United Airlines 2013 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

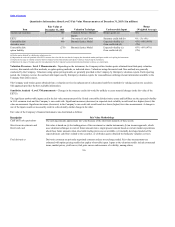

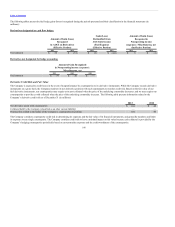

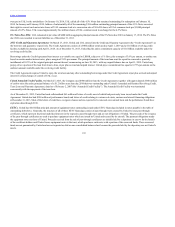

were put to UAL by the noteholders. On January 10, 2014, UAL called all of the 4.5% Notes that remained outstanding for redemption on February 10,

2014. In January and February 2014, holders of substantially all of the remaining $156 million outstanding principal amount of the 4.5% Notes exercised

their right to convert such notes into shares of UAL common stock at a conversion rate of 30.6419 shares of UAL common stock per $1,000 principal

amount of 4.5% Notes. UAL issued approximately five million shares of UAL common stock in exchange for the 4.5% Notes.

8% Notes Due 2024. UAL redeemed at par value all $400 million aggregate principal amount of the 8% Notes due 2024 on January 17, 2014. The 8% Notes

due 2024 were recorded in current liabilities as of December 31, 2013.

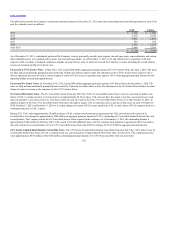

2013 Credit and Guaranty Agreement. On March 27, 2013, United and UAL entered into the Credit and Guaranty Agreement (the “Credit Agreement”) as

the borrower and guarantor, respectively. The Credit Agreement consists of a $900 million term loan due April 1, 2019 and a $1.0 billion revolving credit

facility available for drawing until April 1, 2018. As of December 31, 2013, United had its entire commitment capacity of $1.0 billion available under the

revolving credit facility.

Borrowings under the Credit Agreement bear interest at a variable rate equal to LIBOR, subject to a 1% floor, plus a margin of 3.0% per annum, or another rate

based on certain market interest rates, plus a margin of 2.0% per annum. The principal amount of the term loan must be repaid in consecutive quarterly

installments of 0.25% of the original principal amount thereof, commencing on June 30, 2013, with any unpaid balance due on April 1, 2019. United may

prepay all or a portion of the loan from time to time, at par plus accrued and unpaid interest. United pays a commitment fee equal to 0.75% per-annum on the

undrawn amount available under the revolving credit facility.

The Credit Agreement requires United to repay the term loan and any other outstanding borrowings under the Credit Agreement at par plus accrued and unpaid

interest if certain changes of control of UAL occur.

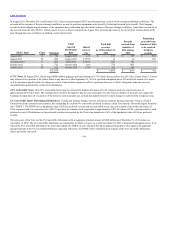

United Amended Credit Facility. On March 27, 2013, the Company used $900 million from the Credit Agreement, together with approximately $300 million

of cash to retire the entire principal balance of a $1.2 billion term loan due 2014 that was outstanding under United’s Amended and Restated Revolving Credit,

Term Loan and Guaranty Agreement, dated as of February 2, 2007 (the “Amended Credit Facility”). The Amended Credit Facility was terminated

concurrently with the repayment of the term loan.

As of December 31, 2013, United had cash collateralized $61 million of letters of credit, most of which had previously been issued under the Credit

Agreement. United also had $398 million of performance bonds and letters of credit relating to various real estate, customs and aircraft financing obligations

at December 31, 2013. Most of the letters of credit have evergreen clauses and are expected to be renewed on an annual basis and the performance bonds have

expiration dates through 2018.

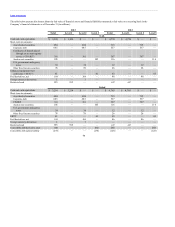

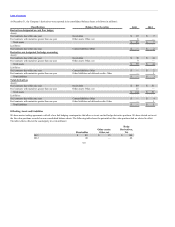

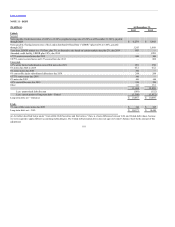

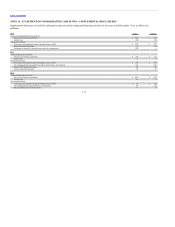

EETCs. United has $6.0 billion principal amount of equipment notes outstanding issued under EETC financings included in notes payable in the table of

outstanding debt above. Generally, the structure of all of these EETC financings consist of pass-through trusts created by United to issue pass-through

certificates, which represent fractional undivided interests in the respective pass-through trusts and are not obligations of United. The proceeds of the issuance

of the pass-through certificates are used to purchase equipment notes which are issued by United and secured by its aircraft. The payment obligations under

the equipment notes are those of United. Proceeds received from the sale of pass-through certificates are initially held by a depositary in escrow for the benefit

of the certificate holders until United issues equipment notes to the trust, which purchases such notes with a portion of the escrowed funds. These escrowed

funds are not guaranteed by United and are not reported as debt on our consolidated balance sheet because the proceeds held by the depositary are not United’s

assets.

103