placement exempt from registration under the Securities Act of 1933, as amended, $142.0

principal amount of 2.60% Senior Notes, Series A, due November 23, 2015, $290.0 principal amount of 4.03% Senior Notes, Series B, due

November 23, 2020, and $103.0 principal amount of 4.18% Senior Notes, Series C, due November 23, 2022. The Notes are senior

unsecured obligations of the Company, rank equal in right of payment with all other senior unsecured indebtedness of the Company, and

are unconditionally guaranteed by one of the Company’s wholly-owned subsidiaries. The Notes require the Company to comply with an

interest coverage ratio and contain customary default provisions, including cross-default provisions. The proceeds from the sale of the Notes

were used to repay existing debt and for general corporate purposes.

In March 2009, we issued, in a public offering, $500.0 principal amount of 5.625% Notes, due March 1, 2014 and $350.0 principal amount

of 6.50% Notes, due March 1, 2019. In March 2008, we issued, in a public offering, $250.0 principal amount of 4.80% Notes, due

March 1, 2013 and $250.0 principal amount of 5.75% Notes, due March 1, 2018. The proceeds from these offerings were used to repay

the outstanding indebtedness under our commercial paper program and for general corporate purposes.

At December 31, 2011, we were in compliance with all covenants in our indentures and our note purchase agreement. Such indentures and

note purchase agreement do not contain any rating downgrade triggers that would accelerate the maturity of our debt. We would be

required to make an offer to repurchase the notes described above at a price equal to 101% of their aggregate principal amount, plus

accrued and unpaid interest, in the event of a change in control involving us and a corresponding ratings downgrade to below investment

grade. We also have outstanding $250.0 principal amount of 4.20% Notes, due July 15, 2018 and $125.0 principal amount of 4.625%

Notes, due May 15, 2013. Additionally, we had $500.0 principal amount of 5.125% Notes, due in January 2011, outstanding at

December 31, 2010, which has subsequently been repaid primarily with the use of commercial paper. Please refer to Note 5, Debt and Other

Financing, to our 2011 Annual Report for more details.

A V O N 2011 41