United Airlines 2013 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

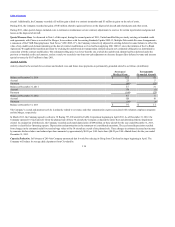

Table of Contents

2013. These leases are typically with municipalities or other governmental entities, which are excluded from the consolidation requirements concerning

VIEs. To the extent United’s leases and related guarantees are with a separate legal entity other than a governmental entity, United is not the primary beneficiary

because the lease terms are consistent with market terms at the inception of the lease and the lease does not include a residual value guarantee, fixed-price

purchase option, or similar feature.

In April 2013, United executed an amendment to its Terminal C lease at Newark Liberty International Airport (“Newark Liberty”) that, among other matters,

extended the term of the Terminal C lease with respect to concourses C-1 and C-2 at Newark Liberty until 2033. United also committed to invest an additional

$150 million in facility upgrades at Newark Liberty to enhance the customer experience and efficiency of the operation.

In November 2013, United signed a lease amendment with the City of Los Angeles and Los Angeles World Airports (“LAWA”) to its terminal facilities lease at

Los Angeles International Airport (“LAX”). The amendment allows United to make approximately $450 million in renovations at LAX over the next four

years. United will fund the cost of these renovations and LAWA will acquire the improvements at the end of each designated construction phase through a

cash payment at the construction cost. United expects to be considered the owner of the property during and after the construction period for accounting

purposes. As a result, the construction project will be included on the Company’s balance sheet as operating property and equipment and with the construction

obligation under other liabilities.

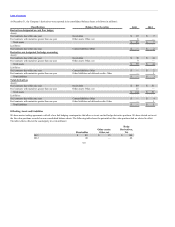

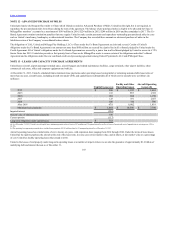

United’s nonaircraft rent expense was approximately $1.3 billion for each of the years ended December 31 2013, 2012, and 2011.

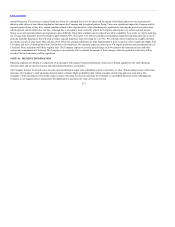

In addition to nonaircraft rent and aircraft rent, which is separately presented in the consolidated statements of operations, United had aircraft rent related to

regional aircraft operating leases, which is included as part of regional capacity purchase expense in United’s consolidated statement of operations, of $428

million, $463 million and $498 million for the years ended December 31, 2013, 2012 and 2011, respectively.

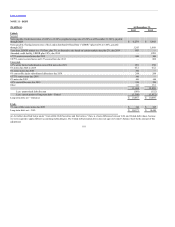

In connection with UAL Corporation’s and United Air Lines, Inc.’s fresh-start reporting requirements upon their exit from Chapter 11 bankruptcy protection

in 2006 and the Company’s acquisition accounting adjustments related to the Merger, lease valuation adjustments for operating leases were initially recorded in

the consolidated balance sheet, representing the net present value of the differences between contractual lease rates and the fair market lease rates for similar

leased assets at the time. An asset (liability) results when the contractual lease rates are more (less) favorable than market lease terms at the valuation date. The

lease valuation adjustment is amortized on a straight-line basis as an increase (decrease) to rent expense over the individual applicable remaining lease terms,

resulting in recognition of rent expense as if United had entered into the leases at market rates. The related remaining lease terms are one to 11 years for United.

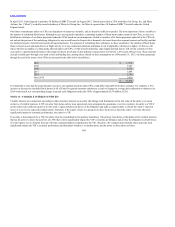

The lease valuation adjustments are classified within other noncurrent liabilities and the net accretion amounts are $173 million, $240 million and $227

million for the years ended December 31, 2013, 2012 and 2011, respectively.

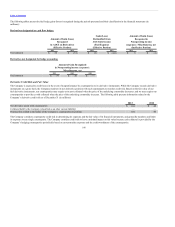

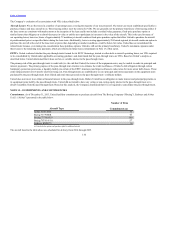

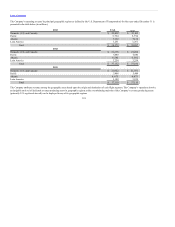

United has CPAs with certain regional carriers. We purchase all of the capacity from the flights covered by the CPA at a negotiated price. We pay the regional

carrier a pre-determined rate, subject to annual inflation adjustments, primarily for block hours flown (the hours from gate departure to gate arrival) and other

operating factors and reimburse the regional carrier for various pass-through expenses related to the flights. Under the CPAs, we are responsible for the cost of

providing fuel for all flights and for paying aircraft rent for all of the aircraft covered by the CPAs. Generally, the CPAs contain incentive bonus and rebate

provisions based upon each regional carrier’s operational performance. United’s CPAs are for 572 regional aircraft, and the CPAs have terms expiring through

2027. Aircraft operated under CPAs include aircraft leased directly from the regional carriers and those leased from third-party lessors and operated by the

regional carriers.

In May 2013, United entered into a CPA with SkyWest Airlines, Inc. (“SkyWest”), a wholly-owned subsidiary of SkyWest, Inc., to operate 40 Embraer S.A.

(“Embraer”) EMB175 aircraft under the United Express brand. SkyWest will purchase these 76-seat aircraft with deliveries in 2014 and 2015.

108