United Airlines 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

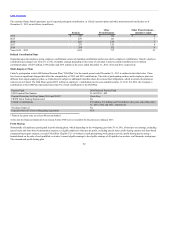

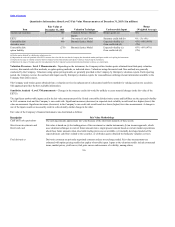

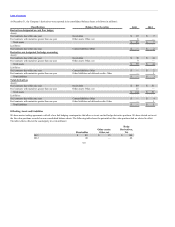

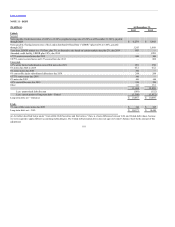

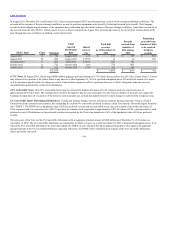

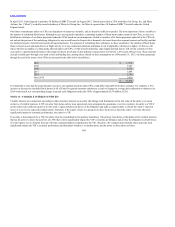

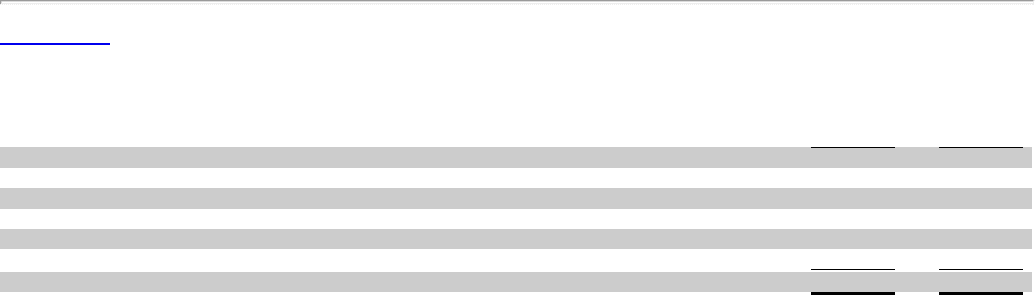

The table below presents the Company’s contractual principal payments at December 31, 2013 under then-outstanding long-term debt agreements in each of the

next five calendar years (in millions):

2014 $ 1,368 $ 1,368

2015 2,072 2,072

2016 1,051 1,051

2017 614 614

2018 1,135 1,135

After 2018 5,468 5,364

$ 11,708 $ 11,604

As of December 31, 2013, a substantial portion of the Company’s assets, principally aircraft, spare engines, aircraft spare parts, route authorities and certain

other intangible assets, were pledged under various loan and other agreements. As of December 31, 2013, UAL and United were in compliance with their

respective debt covenants. Continued compliance depends on many factors, some of which are beyond the Company’s control, including the overall industry

revenue environment and the level of fuel costs.

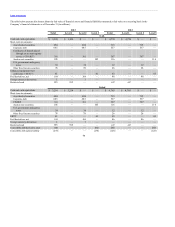

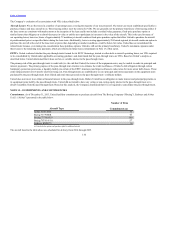

Unsecured 6.375% Senior Notes. In May 2013, UAL issued $300 million aggregate principal amount of 6.375% Senior Notes due June 1, 2018. The notes

are fully and unconditionally guaranteed and recorded by United on its balance sheet as debt. The indenture for the 6.375% Senior Notes requires UAL to

offer to repurchase the notes for cash if certain changes of control of UAL occur at a purchase price equal to 101% of the aggregate principal amount of notes

repurchased plus accrued and unpaid interest.

Unsecured 6% Senior Notes. In November 2013, UAL issued $300 million aggregate principal amount of 6% Senior Notes due December 1, 2020. The

notes are fully and unconditionally guaranteed and recorded by United on its balance sheet as debt. The indenture for the 6% Senior Notes includes the same

change of control covenant as the indenture for the 6.375% Senior Notes.

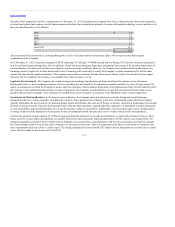

6% Convertible Senior NotesThe 6% Convertible Senior Notes due 2029 (the “UAL 6% Convertible Senior Notes”) may be converted by holders into

shares of UAL’s common stock at a conversion price of approximately $8.69 per share. UAL does not have the option to pay the conversion price in cash

upon a noteholder’s conversion; however, UAL may redeem for cash all or part of the UAL 6% Convertible Senior Notes on or after October 15, 2014. In

addition, holders of the UAL 6% Convertible Senior Notes have the right to require UAL to repurchase all or a portion of their notes on each of October 15,

2014, October 15, 2019 and October 15, 2024 or if certain changes of control of UAL occur, payable by UAL in cash, shares of UAL common stock or a

combination thereof, at UAL’s option.

During 2013, UAL issued approximately 28 million shares of UAL common stock pursuant to agreements that UAL entered into with certain of its

securityholders in exchange for approximately $240 million in aggregate principal amount of UAL’s outstanding 6% Convertible Senior Notes held by such

securityholders. The Company retired the 6% Convertible Senior Notes acquired in the exchange. As of December 31, 2013, the outstanding balance is

approximately $104 million. In February 2014, UAL issued 3,582,640 additional shares of UAL common stock pursuant to agreements that UAL entered

into with certain of its securityholders of UAL’s 6% Convertible Senior Notes due 2029 in exchange for $31,126,000 in aggregate principal amount.

4.5% Senior Limited Subordination Convertible Notes. The 4.5% Senior Limited Subordination Convertible Notes due 2021 (the “4.5% Notes”) may be

converted by holders into shares of UAL’s common stock at a conversion price of approximately $32.64 per share. In June 2011, UAL repurchased at par

value approximately $570 million of the $726 million outstanding principal amount of its 4.5% Notes due 2021 with cash after notes

102