Avon 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

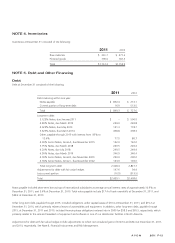

NOTE 6. Accumulated Other Comprehensive Loss

Accumulated other comprehensive loss at December 31 consisted of the following:

2011 2010

Foreign currency translation adjustments $(325.0) $(147.4)

Pension and postretirement adjustment, net of taxes of $252.9

and $220.9 (515.9) (443.8)

Net derivative losses from cash flow hedges, net of taxes of

$5.8 and $7.9 (13.5) (14.6)

Total $(854.4) $(605.8)

Foreign exchange losses of $2.0 for 2011 and $5.6 for 2010 resulting from the translation of actuarial losses, prior service credit and

translation obligation recorded in Accumulated Other Comprehensive Loss (“AOCI”) are included in foreign currency translation adjustments

in the rollforward of accumulated other comprehensive loss on the Consolidated Statements of Changes in Shareholders Equity. During

2010, $1.6 of accumulated foreign currency translation adjustments and $9.0 of pension adjustments were realized upon completion of the

sale of Avon Japan. During 2011, we identified an out-of-period adjustment relating to balances included in AOCI relating to Avon Japan.

See Note 1, Description of the Business and Summary of Significant Accounting Policies, for further information.

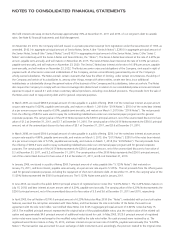

NOTE 7. Income Taxes

Deferred tax assets (liabilities) resulting from temporary differences in the recognition of income and expense for tax and financial reporting

purposes at December 31 consisted of the following:

2011 2010

Deferred tax assets:

Accrued expenses and reserves $ 261.5 $ 279.7

Pension and postretirement benefits 166.0 155.4

Asset revaluations 39.5 51.6

Capitalized expenses 105.8 77.9

Intangible assets 74.7 –

Share-based compensation 54.9 55.3

Restructuring initiatives 18.0 39.7

Postemployment benefits 18.4 22.9

Tax loss carryforwards 576.8 465.4

Foreign tax credit carryforwards 282.1 178.8

Minimum tax and business credit carryforwards 47.0 42.6

All other 66.0 89.8

Valuation allowance (546.1) (462.7)

Total deferred tax assets 1,164.6 996.4

Deferred tax liabilities:

Depreciation and amortization (48.6) (47.3)

Unremitted foreign earnings (39.2) (35.2)

Prepaid expenses (7.9) (7.8)

Capitalized interest (10.1) (10.4)

All other (24.1) (37.4)

Total deferred tax liabilities (129.9) (138.1)

Net deferred tax assets $1,034.7 $ 858.3