United Airlines 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

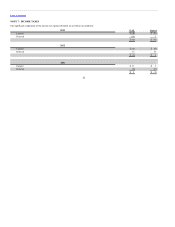

Table of Contents

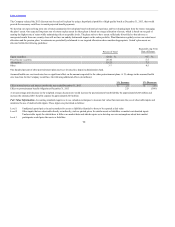

The Company’s federal income tax returns for tax years after 2002 remain subject to examination by the Internal Revenue Service (“IRS”) and state taxing

jurisdictions. Continental’s federal income tax returns for tax years after 2001 remain subject to examination by the IRS and state taxing jurisdictions. In 2013,

the IRS concluded an audit of 2010 through 2011 for UAL without any material adjustments to the financial statements.

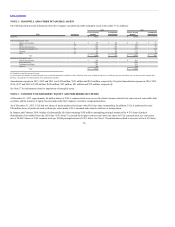

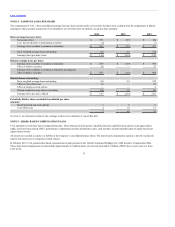

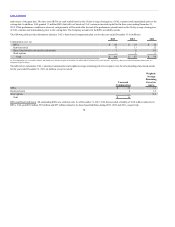

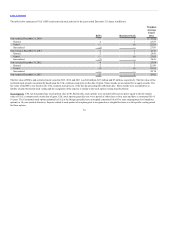

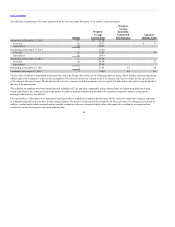

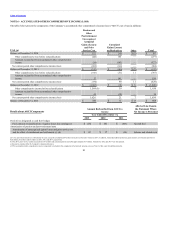

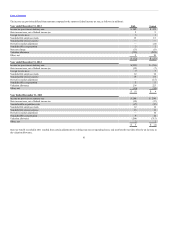

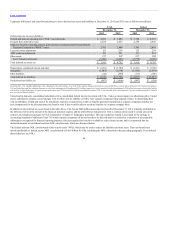

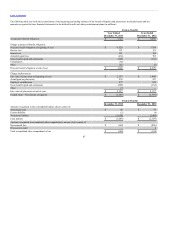

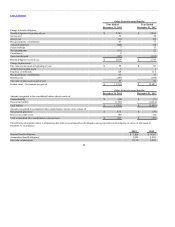

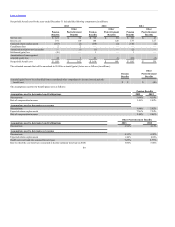

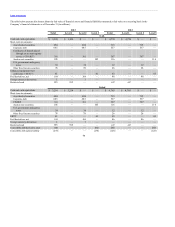

The following summarizes the significant pension and other postretirement plans of United:

Pension Plans

United maintains two primary defined benefit pension plans, one covering certain pilot employees and another covering certain U.S. non-pilot employees. Each

of these plans provide benefits based on a combination of years of benefit accruals service and an employee’s final average compensation. Additional benefit

accruals were frozen under the plan covering certain pilot employees during 2005 and management and administrative employees as of December 31, 2013 at

which time any existing accrued benefits for those employees were preserved. Benefit accruals for certain non-pilot employees under its other primary defined

benefit pension plan continue. United maintains additional defined benefit pension plans, which cover certain international employees.

Other Postretirement Plans

We maintain postretirement medical programs which provide medical benefits to certain retirees and eligible dependents, as well as life insurance benefits to

certain retirees participating in the plan. Benefits provided are subject to applicable contributions, co-payments, deductible and other limits as described in the

specific plan documentation.

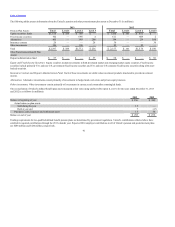

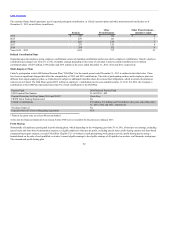

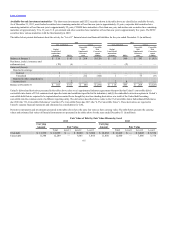

During 2013, the Company experienced significant changes in its benefit obligations related to its primary defined benefit pension plans and postretirement

medical programs. The significant changes resulted from the reduction or elimination of benefits for certain work groups including elimination of the

postretirement medical benefits for all management and administrative employees and only those International Association of Machinists (“IAM”) employees

with less than 20 years of service. Additionally, future accruals for defined benefit pension benefits for management and administrative employees were

eliminated effective December 31, 2013. All of these changes are reflected in the December 31, 2013 obligation. In addition, certain key actuarial changes

resulted in an additional net reduction of the pension and postretirement medical benefit obligations, principally market increases in discount rates, changes in

participation and retirement rates for retiree medical plans (driven primarily by the actual experience in pilot retirement rates resulting from a change of the

mandatory pilot retirement age to 65), partially offset by increases in anticipated salary scale for the pension plan, and an increase in health care trend rates

for postretirement medical plans.

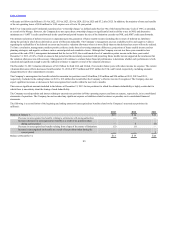

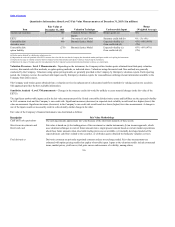

Changes in benefits that either qualified as curtailments (which reduced prior actuarial losses) or negative plan amendments are detailed in the tables below.

Actuarial assumption changes are reflected as a component of the net actuarial gains/(losses) during 2013. These amounts will be amortized over the average

remaining service life of the covered active employees or the average life expectancy of inactive participants and will reduce 2013 pension and retiree medical

expense as described below.

86