United Airlines 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

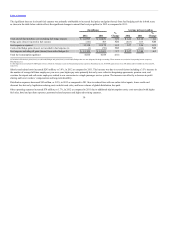

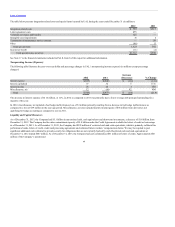

bodies. The leasing arrangements associated with a majority of these obligations are accounted for as operating leases and are not recorded in the Company’s

financial statements. The leasing arrangements associated with a portion of these obligations are accounted for as capital leases. The annual lease payments for

those obligations accounted for as operating leases are included in the operating lease payments in the contractual obligations table above.

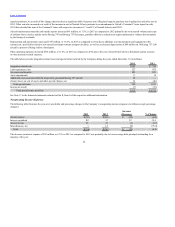

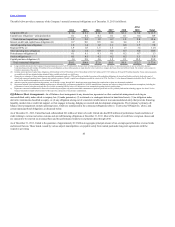

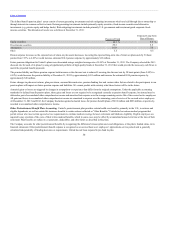

EETCs. In August 2013, December 2012 and October 2012, United created separate EETC pass-through trusts, each of which issued pass-through

certificates. The proceeds of the issuance of the pass-through certificates are used to purchase equipment notes issued by United and secured by its aircraft.

The Company records the debt obligation upon issuance of the equipment notes rather than upon the initial issuance of the pass-through certificates. The pass-

through certificates represent fractional undivided interests in the respective pass-through trusts and are not obligations of United. The payment obligations

under the equipment notes are those of United. Proceeds received from the sale of pass-through certificates are initially held by a depositary in escrow for the

benefit of the certificate holders until United issues equipment notes to the trust, which purchases such notes with a portion of the escrowed funds. These

escrowed funds are not guaranteed by United and are not reported as debt on our consolidated balance sheet because the proceeds held by the depositary are not

United’s assets. United has received all of the proceeds from the 2012 EETCs. United expects to receive all proceeds from the August 2013 pass-through trusts

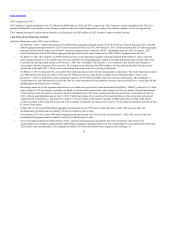

by the end of 2014. Certain details of the pass-through trusts are as follows (in millions, except interest rate):

August 2013 A $ 720 August 2025 4.3% $ 153 $ 153 $ 567

August 2013 B 209 August 2021 5.375% 44 44 165

December 2012 C 425 April 2018 6.125% 425 147 —

October 2012 A 712 October 2024 4.0% 712 465 —

October 2012 B 132 October 2020 5.5% 132 86 —

$ 2,198 $ 1,466 $ 895 $ 732

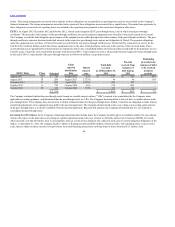

The Company evaluated whether the pass-through trusts formed are variable interest entities (“VIEs”) required to be consolidated by the Company under

applicable accounting guidance, and determined that the pass-through trusts are VIEs. The Company determined that it does not have a variable interest in the

pass-through trusts. The Company does not invest in or obtain a financial interest in the pass-through trusts. Rather, United has an obligation to make interest

and principal payments on its equipment notes held by the pass-through trusts. The Company did not intend to have any voting or non-voting equity interest

in the pass-through trusts or to absorb variability from the pass-through trusts. Based on this analysis, the Company determined that it is not required to

consolidate the pass-through trusts.

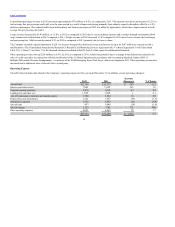

Increased Cost Provisions. In the Company’s financing transactions that include loans, the Company typically agrees to reimburse lenders for any reduced

returns with respect to the loans due to any change in capital requirements and, in the case of loans in which the interest rate is based on LIBOR, for certain

other increased costs that the lenders incur in carrying these loans as a result of any change in law, subject in most cases to certain mitigation obligations of the

lenders. At December 31, 2013, the Company had $2.1 billion of floating rate debt and $286 million of fixed rate debt, with remaining terms of up to twelve

years, that are subject to these increased cost provisions. In several financing transactions involving loans or leases from non-U.S. entities, with

46