Avon 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

March 15, 2007 and therefore were eligible to vote proxies or (2) purchased or otherwise acquired shares of Avon’s common stock from

July 31, 2006 through and including May 24, 2011. The complaint asserts violations of Sections 10(b), 14(a) and 20(a) of the Securities

Exchange Act of 1934 based on allegedly false or misleading statements and omissions with respect to, among other things, the Company’s

compliance with the FCPA, including the adequacy of the Company’s internal controls. On September 29, 2011, the Court appointed LBBW

Asset Management Investmentgesellschaft mbH and SGSS Deutschland Kapitalanlagegesellschaft mbH as lead plaintiffs and Motley Rice LLC

as lead counsel. Pursuant to a stipulated scheduling order, lead plaintiffs are to file an amended complaint no later than March 16, 2012,

and a schedule has been set for defendants to answer, move to dismiss or otherwise respond. In light of, among other things, the early

stage of the litigation, we are unable to predict the outcome of this matter and are unable to make an estimate of the amount or range of

loss that it is reasonably possible that we could incur from an unfavorable outcome.

With respect to the above-described internal investigations, compliance reviews, government’s investigation and the derivative and class

action matters, under some circumstances, adverse outcomes could be material to our consolidated financial position, results of operations

or cash flows.

Various other lawsuits and claims, arising in the ordinary course of business or related to businesses previously sold, are pending or

threatened against Avon. In management’s opinion, based on its review of the information available at this time, the total cost of resolving

such other contingencies at December 31, 2011, should not have a material adverse effect on our consolidated financial position, results of

operations or cash flows.

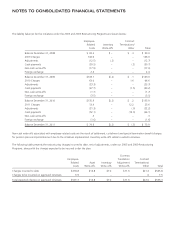

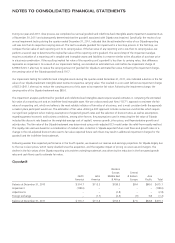

NOTE 17. Goodwill and Intangible Assets

In July 2010, we acquired substantially all the assets and liabilities of Silpada Designs, Inc. (“Silpada”), for approximately $650 in cash, plus a

potential additional payment in early 2015 based on the achievement of earnings growth of the Silpada North America business during the

periods between 2012 through 2014. Silpada is included within our North America segment. The purchase price allocation resulted in

goodwill of $314.7, indefinite-lived trademarks of $150.0 and customer relationships of $172.8. The customer relationships have an average

10-year useful life. At the date of the acquisition, a liability of approximately $26 was recorded associated with this potential additional

consideration (“contingent consideration”), based on a valuation of the estimated fair value of the liability after probability-weighting and

discounting various potential payments. At December 31, 2010, we estimated that the fair value of the contingent consideration liability was

$11, and zero at December 31, 2011. The changes in the fair value of the contingent consideration were recorded within selling, general

and administrative expenses in the respective periods.

In March 2010, we acquired Liz Earle Beauty Co. Limited (“Liz Earle”). The acquired business is included in our Western Europe, Middle

East & Africa operating segment. The purchase price allocation resulted in goodwill of $123.6, indefinite-lived trademarks of $22.8, licensing

agreements of $8.7 and customer relationships of $4.7. The licensing agreements and customer relationships have a weighted average

8-year useful life.

The following unaudited pro forma summary presents the Company’s consolidated information as if Silpada and Liz Earle had been acquired

on January 1, 2009, and on January 1, 2010:

2010 2009

Pro forma Revenue Results including Acquisitions $10,975.8 $10,473.3

Pro forma Operating Profit Results including Acquisitions 1,084.9 1,051.6

Pro forma Income from continuing operations, net of tax Results including Acquisitions 601.9 648.2

In the second quarter of 2011, due to the impact of rising silver prices and declines in revenues relative to our internal forecasts, we

completed an interim impairment assessment of the fair value of goodwill and an indefinite-lived intangible asset related to Silpada. Based

upon this interim analysis, the estimated fair value of the Silpada reporting unit and its trademark exceeded their respective carrying value. In

the third quarter of 2011, we considered whether any circumstances existed that would more likely than not reduce the estimated fair

values of the Silpada reporting unit and its trademark below their respective carrying values and concluded another interim impairment

analysis was not considered necessary.

A V O N 2011 F-41