United Airlines 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

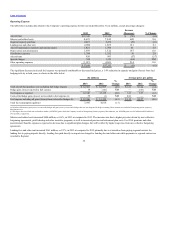

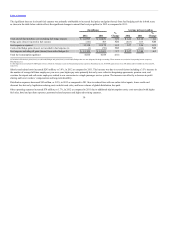

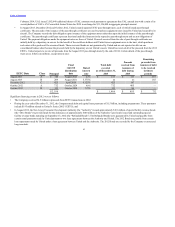

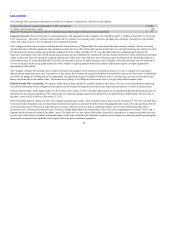

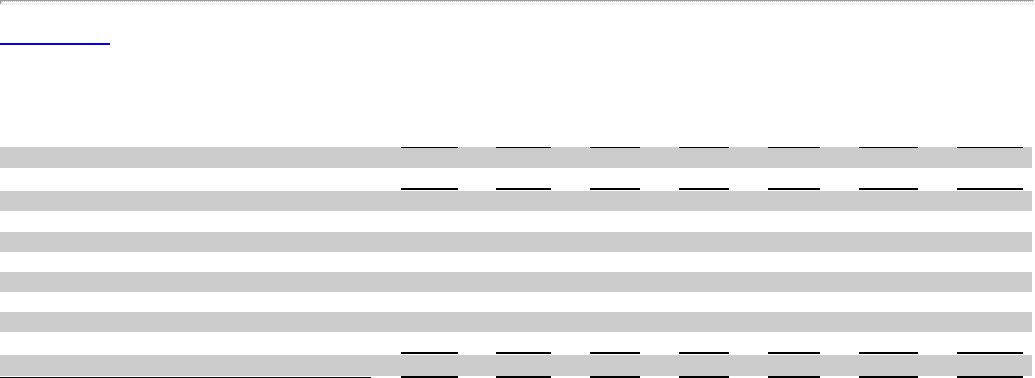

The table below provides a summary of the Company’s material contractual obligations as of December 31, 2013 (in billions):

Long-term debt (a) $ 1.4 $ 2.1 $1.1 $0.6 $ 1.1 $ 5.4 $ 11.7

Capital lease obligations—principal portion 0.1 0.1 0.1 0.1 0.1 0.4 0.9

Total debt and capital lease obligations 1.5 2.2 1.2 0.7 1.2 5.8 12.6

Interest on debt and capital lease obligations (b) 0.7 0.6 0.5 0.4 0.4 1.5 4.1

Aircraft operating lease obligations 1.6 1.4 1.2 1.1 0.8 1.7 7.8

Regional CPAs (c) 1.9 1.8 1.5 1.5 1.3 3.4 11.4

Other operating lease obligations 1.2 1.0 0.9 0.8 0.7 6.0 10.6

Postretirement obligations (d) 0.1 0.1 0.1 0.1 0.2 0.7 1.3

Pension obligations (e) 0.1 0.1 0.2 0.2 0.2 1.1 1.9

Capital purchase obligations (f) 3.0 2.8 2.0 1.5 2.1 12.5 23.9

Total contractual obligations $10.1 $10.0 $7.6 $6.3 $6.9 $32.7 $ 73.6

(a) Long-term debt presented in the Company’s financial statements is net of a $169 million debt discount which is being amortized over the debt terms. Contractual payments are not net of the debt discount.

Contractual long-term debt includes $74 million of non-cash obligations as these debt payments are made directly to the creditor by a company that leases three aircraft from United. The creditor’s only recourse to

United is repossession of the aircraft.

(b) Includes interest portion of capital lease obligations of $88 million in 2014, $70 million in 2015, $64 million in 2016, $43 million in 2017, $35 million in 2018 and $279 million thereafter. Future interest payments

on variable rate debt are estimated using estimated future variable rates based on a yield curve.

(c) Represents our estimates of future minimum noncancelable commitments under our CPAs and does not include the portion of the underlying obligations for aircraft and facility rent that is disclosed as part of

aircraft and nonaircraft operating leases. Amounts also exclude a portion of United’s capital lease obligation recorded for certain of its CPAs. See Note 13 to the financial statements included in Part II, Item 8 of this

report for the significant assumptions used to estimate the payments.

(d) Amounts represent postretirement benefit payments, net of subsidy receipts, through 2023. Benefit payments approximate plan contributions as plans are substantially unfunded.

(e) Represents estimate of the minimum funding requirements as determined by government regulations for United’s material plans. Amounts are subject to change based on numerous assumptions, including the

performance of assets in the plan and bond rates. See Critical Accounting Policies, below, for a discussion of our assumptions regarding United’s pension plans.

(f) Represents contractual commitments for firm order aircraft and spare engines only and noncancelable commitments to purchase goods and services, primarily information technology support. See Note 15 to the

financial statements included in Part II, Item 8 of this report for a discussion of our purchase commitments.

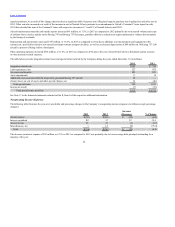

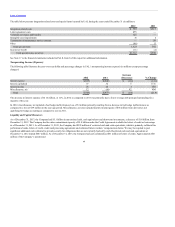

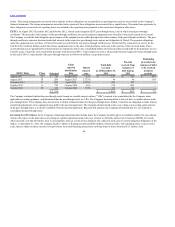

Off-Balance Sheet Arrangements. An off-balance sheet arrangement is any transaction, agreement or other contractual arrangement involving an

unconsolidated entity under which a company has (1) made guarantees, (2) a retained or a contingent interest in transferred assets, (3) an obligation under

derivative instruments classified as equity, or (4) any obligation arising out of a material variable interest in an unconsolidated entity that provides financing,

liquidity, market risk or credit risk support, or that engages in leasing, hedging or research and development arrangements. The Company’s primary off-

balance sheet arrangements include operating leases, which are summarized in the contractual obligations table in above, and

certain municipal bond obligations, as discussed below.

As of December 31, 2013, United had cash collateralized $61 million of letters of credit. United also had $398 million of performance bonds and letters of

credit relating to various real estate, customs and aircraft financing obligations at December 31, 2013. Most of the letters of credit have evergreen clauses and

are expected to be renewed on an annual basis and the performance bonds have expiration dates through 2018.

As of December 31, 2013, United is the guarantor of approximately $1.9 billion in aggregate principal amount of tax-exempt special facilities revenue bonds

and interest thereon. These bonds, issued by various airport municipalities, are payable solely from rentals paid under long-term agreements with the

respective governing

45