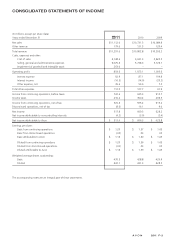

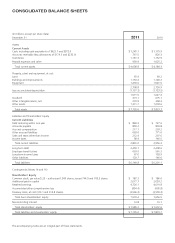

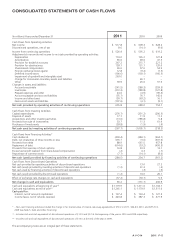

Avon 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

We use the nonessentials rate of 4.30 to remeasure our Bolívare denominated assets and liabilities into U.S. dollars at the reporting date,

since this is the rate expected to be available for dividend remittances. We record a loss within operating profit when we believe we are

going to convert these Bolívare denominated assets or settle our U.S. dollar denominated liabilities from sources where the exchange rate is

less favorable than the official rate.

As a result of the change in the official rate to 4.30 in conjunction with accounting for our operations in Venezuela under highly inflationary

accounting guidelines, during the first quarter of 2010, we recorded net charges of $46.1 million in “Other expense, net” and $12.7 million

in “Income taxes”.

Revenue Recognition

Net sales primarily include sales generated as a result of Representative orders less any discounts, taxes and other deductions. We recognize

revenue upon delivery, when both title and the risks and rewards of ownership pass to the independent Representatives, who are our

customers. Our internal financial systems accumulate revenues as orders are shipped to the Representative. Since we report revenue upon

delivery, revenues recorded in the financial system must be reduced for an estimate of the financial impact of those orders shipped but not

delivered at the end of each reporting period. We use estimates in determining the adjustments to revenue and operating profit for orders

that have been shipped but not delivered as of the end of the period. These estimates are based on daily sales levels, delivery lead times,

gross margin and variable expenses. We also estimate an allowance for sales returns based on historical experience with product returns. In

addition, we estimate an allowance for doubtful accounts receivable based on an analysis of historical data and current circumstances.

Other Revenue

Other revenue primarily includes shipping and handling and order processing fees billed to Representatives.

Cash and Cash Equivalents

Cash equivalents are stated at cost plus accrued interest, which approximates fair value. Cash equivalents are high-quality, short-term money

market instruments with an original maturity of three months or less and consist of time deposits with a number of U.S. and non-U.S.

commercial banks and money market fund investments.

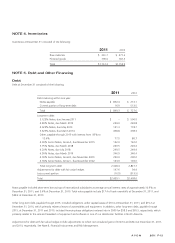

Inventories

Inventories are stated at the lower of cost or market. Cost is determined using the first-in, first-out method. We classify inventory into

various categories based upon their stage in the product life cycle, future marketing sales plans and disposition process. We assign a degree

of obsolescence risk to products based on this classification to determine the level of obsolescence provision.

Prepaid Brochure Costs

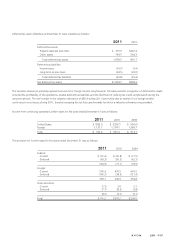

Costs to prepare brochures are deferred to prepaid expenses and other as incurred. Fees charged to Representatives for the sale of

brochures are netted with the costs to prepare brochures. The net brochure cost associated with each sales campaign is expensed to selling,

general, and administrative expenses over the campaign length. Prepaid expenses and other included deferred brochure costs of $45.8 at

December 31, 2011, and $44.8 at December 31, 2010. Additionally, paper stock is purchased in advance of creating the brochures. Prepaid

expenses and other included paper supply of $25.3 at December 31, 2011, and $19.1 at December 31, 2010.

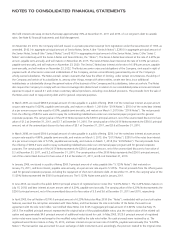

Property, Plant and Equipment

Property, plant and equipment are stated at cost and are depreciated using a straight-line method over the estimated useful lives of the

assets. The estimated useful lives generally are as follows: buildings, 45 years; land improvements, 20 years; machinery and equipment, 15

years; and office equipment, five to ten years. Leasehold improvements are depreciated over the shorter of the lease term or the estimated

useful life of the asset. Upon disposal of property, plant and equipment, the cost of the assets and the related accumulated depreciation are

removed from the accounts and the resulting gain or loss is reflected in earnings. Costs associated with repair and maintenance activities are

expensed as incurred. We evaluate our long-lived assets for impairment whenever events or changes in circumstances indicate that the

carrying amount of an asset group may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the

carrying amount of an asset to estimated undiscounted future cash flows expected to be generated by the asset. If the carrying amount of

an asset exceeds its estimated future cash flows, an impairment charge is recognized for the amount by which the carrying amount of the

asset exceeds the fair value of the asset.