Avon 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We file income tax returns in the U.S. federal jurisdiction, and various states and foreign jurisdictions. As of December 31, 2011, the tax

years that remained subject to examination by major tax jurisdiction for our most significant subsidiaries were as follows:

Jurisdiction Open Years

Brazil 2006-2011

China 2006-2011

Mexico 2004, 2006-2011

Poland 2006-2011

Russia 2009-2011

United States 2010-2011

We anticipate that it is reasonably possible that the total amount of unrecognized tax benefits could decrease in the range of $10 to $15

within the next 12 months due to the closure of tax years by expiration of the statute of limitations and audit settlements.

NOTE 8. Financial Instruments and Risk Management

We operate globally, with manufacturing and distribution facilities in various locations around the world. We may reduce our exposure to

fluctuations in the fair value and cash flows associated with changes in interest rates and foreign exchange rates by creating offsetting

positions through the use of derivative financial instruments. Since we use foreign currency-rate sensitive and interest-rate sensitive

instruments to hedge a certain portion of our existing and forecasted transactions, we expect that any gain or loss in value of the hedge

instruments generally would be offset by decreases or increases in the value of the underlying forecasted transactions.

We do not enter into derivative financial instruments for trading or speculative purposes, nor are we a party to leveraged derivatives. The

master agreements governing our derivative contracts generally contain standard provisions that could trigger early termination of the

contracts in certain circumstances, including if we were to merge with another entity and the creditworthiness of the surviving entity were to

be “materially weaker” than that of Avon prior to the merger.

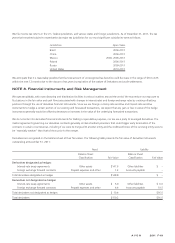

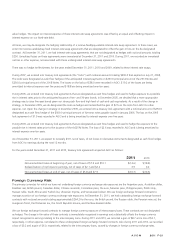

Derivatives are recognized on the balance sheet at their fair values. The following table presents the fair value of derivative instruments

outstanding at December 31, 2011:

Asset Liability

Balance Sheet

Classification Fair Value

Balance Sheet

Classification Fair Value

Derivatives designated as hedges:

Interest-rate swap agreements Other assets $147.6 Other liabilities $ –

Foreign exchange forward contracts Prepaid expenses and other 1.2 Accounts payable –

Total derivatives designated as hedges $148.8 $ –

Derivatives not designated as hedges:

Interest-rate swap agreements Other assets $ 6.0 Other liabilities $ 6.0

Foreign exchange forward contracts Prepaid expenses and other 4.4 Accounts payable 10.5

Total derivatives not designated as hedges $ 10.4 $16.5

Total derivatives $159.2 $16.5

A V O N 2011 F-19