United Airlines 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

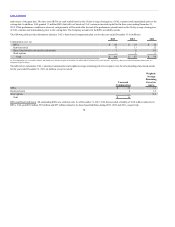

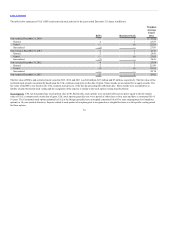

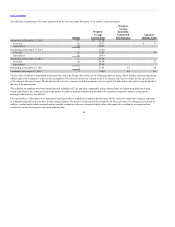

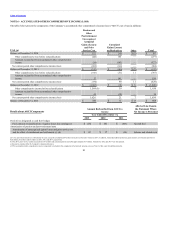

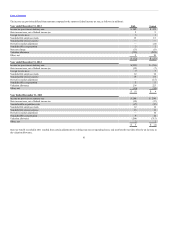

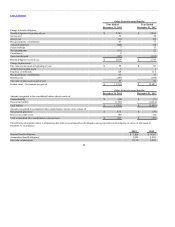

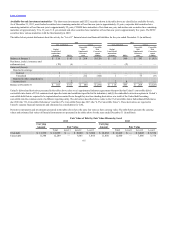

will expire as follows (in billions): $1.4 in 2022, $1.9 in 2023, $2.4 in 2024, $2.0 in 2025 and $3.2 after 2025. In addition, the majority of state tax benefits

of the net operating losses of $168 million for UAL expires over a five to 20-year period.

Both UAL Corporation and Continental experienced an “ownership change” as defined under Section 382 of the Internal Revenue Code of 1986, as amended,

as a result of the Merger. However, the Company does not expect these ownership changes to significantly limit its ability to use its NOL and alternative

minimum tax (“AMT”) credit carryforwards in the carryforward period because the size of the limitation exceeds our NOL and AMT credit carryforwards.

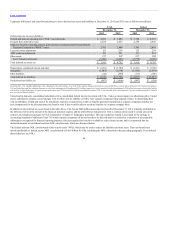

The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income (including the reversals of deferred tax liabilities)

during the periods in which those deferred tax assets will become deductible. The Company’s management assesses available positive and negative evidence

regarding the realizability of its deferred tax assets and records a valuation allowance when it is more likely than not that deferred tax assets will not be realized.

To form a conclusion, management considers positive evidence in the form of reversing temporary differences, projections of future taxable income and tax

planning strategies, and negative evidence such as current period and cumulative losses. Although the Company was not in a three-year cumulative loss

position at the end of 2013, management determined that the loss in 2012, the overall modest level of cumulative pretax income in the three years ended

December 31, 2013 of 0.6% of total revenues in that period and the uncertainty associated with projecting future taxable income supported the conclusion that

the valuation allowance was still necessary. Management will continue to evaluate future financial performance to determine whether such performance is both

sustained and significant enough to provide sufficient evidence to support reversal of the valuation allowance.

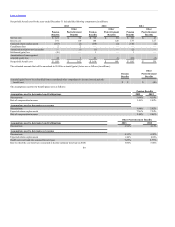

The December 31, 2013 valuation allowances of $3.8 billion for both UAL and United, if reversed in future years will reduce income tax expense. The current

valuation allowance reflects decreases from December 31, 2012 of $797 million and $727 million for UAL and United, respectively, including amounts

charged directly to other comprehensive income.

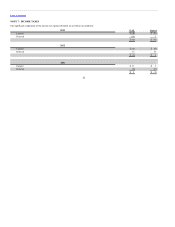

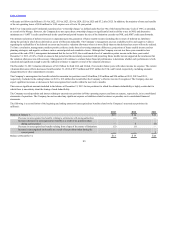

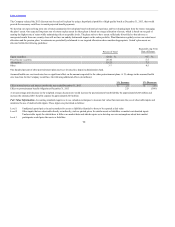

The Company’s unrecognized tax benefits related to uncertain tax positions were $14 million, $19 million and $24 million at 2013, 2012 and 2011,

respectively. Included in the ending balance at 2013 is $12 million that would affect the Company’s effective tax rate if recognized. The Company does not

expect significant increases or decreases in their unrecognized tax benefits within the next twelve months.

There are no significant amounts included in the balance at December 31, 2013 for tax positions for which the ultimate deductibility is highly certain but for

which there is uncertainty about the timing of such deductibility.

The Company records penalties and interest relating to uncertain tax positions in Other operating expense and Interest expense, respectively, in its consolidated

statements of operations. The Company has not recorded any significant expense or liabilities related to interest or penalties in its consolidated financial

statements.

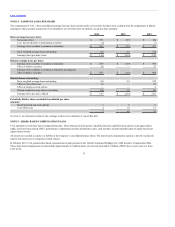

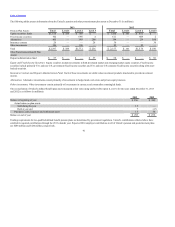

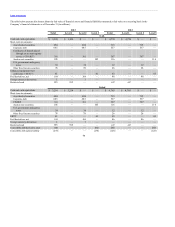

The following is a reconciliation of the beginning and ending amount of unrecognized tax benefits related to the Company’s uncertain tax positions (in

millions):

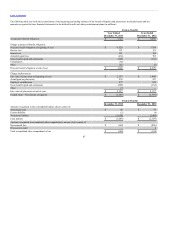

Balance at January 1, $19 $ 24 $32

Decrease in unrecognized tax benefits relating to settlements with taxing authorities — (12) —

Increase (decrease) in unrecognized tax benefits as a result of tax positions taken

during a prior period — 8 (9)

Decrease in unrecognized tax benefits relating from a lapse of the statute of limitations (5) (1) —

Increase in unrecognized tax benefits as a result of tax positions taken during the

current period — — 1

Balance at December 31, $14 $ 19 $24

85