United Airlines 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253

|

|

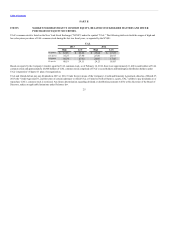

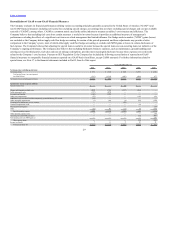

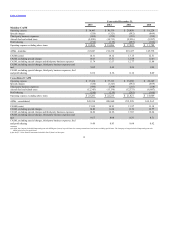

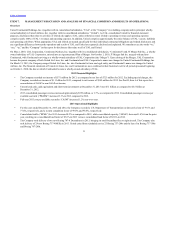

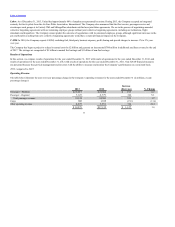

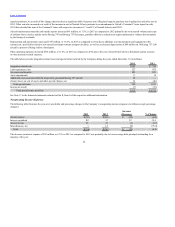

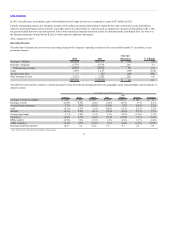

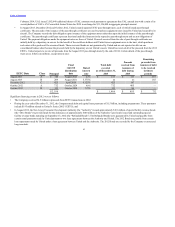

Table of Contents

The table below presents the Company’s passenger revenues and operating data based on geographic region (regional flights consist primarily of domestic

routes):

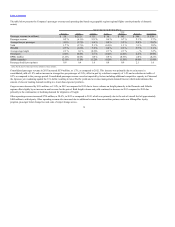

Passenger revenue (in millions) $ 58 $(212) $331 $16 $ 193 $346 $ 539

Passenger revenue 0.5 % (4.3)% 5.9 % 0.6 % 0.7 % 5.1 % 1.7 %

Average fare per passenger 4.0 % (3.7)% 4.4 % 0.8 % 3.2 % 2.8 % 2.6 %

Yield 1.7 % (3.7)% 5.1 % (0.2)% 1.3 % 3.1 % 1.8 %

PRASM 2.7 % (3.2)% 7.2 % 0.8 % 2.3 % 5.7 % 3.1 %

Average stage length 2.3 % 0.3 % (0.6)% 2.1 % 2.1 % — % 1.2 %

Passengers (3.4)% (0.5)% 1.5 % (0.2)% (2.4)% 2.2 % (0.9)%

RPMs (traffic) (1.2)% (0.5)% 0.8 % 0.8 % (0.5)% 2.0 % (0.2)%

ASMs (capacity) (2.1)% (1.1)% (1.2)% (0.2)% (1.5)% (0.6)% (1.4)%

Passenger load factor (points) 0.8 0.4 1.6 0.8 0.9 2.1 1.0

(a) See Part II, Item 6 of this report for the definition of these statistics.

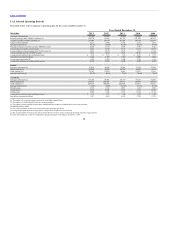

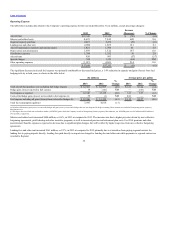

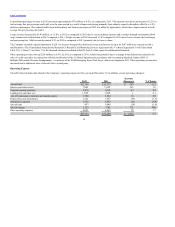

Consolidated passenger revenue in 2013 increased $539 million, or 1.7%, as compared to 2012. This increase was primarily due to an increase in

consolidated yield of 1.8% and an increase in average fare per passenger of 2.6%, offset in part by a decline in capacity of 1.4% and a reduction in traffic of

0.2% as compared to the year-ago period. Consolidated passenger revenue was also impacted by factors including additional competitive capacity in China and

the Japanese yen weakening against the U.S. dollar, resulting in lower Pacific yields and a revenue management demand forecast which underestimated the

amount of close-in booking demand resulting in a lower-than-expected yield mix.

Cargo revenue decreased by $136 million, or 13.4%, in 2013 as compared to 2012 due to lower volumes on freight primarily in the Domestic and Atlantic

regions offset slightly by an increase in mail revenue for the period. Both freight volume and yield continued to decrease in 2013 compared to 2012 due

primarily to the continuation of declining demand for shipments of freight.

Other operating revenue increased $724 million, or 20.4%, in 2013 as compared to 2012, which was primarily due to the sale of aircraft fuel of approximately

$400 million to a third party. Other operating revenue also increased due to additional revenue from non-airline partners under our MileagePlus loyalty

program, passenger ticket change fees and sales of airport lounge access.

34