United Airlines 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

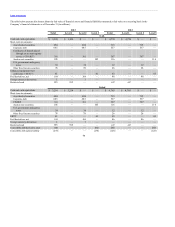

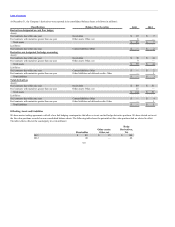

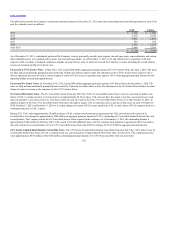

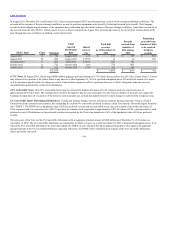

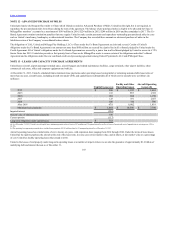

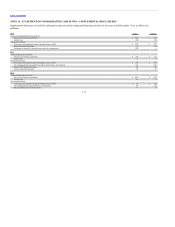

In August 2013, December 2012 and October 2012, United created separate EETC pass-through trusts, each of which issued pass-through certificates. The

proceeds of the issuance of the pass-through certificates are used to purchase equipment notes issued by United and secured by its aircraft. The Company

records the debt obligation upon issuance of the equipment notes rather than upon the initial issuance of the pass-through certificates. United has received all of

the proceeds from the 2012 EETCs. United expects to receive all proceeds from the August 2013 pass-through trusts by the end of 2014. Certain details of the

pass-through trusts are as follows (in millions, except interest rate):

August 2013 A $ 720 August 2025 4.3% $ 153 $ 153 $ 567

August 2013 B 209 August 2021 5.375% 44 44 165

December 2012 C 425 April 2018 6.125% 425 147 —

October 2012 A 712 October 2024 4.0% 712 465 —

October 2012 B 132 October 2020 5.5% 132 86 —

$ 2,198 $ 1,466 $ 895 $ 732

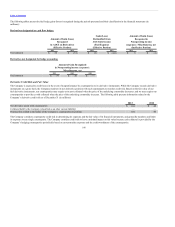

6.75% Notes. In August 2010, United issued $800 million aggregate principal amount of 6.75% Senior Secured Notes due 2015 (the “Senior Notes”). United

may redeem all or a portion of the Senior Notes at any time on or after September 15, 2012 at specified redemption prices. If United sells certain of its assets

or if it experiences specific kinds of a change in control, United will be required to offer to repurchase the notes. United’s obligations under the notes are

unconditionally guaranteed by certain of its subsidiaries.

4.5% Convertible Notes. The 4.5% Convertible Notes may be converted by holders into shares of UAL common stock at a conversion price of

approximately $18.93 per share. The Company does not have the option to pay the conversion price in cash; however, holders of the notes may require the

Company to repurchase all or a portion of the notes for cash at par plus any accrued and unpaid interest if certain changes in control of the Company occur.

6% Convertible Junior Subordinated Debentures. Continental Airlines Finance Trust II, a Delaware statutory business trust (the “Trust”) of which

United owns all the common trust securities, has outstanding five million 6% convertible preferred securities, called Term Income Deferrable Equity Securities

(the “TIDES”). The TIDES have a liquidation value of $50 per preferred security and are convertible at any time at the option of the holder into shares of

UAL common stock at a conversion rate of $57.14 per share of common stock (equivalent to approximately 0.875 of a share of UAL common stock for each

preferred security). Distributions on the preferred securities are payable by the Trust at an annual rate of 6% of the liquidation value of $50 per preferred

security.

The sole assets of the Trust are the 6% Convertible Debentures with an aggregate principal amount of $248 million as of December 31, 2012 mature on

November 15, 2030. The 6% Convertible Debentures are redeemable, in whole or in part, on or after November 20, 2003 at designated redemption prices. If we

redeem the 6% Convertible Debentures, the Trust must redeem the TIDES on a pro rata basis having an aggregate liquidation value equal to the aggregate

principal amount of the 6% Convertible Debentures redeemed. Otherwise, the TIDES will be redeemed upon maturity of the 6% Convertible Debentures,

unless previously converted.

104