Avon 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

At December 31, 2011, Avon Venezuela had pending requests submitted with an agency of the Venezuelan government for approximately

$131 for remittance of dividends and royalties to its parent company in the U.S. These outstanding requests had been periodically submitted

between 2005 and 2011.

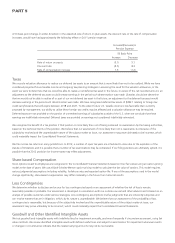

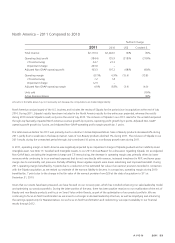

Latin America – 2010 Compared to 2009

%/Point Change

2010 2009 US$ Constant $

Total revenue $4,589.5 $4,103.2 12% 13%

Operating profit 604.7 647.9 (7)% 6%

CTI restructuring 19.8 34.4

Venezuelan special items 79.5 —

Adjusted Non-GAAP operating profit 704.0 682.3 3% 4%

Operating margin 13.2% 15.8% (2.6) (1.0)

CTI restructuring .4 .8

Venezuelan special items 1.7 —

Adjusted Non-GAAP operating margin 15.3% 16.6% (1.3) (1.4)

Units sold 5%

Active Representatives 8%

Amounts in the table above may not necessarily sum because the computations are made independently.

Total revenue during 2010 increased as compared to 2009 due to growth in Active Representatives, driven by continued investments in RVP,

and a higher average order. Revenue during 2010 grew 20% in Brazil and 15% in Mexico, with benefits from favorable foreign exchange,

while the impact of unfavorable foreign exchange drove a revenue decline of 27% in Venezuela during 2010. Constant $ revenue during

2010 benefited from continued growth in most markets, particularly from growth of 8% in Brazil, 8% in Mexico and 47% in Venezuela.

Constant $ revenue growth in Mexico during 2010, was driven by an increase in Active Representatives, as well as an increase in average

order. Constant $ revenue growth for 2010, in Venezuela reflected a higher average order primarily due to increased prices, partially as a

result of inflation, and growth in Active Representatives.

Constant $ revenue growth during 2010 in Brazil was primarily driven by an increase in Active Representatives. Constant $ revenue growth

in 2010 in Brazil was pressured by service disruptions in the second half of the year and a decline in skin care sales. Brazil’s revenue grew

38% and 9% during the first half and second half of 2010, respectively, with constant $ growth rates of 13% in the first half and 4% in the

second half. Brazil’s performance in the second half of 2010 was primarily driven by service disruptions resulting in shorting of products. The

mid-year implementation of government mandated e-invoicing exacerbated our legacy order processing systems and capacity which have

also been pressured by a significant increase in order scale in recent years as Brazil’s growth during this period outpaced our expectations

and our planned infrastructure investments. These factors pressured the capacity of our legacy systems and were the primary cause of the

service disruptions.

Operating margin declined during 2010 in Latin America due to the negative impact of the devaluation of the Venezuelan currency in

conjunction with highly inflationary accounting as discussed previously. The decline in operating margin during 2010 caused by the

Venezuelan special items was partially offset by benefits of .4 points from lower CTI restructuring. On an Adjusted Non-GAAP basis,

excluding the Venezuelan special items and CTI restructuring, the decrease in operating margin in 2010 was primarily driven by higher

distribution costs, increased investment in RVP and advertising, partially offset by the benefit of favorable foreign exchange.