Avon 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We capitalize interest on borrowings during the active construction period of major capital projects. Capitalized interest is added to the cost

of the related asset and depreciated over the useful lives of the assets. We capitalized interest of $0.4 for 2011, $5.3 for 2010, and $4.9 for

2009.

Deferred Software

Certain systems development costs related to the purchase, development and installation of computer software are capitalized and

amortized over the estimated useful life of the related project, not to exceed five years. Costs incurred prior to the development stage, as

well as maintenance, training costs, and general and administrative expenses are expensed as incurred. Other assets included unamortized

deferred software costs of $176.7 at December 31, 2011 and $140.6 at December 31, 2010.

Goodwill and Intangible Assets

Goodwill is not amortized, but rather is assessed for impairment annually and on the occurrence of an event that indicates impairment may

have occurred. Intangible assets with estimable useful lives are amortized using a straight-line method over the estimated useful lives of the

assets.

We completed our annual goodwill and indefinite-lived intangible assets impairment assessments for 2011 during the year-end close process

and determined that the estimated fair values substantially exceeded the carrying values of each of our reporting units, with the exception of

our Silpada reporting unit. Our analysis of the Silpada business indicated an impairment as the carrying value of the business exceeded the

estimated fair value. Accordingly, an estimated non-cash impairment charge of $263.0 was recorded in the fourth quarter of 2011 to reduce

the carrying amounts of goodwill and an indefinite-lived intangible asset. See Note 17, Goodwill and Intangible Assets. For the years ended

December 31, 2010 and 2009, we completed our annual goodwill and indefinite-lived intangible assets impairment assessments and no

adjustments were necessary.

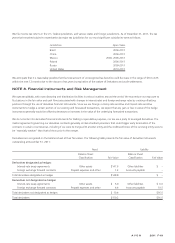

Financial Instruments

We use derivative financial instruments, including interest-rate swap agreements and forward foreign currency contracts to manage interest

rate and foreign currency exposures. We record all derivative instruments at their fair values on the Consolidated Balance Sheets as either

assets or liabilities. See Note 8, Financial Instruments and Risk Management.

Deferred Income Taxes

Deferred income taxes have been provided on items recognized for financial reporting purposes in different periods than for income tax

purposes using tax rates in effect for the year in which the differences are expected to reverse. A valuation allowance is provided for

deferred tax assets if it is more likely than not these items will not be realized. The ultimate realization of our deferred tax assets depends

upon generating sufficient future taxable income during the periods in which our temporary differences become deductible or before our

net operating loss and tax credit carryforwards expire. Deferred taxes are not provided on the portion of unremitted earnings of subsidiaries

outside of the U.S. when management concludes that these earnings are indefinitely reinvested. It is not practicable to determine the

amount of unrecognized deferred taxes with respect to these unremitted earnings. Deferred taxes are provided on earnings not considered

indefinitely reinvested. At December 31, 2011, U.S. income taxes have not been provided on $2,530.7 of undistributed income of

subsidiaries that has been or is intended to be indefinitely reinvested outside the U.S.

Uncertain Tax Positions

We recognize the benefit of a tax position, if that position is more likely than not of being sustained on audit, based on the technical merits

of the position.

Selling, General and Administrative Expenses

Selling, general and administrative expenses include costs associated with selling; marketing; and distribution activities, including shipping

and handling costs; advertising; net brochure costs; research and development; information technology; and other administrative costs,

including finance, legal and human resource functions.

Shipping and Handling

Shipping and handling costs are expensed as incurred and amounted to $1,071.7 in 2011, $968.8 in 2010 and $920.0 in 2009.

A V O N 2011 F-9