Avon 2011 Annual Report Download - page 33

Download and view the complete annual report

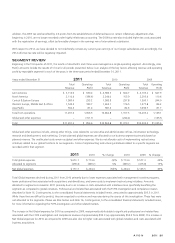

Please find page 33 of the 2011 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We completed our annual goodwill and indefinite-lived intangible assets impairment assessments for 2011 during the year-end close process

and determined that the estimated fair values substantially exceeded the carrying values of each of our reporting units, with the exception of

our Silpada reporting unit. Our analysis of the Silpada business indicated an impairment as the carrying value of the business exceeded the

estimated fair value. Accordingly, an estimated non-cash before tax impairment charge of $263.0 was recorded in the fourth quarter of

2011 to reduce the carrying amounts of goodwill and an indefinite-lived intangible asset. At December 31, 2011, as a result of the

impairment charge recorded, the carrying values of Silpada’s goodwill and indefinite-lived intangible asset were $116.7 and $85.0,

respectively. Following weaker than expected performance in the fourth quarter, we lowered our revenue and earnings projections for

Silpada largely due to the rise in silver prices, which nearly doubled since the acquisition, and the negative impact of pricing on revenues and

margins. The decline in the fair values of the Silpada reporting unit and the underlying trademark was driven by the reduction in the

forecasted growth rates and cash flows used to estimate fair value.

The impairment analyses performed for goodwill and indefinite-lived intangible assets require several estimates in computing the estimated

fair value of a reporting unit and an indefinite-lived intangible asset. We use a discounted cash flow (“DCF”) approach to estimate the fair

value of a reporting unit, which we believe is the most reliable indicator of fair value of a business, and is most consistent with the approach

a market place participant would use. The estimation of fair value utilizing a DCF approach includes numerous uncertainties which require

our significant judgment when making assumptions of expected growth rates and the selection of discount rates, as well as assumptions

regarding general economic and business conditions, among other factors. Key assumptions used in measuring the fair value of Silpada

included the discount rate (based on the weighted-average cost of capital), revenue growth, silver prices, and Representative growth and

activity rates. The fair value of the Silpada trademark was determined using a risk-adjusted DCF model under the relief-from-royalty method.

The royalty rate used was based on a consideration of market rates. A decline in Silpada expected future cash flows and growth rates or a

change in the risk-adjusted discount rate used to fair value expected future cash flows may result in additional impairment charges for the

goodwill and the indefinite-lived trademark.

See Note 17, Goodwill and Intangible Assets, to our 2011 Annual Report for further information on Silpada.

For the years ended December 31, 2010 and 2009, we completed our annual goodwill and indefinite-lived intangible assets impairment

assessments and no adjustments were necessary. Additionally, no events or changes in circumstances occurred that indicated that our

definite-lived intangible assets may not be recoverable during the three years ended December 31, 2011. The impairment analyses

performed for goodwill and indefinite-lived intangible assets require several estimates including future cash flows, growth rates and the

selection of discount rates. A significant decline in expected future cash flows and growth rates or a change in the discount rate used to fair

value expected future cash flows may result in a future impairment charge.

A V O N 2011 25