United Airlines 2013 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

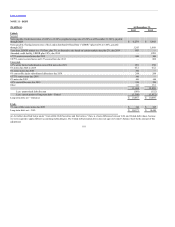

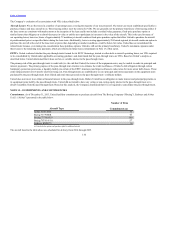

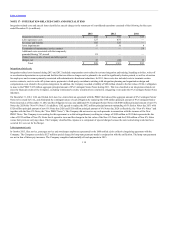

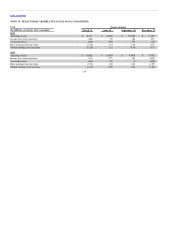

The table below summarizes United’s commitments as of December 31, 2013 (including those assigned from UAL), which primarily relate to the acquisition

of aircraft and related spare engines, aircraft improvements and include other commitments primarily to acquire information technology services and assets for

the years ended December 31 (in billions):

2014 $ 3.0

2015 2.8

2016 2.0

2017 1.5

2018 2.1

After 2018 12.5

$ 23.9

Any incremental firm aircraft orders, including through the exercise of purchase options and purchase rights, will increase the total future capital

commitments of the Company.

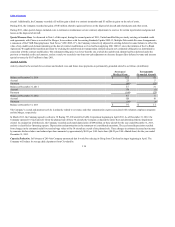

As of December 31, 2013, United has arranged for EETC financing of 15 Boeing 737-900ER aircraft and two Boeing 787-8 aircraft, which are scheduled to

be delivered from January through June 2014. In addition, United has secured backstop financing commitments from certain of its aircraft manufacturers for

a limited number of its future aircraft deliveries, subject to certain customary conditions. However, the Company does not have backstop financing or any

financing currently in place for its other firm aircraft orders. Financing will be necessary to satisfy the Company’s capital commitments for its firm order

aircraft and other related capital expenditures. The Company can provide no assurance that any financing not already in place for aircraft and spare engine

deliveries will be available to the Company on acceptable terms when necessary or at all.

Legal and Environmental. The Company has certain contingencies resulting from litigation and claims incident to the ordinary course of business.

Management believes, after considering a number of factors, including (but not limited to) the information currently available, the views of legal counsel, the

nature of contingencies to which the Company is subject and prior experience, that the ultimate disposition of the litigation and claims will not materially affect

the Company’s consolidated financial position or results of operations. The Company records liabilities for legal and environmental claims when a loss is

probable and reasonably estimable. These amounts are recorded based on the Company’s assessments of the likelihood of their eventual disposition.

Guarantees and Indemnifications. In the normal course of business, the Company enters into numerous real estate leasing and aircraft financing

arrangements that have various guarantees included in the contracts. These guarantees are primarily in the form of indemnities under which the Company

typically indemnifies the lessors and any tax/financing parties against tort liabilities that arise out of the use, occupancy, operation or maintenance of the leased

premises or financed aircraft. Currently, the Company believes that any future payments required under these guarantees or indemnities would be immaterial,

as most tort liabilities and related indemnities are covered by insurance (subject to deductibles). Additionally, certain leased premises such as fueling stations

or storage facilities include indemnities of such parties for any environmental liability that may arise out of or relate to the use of the leased premises.

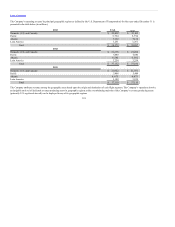

United is the guarantor of approximately $1.9 billion in aggregate principal amount of tax-exempt special facilities revenue bonds and interest thereon. These

bonds, issued by various airport municipalities, are payable solely from rentals paid under long-term agreements with the respective governing bodies. The

leasing arrangements associated with $1.6 billion of these obligations are accounted for as operating leases with the associated expense recorded on a straight-

line basis resulting in ratable accrual of the lease obligation over the expected lease term. These tax-exempt special facilities revenue bonds are included in our

lease commitments disclosed in Note 13 of this report. The leasing arrangements associated with $267 million of these obligations are accounted for as capital

leases. All these bonds are due between 2015 and 2038.

111