Avon 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

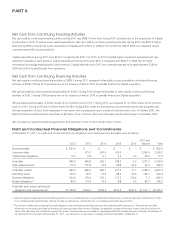

Net Cash from Continuing Investing Activities

Net cash used by continuing investing activities during 2011 was $828.0 lower than during 2010, primarily due to the acquisitions of Silpada

and Liz Earle in 2010, as well as lower capital expenditures. Net cash used by continuing investing activities during 2010 was $877.4 higher

than during 2009, primarily due to the acquisitions of Silpada and Liz Earle. In addition during the first half of 2009, we redeemed certain

corporate-owned life insurance policies.

Capital expenditures during 2011 were $276.7 compared with $331.2 in 2010, as 2010 included higher investment associated with new

distribution facilities in Latin America. Capital expenditures during 2010 were $331.2 compared with $296.3 in 2009 due to higher

information technology expenditures in Latin America. Capital expenditures in 2012 are currently expected to be approximately $260 to

$290 and will be funded by cash from operations.

Net Cash from Continuing Financing Activities

Net cash used by continuing financing activities of $284.5 during 2011 compared unfavorably to cash provided by continuing financing

activities of $234.7 during 2010 primarily due to the issuance of debt in 2010 to partially finance the Silpada acquisition.

Net cash provided by continuing financing activities of $234.7 during 2010 compared favorably to cash used by continuing financing

activities of $361.2 during 2009 primarily due to the issuance of debt in 2010 to partially finance the Silpada acquisition.

We purchased approximately .4 million shares of our common stock for $7.7 during 2011, as compared to .4 million shares of our common

stock for $14.1 during 2010 and .4 million shares for $8.6 during 2009, under our previously announced share repurchase programs and

through acquisition of stock from employees in connection with tax payments upon vesting of restricted stock units. In October 2007, the

Board of Directors authorized the repurchase of $2 billion of our common stock over a five-year period, which began in December 2007.

We increased our quarterly dividend payments to $.23 per share in 2011 from $.22 per share in 2010.

Debt and Contractual Financial Obligations and Commitments

At December 31, 2011, our debt and contractual financial obligations and commitments by due dates were as follows:

2012 2013 2014 2015 2016

2017 and

Beyond Total

Short-term debt $ 832.6 $ – $ – $ – $ – $ – $ 832.6

Long-term debt – 375.0 500.0 142.0 – 1,243.0 2,260.0

Capital lease obligations 16.7 9.8 9.1 6.5 5.9 29.3 77.3

Total debt 849.3 384.8 509.1 148.5 5.9 1,272.3 3,169.9

Debt-related interest 115.9 101.8 74.0 68.8 65.2 66.3 492.0

Total debt-related 965.2 486.6 583.1 217.3 71.1 1,338.6 3,661.9

Operating leases 105.0 92.2 79.6 68.9 52.5 146.1 544.3

Purchase obligations 344.6 154.4 126.1 115.3 120.4 5.7 866.5

Benefit obligations(1) 86.0 10.8 10.4 8.8 9.3 80.7 206.0

Total debt and contractual financial

obligations and commitments(2) $1,500.8 $744.0 $799.2 $410.3 $253.3 $1,571.1 $5,278.7

(1) Amounts represent expected future benefit payments for our unfunded pension and postretirement benefit plans, as well as expected contributions for 2012

to our funded pension benefit plans. We are not able to estimate our contributions to our funded pension plans beyond 2012.

(2) The amount of debt and contractual financial obligations and commitments excludes amounts due under derivative transactions. The table also excludes

information on recurring purchases of inventory as these purchase orders are non- binding, are generally consistent from year to year, and are short-term in

nature. The table does not include any reserves for income taxes because we are unable to reasonably predict the ultimate amount or timing of settlementof

our reserves for income taxes. At December 31, 2011, our reserves for income taxes, including interest and penalties, totaled $41.8.