United Airlines 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

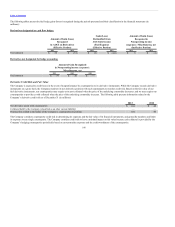

United previously sold frequent flyer miles to Chase which United recorded as Advanced Purchase of Miles. United has the right, but is not required, to

repurchase the pre-purchased miles from Chase during the term of the agreement. The balance of pre-purchased miles is eligible to be allocated by Chase to

MileagePlus members’ accounts by a maximum of $199 million in 2014, $224 million in 2015, $249 million in 2016 and the remainder in 2017. The Co-

Brand Agreement contains termination penalties that may require United to make certain payments and repurchase outstanding pre-purchased miles in cases

such as United’s insolvency, bankruptcy or other material breaches. The Company has recorded these amounts as advanced purchase of miles in the

liabilities section of the Company’s consolidated balance sheets.

The obligations of UAL, United and Mileage Plus Holdings, LLC to Chase under the Co-Brand Agreement are joint and several. Certain of United’s

obligations under the Co-Brand Agreement in an amount not more than $850 million are secured by a junior lien in all collateral pledged by United under the

Credit Agreement. All of United’s obligations under the Co-Brand Agreement are secured by a junior lien in all collateral pledged by United to secure its 6.75%

Senior Notes due 2015. United also provides a first priority lien to Chase on its MileagePlus assets to secure certain of its obligations under the Co-Brand

Agreement and its obligations under the new combined credit card processing agreement among United, Paymentech, LLC and JPMorgan Chase.

United leases aircraft, airport passenger terminal space, aircraft hangars and related maintenance facilities, cargo terminals, other airport facilities, other

commercial real estate, office and computer equipment and vehicles.

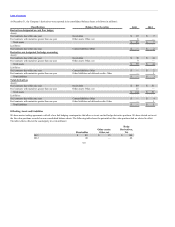

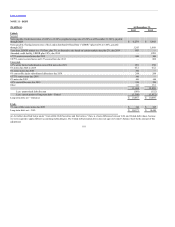

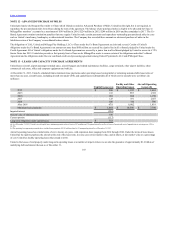

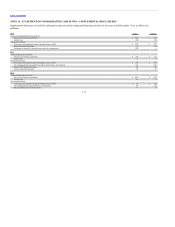

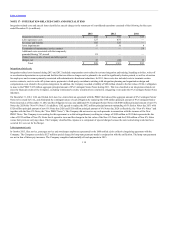

At December 31, 2013, United’s scheduled future minimum lease payments under operating leases having initial or remaining noncancelable lease terms of

more than one year, aircraft leases, including aircraft rent under CPAs and capital leases (substantially all of which are for aircraft) were as follows (in

millions):

2014 $ 206 $ 1,192 $ 1,601

2015 183 987 1,381

2016 168 864 1,150

2017 123 831 1,053

2018 106 710 786

After 2018 678 6,002 1,819

Minimum lease payments $ 1,464 $ 10,586 $ 7,790

Imputed interest (594)

Present value of minimum lease payments 870

Current portion (117)

Long-term obligations under capital leases $ 753

(a) As of December 31, 2013, United’s aircraft capital lease minimum payments relate to leases of 47 mainline and 38 regional aircraft as well as to leases of nonaircraft assets. Imputed interest rate ranges are 4.8% to

18.5%.

(b) The operating lease payments presented above include future payments of $103 million related to 25 nonoperating aircraft as of December 31, 2013.

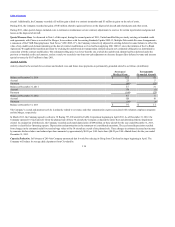

Aircraft operating leases have initial terms of six to twenty-six years, with expiration dates ranging from 2014 through 2024. Under the terms of most leases,

United has the right to purchase the aircraft at the end of the lease term, in some cases at fair market value, and in others, at fair market value or a percentage

of cost. United has facility operating leases that extend to 2041.

United is the lessee of real property under long-term operating leases at a number of airports where we are also the guarantor of approximately $1.6 billion of

underlying debt and interest thereon as of December 31,

107