United Airlines 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

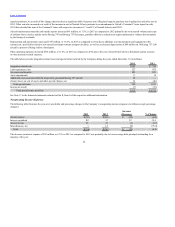

February 2014, UAL issued 3,582,640 additional shares of UAL common stock pursuant to agreements that UAL entered into with certain of its

securityholders of UAL’s 6% Convertible Senior Notes due 2029 in exchange for $31,126,000 in aggregate principal amount.

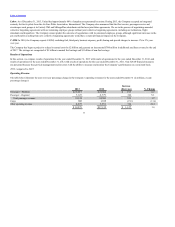

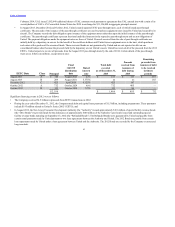

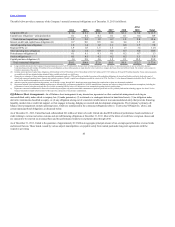

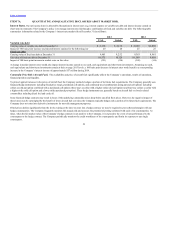

• In August 2013, December 2012 and October 2012, United created separate EETC pass-through trusts, each of which issued pass-through

certificates. The proceeds of the issuance of the pass-through certificates are used to purchase equipment notes issued by United and secured by its

aircraft. The Company records the debt obligation upon issuance of the equipment notes rather than upon the initial issuance of the pass-through

certificates. The pass-through certificates represent fractional undivided interests in the respective pass-through trusts and are not obligations of

United. The payment obligations under the equipment notes are those of United. Proceeds received from the sale of pass-through certificates are

initially held by a depositary in escrow for the benefit of the certificate holders until United issues equipment notes to the trust, which purchases

such notes with a portion of the escrowed funds. These escrowed funds are not guaranteed by United and are not reported as debt on our

consolidated balance sheet because the proceeds held by the depositary are not United’s assets. United has received all of the proceeds from the 2012

EETCs. United expects to receive all proceeds from the August 2013 pass-through trusts by the end of 2014. Certain details of the pass-through

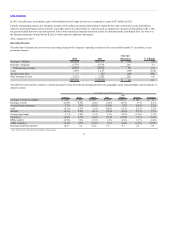

trusts are as follows (in millions, except interest rate):

August 2013 A $ 720 August 2025 4.3% $ 153 $ 153 $ 567

August 2013 B 209 August 2021 5.375% 44 44 165

December 2012 C 425 April 2018 6.125% 425 147 —

October 2012 A 712 October 2024 4.0% 712 465 —

October 2012 B 132 October 2020 5.5% 132 86 —

$ 2,198 $ 1,466 $ 895 $ 732

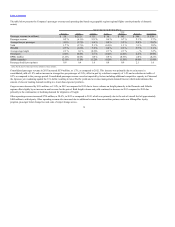

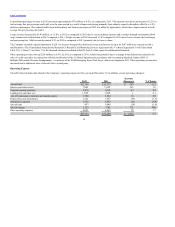

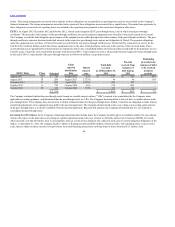

Significant financing events in 2012 were as follows:

• The Company received $1.5 billion in proceeds from EETC transactions in 2012;

• During the year ended December 31, 2012, the Company made debt and capital lease payments of $1.5 billion, including prepayments. These payments

include $195 million related to United’s Series 2002-1 EETCs; and

• In August 2012, the New Jersey Economic Development Authority (the “Authority”) issued approximately $101 million of special facility revenue bonds

(the “2012 Bonds”) to provide funds for the defeasance of approximately $100 million of the Authority’s previously issued and outstanding special

facility revenue bonds maturing on September 15, 2012 (the “Refunded Bonds”). The Refunded Bonds were guaranteed by United and payable from

certain rental payments made by United pursuant to two lease agreements between the Authority and United. The 2012 Bonds are payable from certain

loan repayments made by United under a loan agreement between United and the Authority. The 2012 Bonds are recorded by the Company as unsecured

long-term debt.

43