United Airlines 2013 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Taking into consideration the obligations under (i) the preferred securities guarantee relating to the TIDES, (ii) the indenture relating to the 6% Convertible

Debentures to pay all debt and obligations and all costs and expenses of the Trust (other than U.S. withholding taxes) and (iii) the indenture, the declaration of

trust relating to the TIDES and the 6% Convertible Debentures, United has fully and unconditionally guaranteed payment of (i) the distributions on the

TIDES, (ii) the amount payable upon redemption of the TIDES and (iii) the liquidation amount of the TIDES.

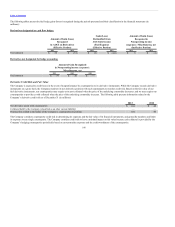

The Trust is a subsidiary of United, and the TIDES are mandatorily redeemable preferred securities with a liquidation value of $248 million. The Trust is a

variable interest entity (“VIE”) because the Company has a limited ability to make decisions about its activities. However, the Company is not the primary

beneficiary of the Trust. Therefore, the Trust and the mandatorily redeemable preferred securities issued by the Trust are not reported in the Company’s

balance sheets. Instead, the Company reports its 6% convertible junior subordinated debentures held by the Trust as long-term debt and interest on these

debentures is recorded as interest expense for all periods presented in the accompanying financial statements.

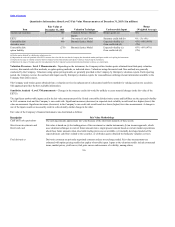

Convertible Debt Securities and Derivatives. Following the Merger, Continental and the trustees for the 4.5% Convertible Notes, 5% Convertible Notes due

2023 and 6% Convertible Debentures entered into supplemental indenture agreements to make United’s convertible debt, which was previously convertible into

shares of Continental common stock, convertible into shares of UAL common stock. For purposes of the United separate-entity reporting, as a result of this

debt, which is now United debt, becoming convertible into the stock of a non-consolidated entity, the embedded conversion options in United’s convertible

debt are required to be separated and accounted for as though they are free-standing derivatives. As a result, the carrying value of United’s debt, net of current

maturities, on a separate-entity reporting basis as of December 31, 2013 and December 31, 2012 was $10 billion and $10 billion, respectively, which is $47

million and $57 million, respectively, lower than the consolidated UAL carrying values on those dates.

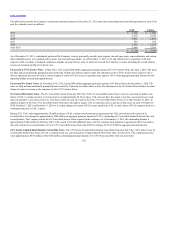

In addition, UAL’s contractual commitment to provide common stock to satisfy United’s obligation upon conversion of the debt is an embedded call option on

UAL common stock that is also required to be separated and accounted for as though it is a free-standing derivative. The fair value of the indenture derivatives

on a separate-entity reporting basis as of December 31, 2013 and December 31, 2012 was an asset of $480 million and $268 million, respectively. The fair

value of the embedded conversion options as of December 31, 2013 and December 31, 2012, was a liability of $270 million and $128 million, respectively.

The initial contribution of the indenture derivatives to United by UAL is accounted for as additional-paid-in-capital in United’s separate-entity financial

statements. Changes in fair value of both the indenture derivatives and the embedded conversion options subsequent to October 1, 2010 are recognized

currently in nonoperating income (expense).

105