Avon 2011 Annual Report Download - page 74

Download and view the complete annual report

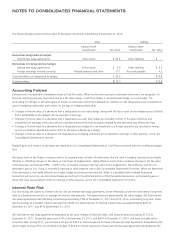

Please find page 74 of the 2011 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

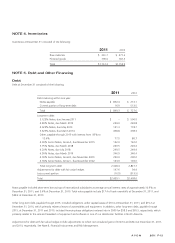

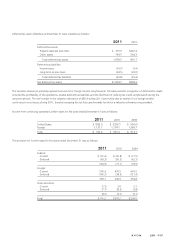

We held interest-rate swap contracts that swap approximately 74% at December 31, 2011 and 2010, of our long-term debt to variable

rates. See Note 8, Financial Instruments and Risk Management.

On November 23, 2010, the Company sold and issued, in a private placement exempt from registration under the Securities Act of 1933, as

amended, $142.0 in aggregate principal amount of Senior Notes, Series A (the “Series A Notes”), $290.0 in aggregate principal amount of

the Senior Notes, Series B (the “Series B Notes”) and $103.0 in aggregate principal amount of the Senior Notes, Series C (the ‘Series C

Notes” and collectively with the Series A Notes and Series B Notes, the “Notes”). The Series A Notes bear interest at the rate of 2.60% per

annum, payable semi-annually, and will mature on November 23, 2015. The Series B Notes bear interest at the rate of 4.03% per annum,

payable semi-annually, and will mature on November 23, 2020. The Series C Notes bear interest at the rate of 4.18% per annum, payable

semi-annually, and will mature on November 23, 2022. The Notes are senior unsecured obligations of the Company, rank equal in right of

payment with all other senior unsecured indebtedness of the Company, and are unconditionally guaranteed by one of the Company’s

wholly-owned subsidiaries. The Notes contain certain covenants that have the effect of limiting, under certain circumstances, the ability of

the Company and certain of its subsidiaries to, among other things, merge with other entities, create new liens, incur additional

indebtedness or substantially change the general nature of the business of the Company and its subsidiaries, taken as a whole. The Notes

also require the Company to comply with an interest coverage ratio (determined in relation to our consolidated pretax income and interest

expense) to equal or exceed 4:1 and contain customary default provisions, including cross-default provisions. The proceeds from the sale of

the Notes were used to repay existing debt and for general corporate purposes.

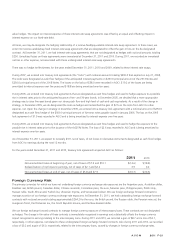

In March 2009, we issued $850.0 principal amount of notes payable in a public offering. $500.0 of the notes bear interest at a per annum

coupon rate equal to 5.625%, payable semi-annually, and mature on March 1, 2014 (the “2014 Notes”). $350.0 of the notes bear interest

at a per annum coupon rate equal to 6.50%, payable semi-annually, and mature on March 1, 2019 (the “2019 Notes”). The net proceeds

from the offering of $837.6 were used to repay the outstanding indebtedness under our commercial paper program and for general

corporate purposes. The carrying value of the 2014 Notes represents the $500.0 principal amount, net of the unamortized discount to face

value of $1.2 at December 31, 2011, and $1.7 at December 31, 2010. The carrying value of the 2019 Notes represents the $350.0 principal

amount, net of the unamortized discount to face value of $3.1 at December 31, 2011, and $3.6 at December 31, 2010.

In March 2008, we issued $500.0 principal amount of notes payable in a public offering. $250.0 of the notes bear interest at a per annum

coupon rate equal to 4.80%, payable semi-annually, and mature on March 1, 2013, (the “2013 Notes”). $250.0 of the notes bear interest

at a per annum coupon rate of 5.75%, payable semi-annually, and mature on March 1, 2018 (the “2018 Notes”). The net proceeds from

the offering of $496.3 were used to repay outstanding indebtedness under our commercial paper program and for general corporate

purposes. The carrying value of the 2013 Notes represents the $250.0 principal amount, net of the unamortized discount to face value of

$.1 at December 31, 2011, and $.2 at December 31, 2010. The carrying value of the 2018 Notes represents the $250.0 principal amount,

net of the unamortized discount to face value of $.5 at December 31, 2011, and $.6 at December 31, 2010.

In January 2006, we issued in a public offering $500.0 principal amount of notes payable (the “5.125% Notes”) that matured on

January 15, 2011, and bore interest, payable semi-annually, at a per annum rate equal to 5.125% . The net proceeds from the offering were

used for general corporate purposes, including the repayment of short-term domestic debt. At December 31, 2010, the carrying value of the

5.125% Notes represented the $500.0 principal amount. The 5.125% Notes were paid in January 2011.

In June 2003, we issued to the public $250.0 principal amount of registered senior notes (the “4.20% Notes”). The 4.20% Notes mature on

July 15, 2018, and bear interest at a per annum rate of 4.20%, payable semi-annually. The carrying value of the 4.20% Notes represents the

$250.0 principal amount, net of the unamortized discount to face value of $.5 and $.6 at December 31, 2011 and 2010, respectively.

In April 2003, the call holder of $100.0 principal amount of 6.25% Notes due May 2018 (the “Notes”), embedded with put and call option

features, exercised the call option associated with these Notes, and thus became the sole note holder of the Notes. Pursuant to an

agreement with the sole note holder, we modified these Notes into $125.0 aggregate principal amount of 4.625% notes due May 15,

2013. The modified principal amount represented the original value of the putable/callable notes, plus the market value of the related call

option and approximately $4.0 principal amount of additional notes issued for cash. In May 2003, $125.0 principal amount of registered

senior notes were issued in exchange for the modified notes held by the sole note holder. No cash proceeds were received by us. The

registered senior Notes mature on May 15, 2013, and bear interest at a per annum rate of 4.625%, payable semi-annually (the “4.625%

Notes”). The transaction was accounted for as an exchange of debt instruments and, accordingly, the premium related to the original notes