Avon 2011 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2011 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

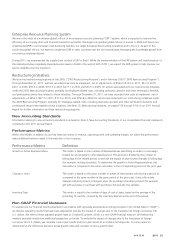

PART II

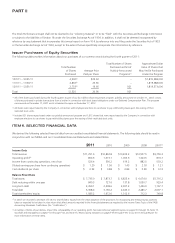

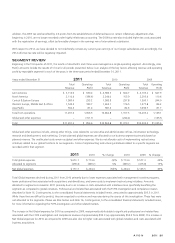

A 50 basis point change (in either direction) in the expected rate of return on plan assets, the discount rate or the rate of compensation

increases, would have had approximately the following effect on 2011 pension expense:

Increase/(Decrease) in

Pension Expense

50 Basis Point

Increase Decrease

Rate of return on assets (5.1) 5.1

Discount rate (8.5) 8.3

Rate of compensation increase 1.3 (1.2)

Taxes

We record a valuation allowance to reduce our deferred tax assets to an amount that is more likely than not to be realized. While we have

considered projected future taxable income and ongoing tax planning strategies in assessing the need for the valuation allowance, in the

event we were to determine that we would be able to realize a net deferred tax asset in the future, in excess of the net recorded amount, an

adjustment to the deferred tax asset would increase earnings in the period such determination was made. Likewise, should we determine

that we would not be able to realize all or part of our net deferred tax asset in the future, an adjustment to the deferred tax asset would

decrease earnings in the period such determination was made. We have recognized deferred tax assets of $282.1 relating to foreign tax

credit carryforwards that will expire between 2018 and 2021. To the extent future U.S. taxable income is less favorable than currently

projected by management, our ability to utilize these foreign tax credits may be affected and a valuation allowance may be required.

Deferred taxes are not provided on the portion of unremitted earnings of subsidiaries outside of the U.S. when we conclude that these

earnings are indefinitely reinvested. Deferred taxes are provided on earnings not considered indefinitely reinvested.

We recognize the benefit of a tax position if that position is more likely than not of being sustained on examination by the taxing authorities,

based on the technical merits of the position. We believe that our assessment of more likely than not is reasonable, but because of the

subjectivity involved and the unpredictable nature of the subject matter at issue, our assessment may prove ultimately to be incorrect, which

could materially impact the Consolidated Financial Statements.

We file income tax returns in many jurisdictions. In 2012, a number of open tax years are scheduled to close due to the expiration of the

statute of limitations and it is possible that a number of tax examinations may be completed. If our filing positions are ultimately upheld, it is

possible that the 2012 provision for income taxes may reflect adjustments.

Share-based Compensation

Stock options issued to employees are recognized in the Consolidated Financial Statements based on their fair values using an option-pricing

model at the date of grant. We use a Black-Scholes-Merton option-pricing model to calculate the fair value of options. This model requires

various judgmental assumptions including volatility, forfeiture rates and expected option life. If any of the assumptions used in the model

change significantly, share-based compensation may differ materially in the future from historical results.

Loss Contingencies

We determine whether to disclose and accrue for loss contingencies based on an assessment of whether the risk of loss is remote,

reasonably possible or probable. Our assessment is developed in consultation with our outside counsel and other advisors and is based on an

analysis of possible outcomes under various strategies. Loss contingency assumptions involve judgments that are inherently subjective and

can involve matters that are in litigation, which, by its nature is unpredictable. We believe that our assessment of the probability of loss

contingencies is reasonable, but because of the subjectivity involved and the unpredictable nature of the subject matter at issue, our

assessment may prove ultimately to be incorrect, which could materially impact the Consolidated Financial Statements.

Goodwill and Other Identified Intangible Assets

We test goodwill and intangible assets with indefinite lives for impairment annually, and more frequently if circumstances warrant, using fair

value methods. We review identified intangible assets with defined useful lives and subject to amortization for impairment whenever events

or changes in circumstances indicate that the related carrying amounts may not be recoverable.